Question: PLEASE HELP ANSWER THESE ASAP. I WILL GIVE THUMBS UP. THANKS! The Mono Recreation Society receives these gifts during the year, each of which were

PLEASE HELP ANSWER THESE ASAP. I WILL GIVE THUMBS UP. THANKS!

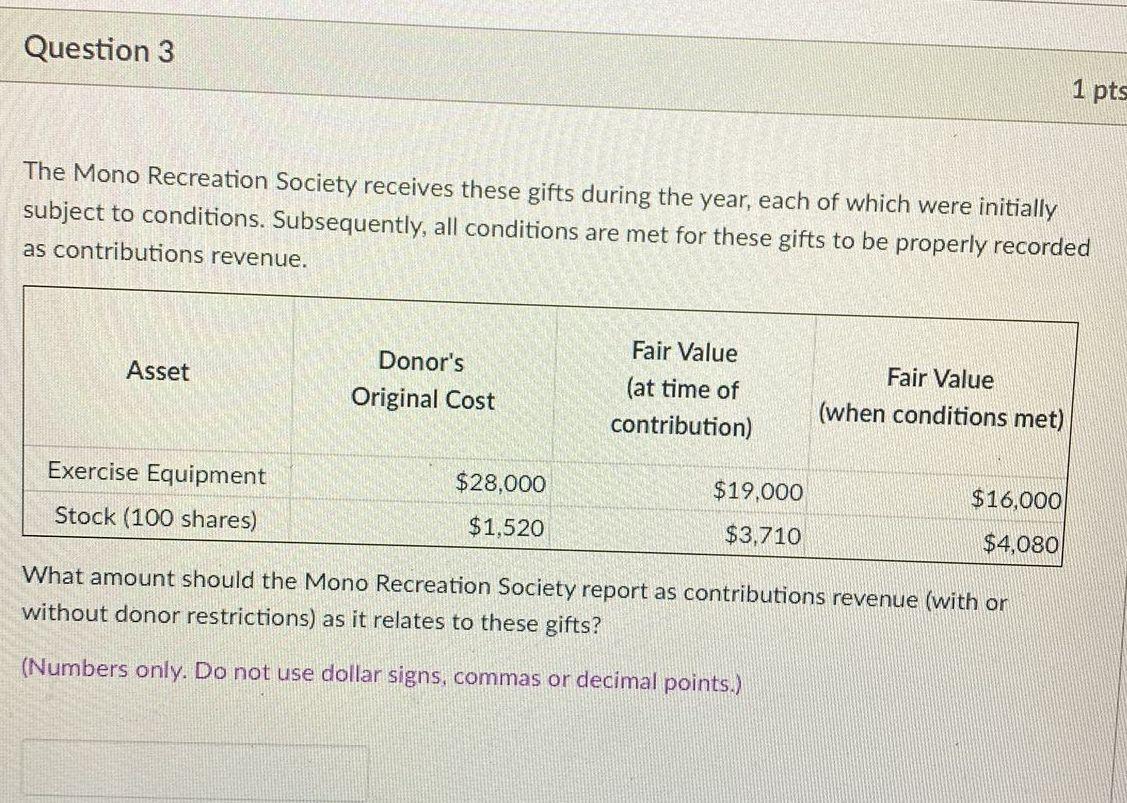

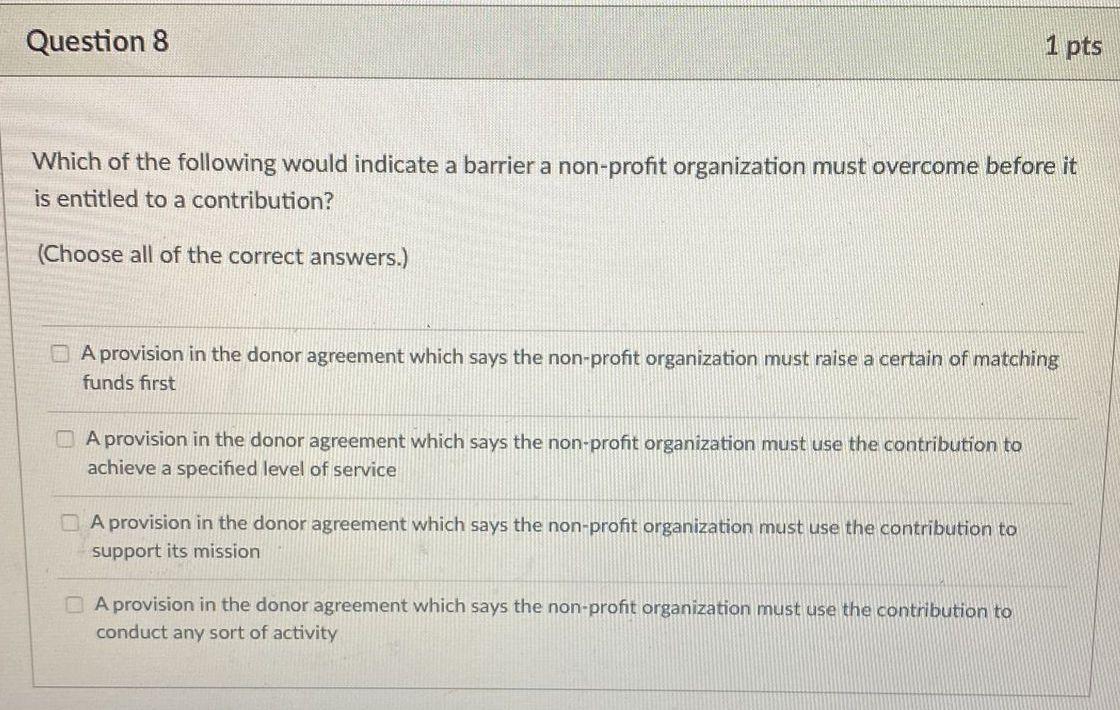

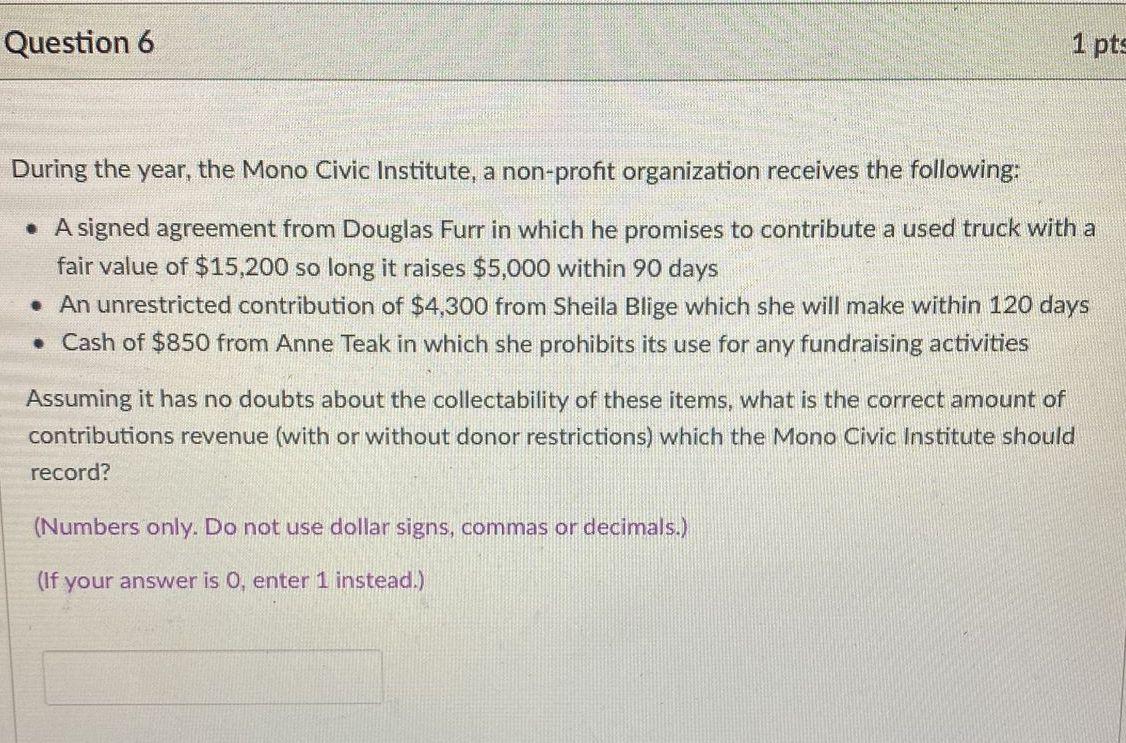

The Mono Recreation Society receives these gifts during the year, each of which were initially subject to conditions. Subsequently, all conditions are met for these gifts to be properly recorded as contributions revenue. What amount should the Mono Recreation Society report as contributions revenue (with or without donor restrictions) as it relates to these gifts? (Numbers only. Do not use dollar signs, commas or decimal points.) Which of the following would indicate a barrier a non-profit organization must overcome before it is entitled to a contribution? (Choose all of the correct answers.) A provision in the donor agreement which says the non-profit organization must raise a certain of matching funds first A provision in the donor agreement which says the non-profit organization must use the contribution to achieve a specified level of service A provision in the donor agreement which says the non-profit organization must use the contribution to support its mission A provision in the donor agreement which says the non-profit organization must use the contribution to conduct any sort of activity During the year, the Mono Civic Institute, a non-profit organization receives the following: - A signed agreement from Douglas Furr in which he promises to contribute a used truck with a fair value of $15,200 so long it raises $5,000 within 90 days - An unrestricted contribution of $4,300 from Sheila Blige which she will make within 120 days - Cash of $850 from Anne Teak in which she prohibits its use for any fundraising activities Assuming it has no doubts about the collectability of these items, what is the correct amount of contributions revenue (with or without donor restrictions) which the Mono Civic Institute should record? (Numbers only. Do not use dollar signs, commas or decimals.) (If your answer is 0 , enter 1 instead.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts