Question: Please help answer the questions urgently. a) Evaluate the finance situation below using a correct cash flow diagram and deliberate the solutions accordingly 1) The

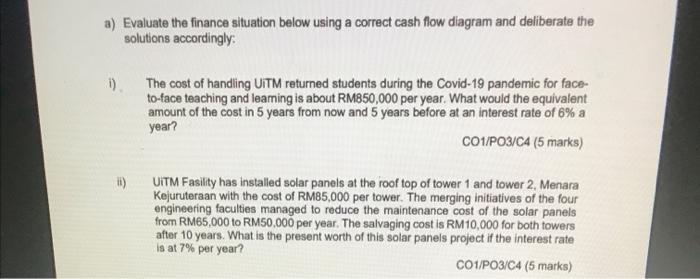

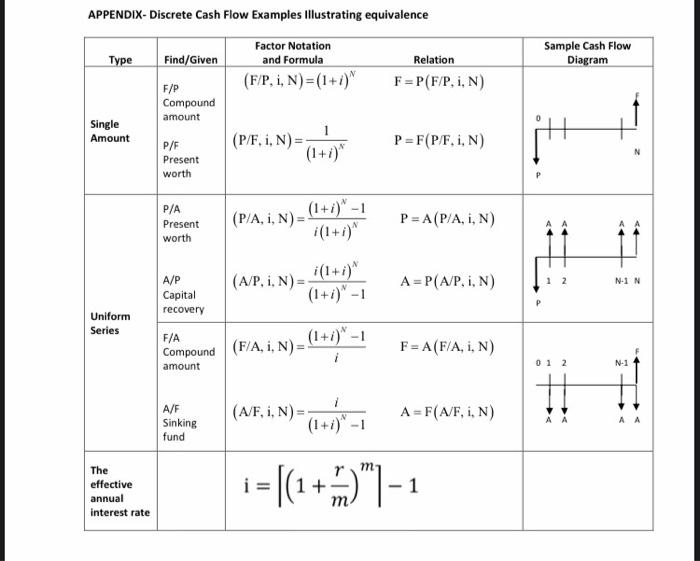

a) Evaluate the finance situation below using a correct cash flow diagram and deliberate the solutions accordingly 1) The cost of handling UiTM returned students during the Covid-19 pandemic for face- to-face teaching and learning is about RM850,000 per year. What would the equivalent amount of the cost in 5 years from now and 5 years before at an interest rate of 6% a year? CO1/P03/C4 (5 marks) it) UITM Fasility has installed solar panels at the roof top of tower 1 and tower 2, Menara Kejuruteraan with the cost of RM85,000 per tower. The merging initiatives of the four engineering faculties managed to reduce the maintenance cost of the solar panels from RM65,000 to RM50,000 per year. The salvaging cost is RM10,000 for both towers after 10 years. What is the present worth of this solar panels project if the interest rate is at 7% per year? CO1/P03/C4 (5 marks) Sample Cash Flow Diagram APPENDIX- Discrete Cash Flow Examples Illustrating equivalence Factor Notation Type Find/Given and Formula Relation (F/P, I, N) = (1+1) F = P(F/P, I, N) Compound Single 1 Amount P/F (P/F. i, N) P=F(P/F,1,N) Present worth F/P amount (1+i) - 1 P/A Present worth (P/A, i, N) P=A(P/A, I, N) (A/P, I, N) A = P(A/P, I, N) N1 N A/P Capital recovery (1+i) - 1 Uniform Series F/A F = A(F/A, i, N) Compound (F/A, i, N) amount 1 0 1 2 N-1 (A/F, I, N) A = F(A/F, i, N) A/F Sinking fund A A (1+1)-1 The effective annual interest rate i = |(1+"|-- 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts