Question: Please help answer this question ASAP! thank you Static budget variable overhead 3,640 Static budget fixed overhead Static budget direct labor hours Static budget number

Please help answer this question ASAP! thank you

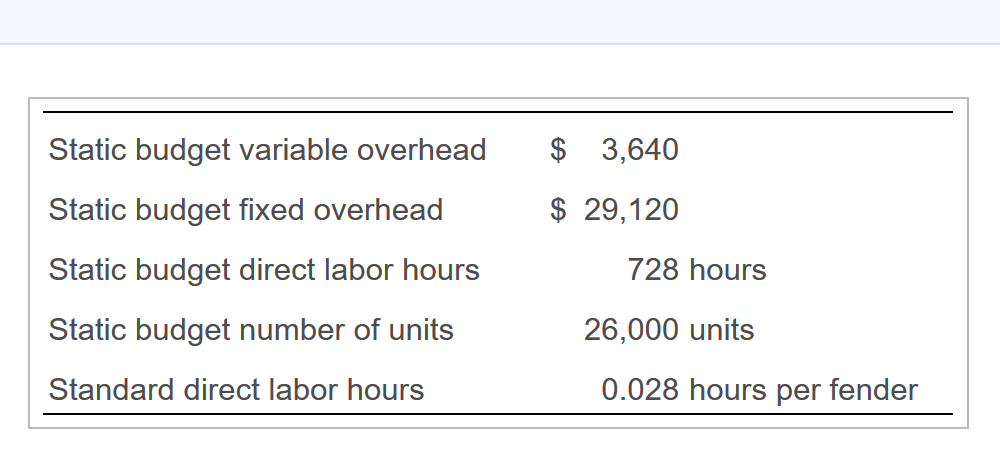

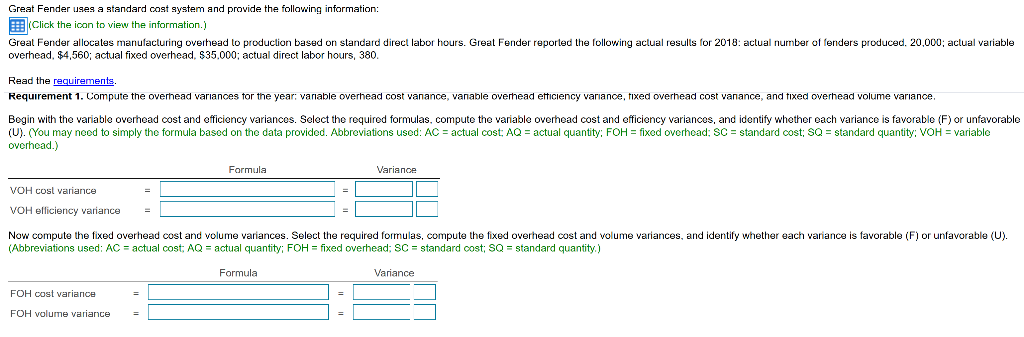

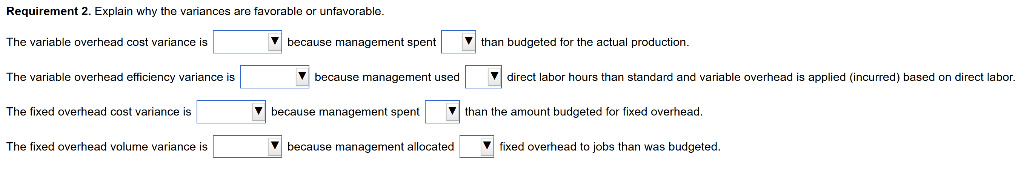

Static budget variable overhead 3,640 Static budget fixed overhead Static budget direct labor hours Static budget number of units Standard direct labor hours $29,120 728 hours 26,000 units 0.028 hours per fender Great Fender uses a standard cost system and provide the following information .) (Click the icon to view the information Great Fender allocates manufacturing overhead to production based on standard direct labor hours. Great Fender reported the following actual resulls for 2018: actual nunber of fenders produced. 20,000; actual variable overhead, $4,560; actual fixed overhead, $35.000; actual direct labor hours, 380. Read the requirements Requirement 1. Compute the overhead variances tor the year: vanable overhead cost vanance, vanable overhead etticiency variance, tixed overhead cost vanance, and tixed overhead volume variance Bogin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable (F) or unfavorable (U). (You may neod to simply the formula based on the data provided. Abbreviations used: ACactual cost: AQactual quantity: FOH fixed overhoad: SCstandard cost: SQ standard quantity: VOHvariable overhcad.) Formula Varianoe VOH cost variance VOH efficiency variance Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U) (Abbreviations used: AC actual cost AQ actual quantity; FOHfixed overhead: SC standard cost, SQ standard quantity.) Formula Variance FOH cost variance - FOH volume variance Requirement 2. Explain why the variances are favorable or unfavorable because management spent than budgeted for the actual production The variable overhead cost variance is 'I direct labor hours than standard and variable overhead is applied (incurred) based on direct labor The variable overhead efficiency variance is because management used The fixed overhead cost variance is V because management spethan the amount budgeted for fixed overhead ause managem ent alocated Thed overhead to jobs than was budgeted. ' The fixed overhead volume variance is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts