Question: please help answer these 3 questions The fixed budget for 20,700 units of production shows sales of $538,200, variable costs of $62,100, and fixed costs

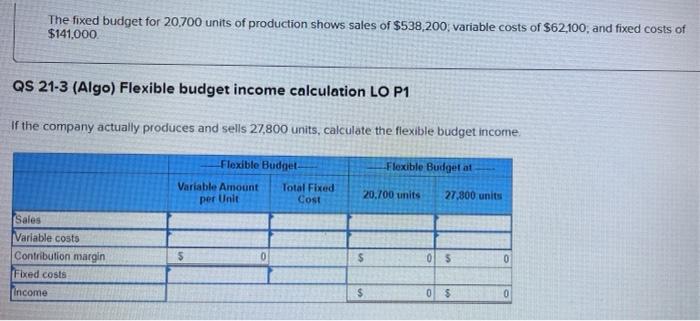

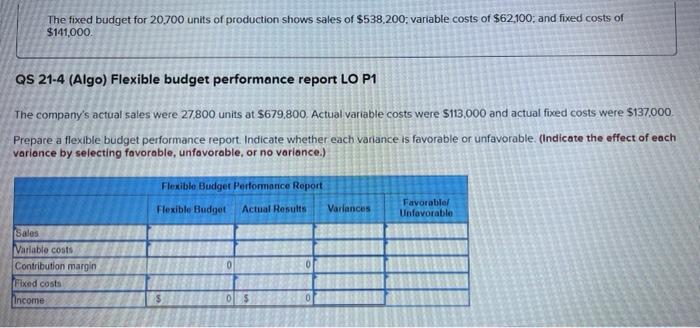

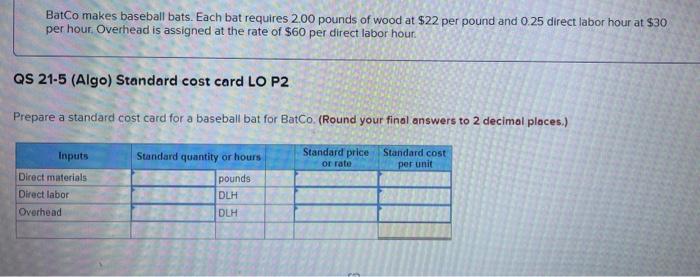

The fixed budget for 20,700 units of production shows sales of $538,200, variable costs of $62,100, and fixed costs of $141,000 QS 21-3 (Algo) Flexible budget income calculation LO P1 of the company actually produces and sells 27,800 units, calculate the flexible budget income Flexible Budget Flexible Budget at Variable Amount Total Fixed Cost 20.700 units 27,800 units per Unit Sales Variable costs Contribution margin Fixed costs 0 $ 05 0 Income $ 0 $ 0 The fixed budget for 20700 units of production shows sales of $538,200; variable costs of $62,100; and fixed costs of $141,000. QS 21-4 (Algo) Flexible budget performance report LO P1 The company's actual sales were 27800 units at $679,800. Actual variable costs were $113,000 and actual fixed costs were $137,000 Prepare a flexible budget performance report. Indicate whether each variance is favorable or unfavorable (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Flexiblo Budget Performance Report Flexible Budget Actual Results Variances Favorable Unfavorable Sales Variable costs Contribution margin Fixed costs Income 0 0 BatCo makes baseball bats. Each bat requires 2.00 pounds of wood at $22 per pound and 0.25 direct labor hour at $30 per hour. Overhead is assigned at the rate of $60 per direct labor hour. QS 21-5 (Algo) Standard cost card LO P2 Prepare a standard cost card for a baseball bat for BatCo. (Round your final answers to 2 decimal places.) Inputs Standard cost Standard price or rate per unit Direct materials Direct labor Overhead Standard quantity or hours pounds DLH DLH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts