Question: please help answer this Problem 4 - Transfer Price Lesserafim Corporation is a company with grapes dessert business lines. Currently, the company has two divisions

please help answer this

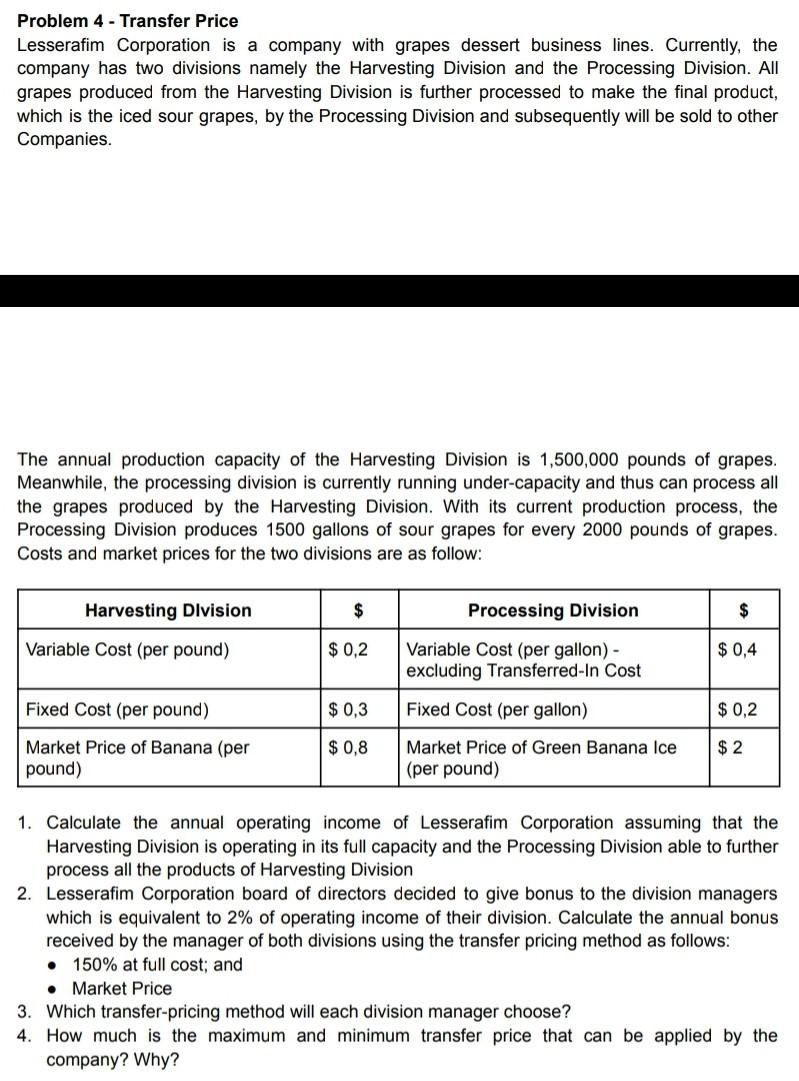

Problem 4 - Transfer Price Lesserafim Corporation is a company with grapes dessert business lines. Currently, the company has two divisions namely the Harvesting Division and the Processing Division. All grapes produced from the Harvesting Division is further processed to make the final product, which is the iced sour grapes, by the Processing Division and subsequently will be sold to other Companies. The annual production capacity of the Harvesting Division is 1,500,000 pounds of apes Meanwhile, the processing division is currently running under-capacity and thus can process all the grapes produced by the Harvesting Division. With its current production process, the Processing Division produces 1500 gallons of sour grapes for every 2000 pounds of grapes. Costs and market prices for the two divisions are as follow: Harvesting Division $ Processing Division $ Variable Cost (per pound) $0,2 $ 0,4 Variable Cost (per gallon) - excluding Transferred-In Cost Fixed Cost (per pound) $0,3 Fixed Cost (per gallon) $ 0,2 $ 0,8 $2 Market Price of Banana (per pound) Market Price of Green Banana Ice (per pound) 1. Calculate the annual operating income of Lesserafim Corporation assuming that the Harvesting Division is operating in its full capacity and the Processing Division able to further process all the products of Harvesting Division 2. Lesserafim Corporation board of directors decided to give bonus to the division managers which is equivalent to 2% of operating income of their division. Calculate the annual bonus received by the manager of both divisions using the transfer pricing method as follows: 150% at full cost; and Market Price 3. Which transfer-pricing method will each division manager choose? 4. How much is the maximum and minimum transfer price that can be applied by the company? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts