Question: please help answer the required for both exercise 6.7 and 6.9. thank you the amount for payment number 336 is 300. thank you Zimba Hats

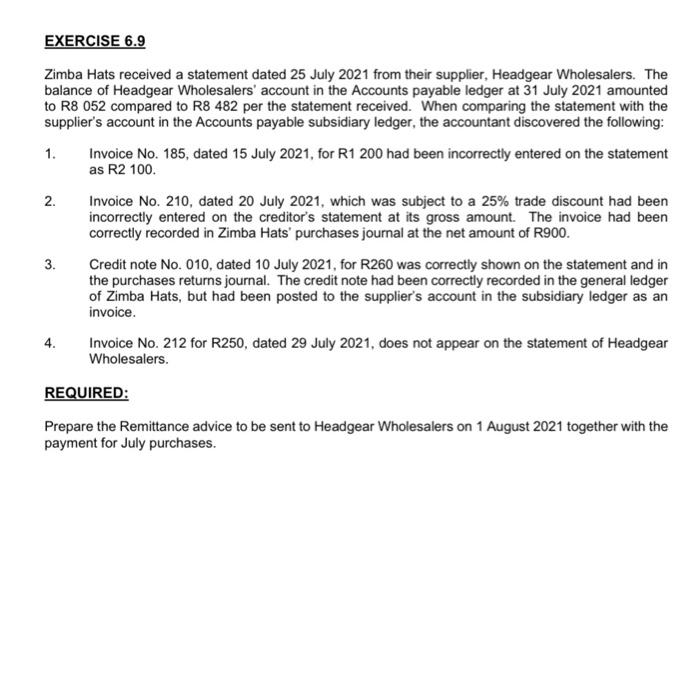

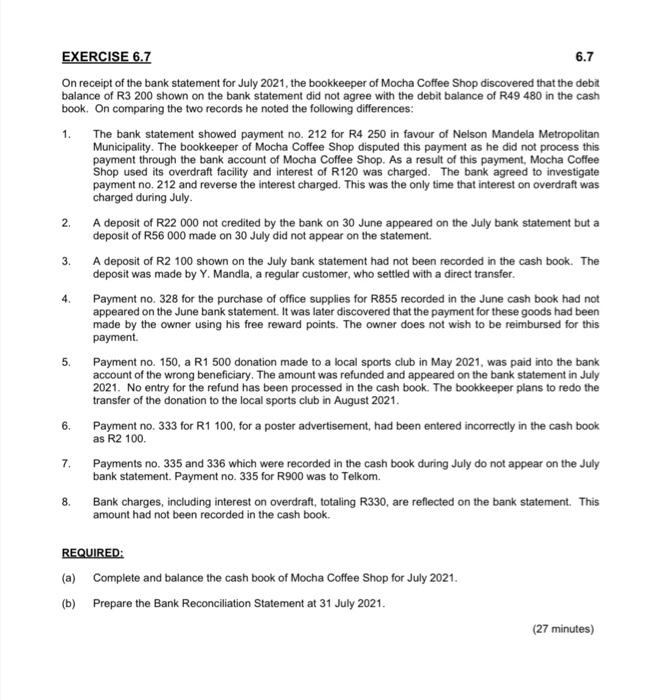

Zimba Hats received a statement dated 25 July 2021 from their supplier, Headgear Wholesalers. The balance of Headgear Wholesalers' account in the Accounts payable ledger at 31 July 2021 amounted to R8 052 compared to R8 482 per the statement received. When comparing the statement with the supplier's account in the Accounts payable subsidiary ledger, the accountant discovered the following: 1. Invoice No. 185, dated 15 July 2021, for R1 200 had been incorrectly entered on the statement as R2 100 . 2. Invoice No. 210, dated 20 July 2021, which was subject to a 25% trade discount had been incorrectly entered on the creditor's statement at its gross amount. The invoice had been correctly recorded in Zimba Hats' purchases journal at the net amount of R900. 3. Credit note No. 010, dated 10 July 2021, for R260 was correctly shown on the statement and in the purchases returns journal. The credit note had been correctly recorded in the general ledger of Zimba Hats, but had been posted to the supplier's account in the subsidiary ledger as an invoice. 4. Invoice No. 212 for R250, dated 29 July 2021, does not appear on the statement of Headgear Wholesalers. REQUIRED: Prepare the Remittance advice to be sent to Headgear Wholesalers on 1 August 2021 together with the payment for July purchases. EXERCISE 6.7 6.7 On receipt of the bank statement for July 2021, the bookkeeper of Mocha Coffee Shop discovered that the debit balance of R3 200 shown on the bank statement did not agree with the debit balance of R49 480 in the cash book. On comparing the two records he noted the following differences: 1. The bank statement showed payment no. 212 for R4 250 in favour of Nelson Mandela Metropolitan Municipality. The bookkeeper of Mocha Coffee Shop disputed this payment as he did not process this payment through the bank account of Mocha Coffee Shop. As a result of this payment, Mocha Coffee Shop used its overdraft facility and interest of R120 was charged. The bank agreed to investigate payment no. 212 and reverse the interest charged. This was the only time that interest on overdraft was charged during July. 2. A deposit of R22 000 not credited by the bank on 30 June appeared on the July bank statement but a deposit of R56 000 made on 30 July did not appear on the statement. 3. A deposit of R2 100 shown on the July bank statement had not been recorded in the cash book. The deposit was made by Y. Mandla, a regular customer, who settled with a direct transfer. 4. Payment no. 328 for the purchase of office supplies for R855 recorded in the June cash book had not appeared on the June bank statement. It was later discovered that the payment for these goods had been made by the owner using his free reward points. The owner does not wish to be reimbursed for this payment. 5. Payment no. 150, a R1 500 donation made to a local sports club in May 2021, was paid into the bank account of the wrong beneficiary. The amount was refunded and appeared on the bank statement in July 2021. No entry for the refund has been processed in the cash book. The bookkeeper plans to redo the transfer of the donation to the local sports club in August 2021. 6. Payment no. 333 for R1 100, for a poster advertisement, had been entered incorrectly in the cash book as R2 100. 7. Payments no. 335 and 336 which were recorded in the cash book during July do not appear on the July bank statement. Payment no. 335 for R900 was to Telkom. 8. Bank charges, including interest on overdraft, totaling R330, are reflected on the bank statement. This amount had not been recorded in the cash book. REQUIRED: (a) Complete and balance the cash book of Mocha Coffee Shop for July 2021. (b) Prepare the Bank Reconciliation Statement at 31 July 2021. (27 minutes)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts