Question: please help answer this Problem 5 Performance Evaluation Facebook Company operates two divisions, Whatsapp and Instagram. Each division sells different products. The financial information for

please help answer this

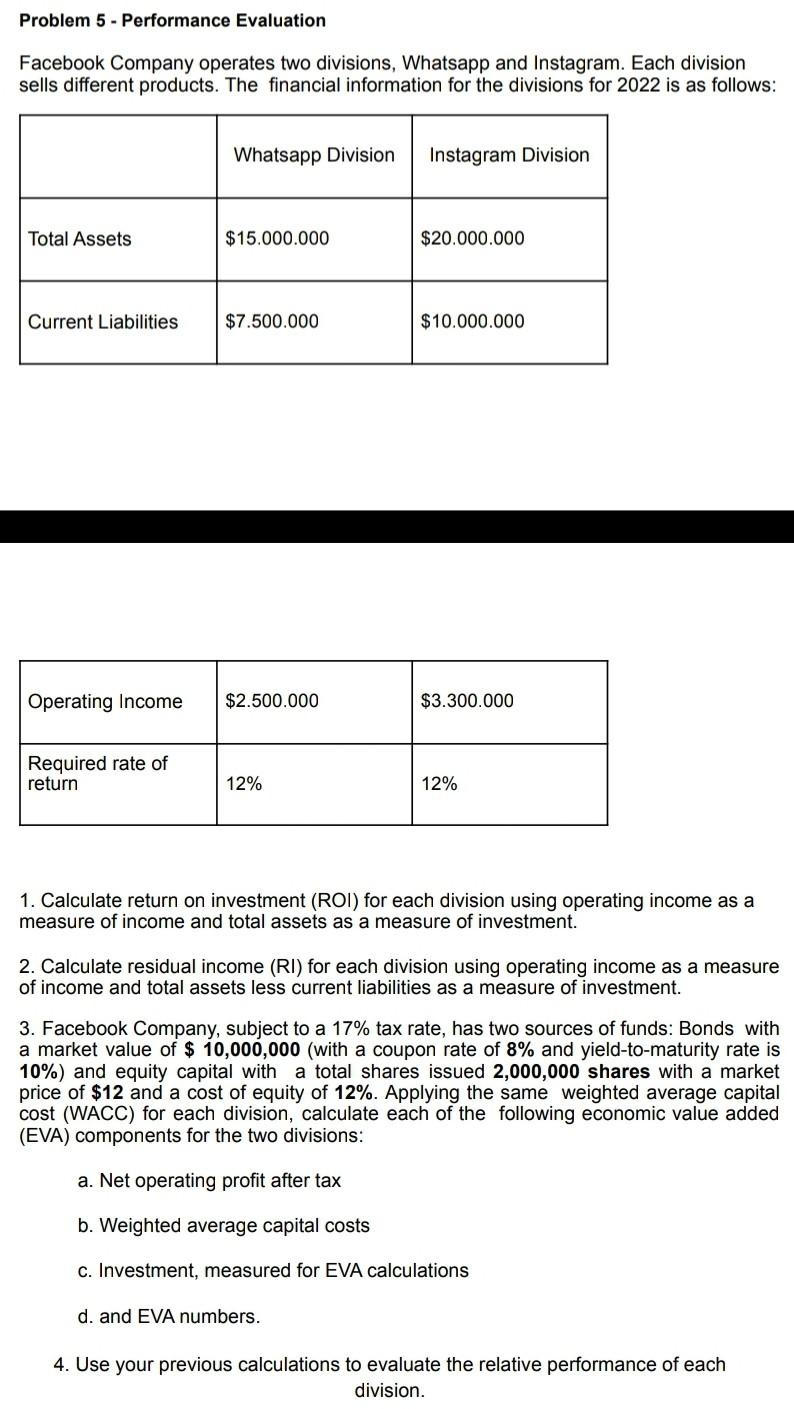

Problem 5 Performance Evaluation Facebook Company operates two divisions, Whatsapp and Instagram. Each division sells different products. The financial information for the divisions for 2022 is as follows: Whatsapp Division Instagram Division Total Assets $15.000.000 $20.000.000 Current Liabilities $7.500.000 $10.000.000 Operating Income $2.500.000 $3.300.000 Required rate of return 12% 12% 1. Calculate return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment. 2. Calculate residual income (RI) for each division using operating income as a measure of income and total assets less current liabilities as a measure of investment. 3. Facebook Company, subject to a 17% tax rate, has two sources of funds: Bonds with a market value of $ 10,000,000 (with a coupon rate of 8% and yield-to-maturity rate is 10%) and equity capital with a total shares issued 2,000,000 shares with a market price of $12 and a cost of equity of 12%. Applying the same weighted average capital cost (WACC) for each division, calculate each of the following economic value added (EVA) components for the two divisions: a. Net operating profit after tax b. Weighted average capital costs c. Investment, measured for EVA calculations d. and EVA numbers. 4. Use your previous calculations to evaluate the relative performance of each division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts