Question: please help Answer the questions with information on Exxon Mobil Corp's (XOM) December 31, 2016 10-K Consolidated Balance Sheet use the Interactive Filing. a. Hover

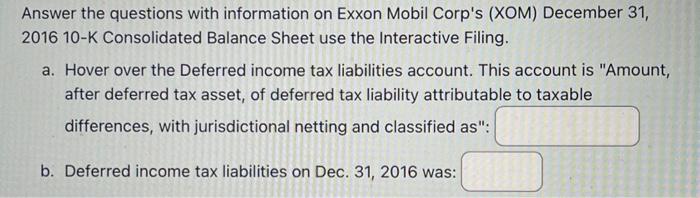

Answer the questions with information on Exxon Mobil Corp's (XOM) December 31, 2016 10-K Consolidated Balance Sheet use the Interactive Filing. a. Hover over the Deferred income tax liabilities account. This account is "Amount, after deferred tax asset, of deferred tax liability attributable to taxable differences, with jurisdictional netting and classified as": b. Deferred income tax liabilities on Dec. 31, 2016 was: Answer the questions with information on Exxon Mobil Corp's (XOM) December 31, 2016 10-K Consolidated Balance Sheet use the Interactive Filing. a. Hover over the Deferred income tax liabilities account. This account is "Amount, after deferred tax asset, of deferred tax liability attributable to taxable differences, with jurisdictional netting and classified as": b. Deferred income tax liabilities on Dec. 31, 2016 was

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts