Question: Please help answer this questions a like will be given Russell 2000 Index: Introduction The next few questions refer to the following information Financial planner

Please help answer this questions a like will be given

Please help answer this questions a like will be given

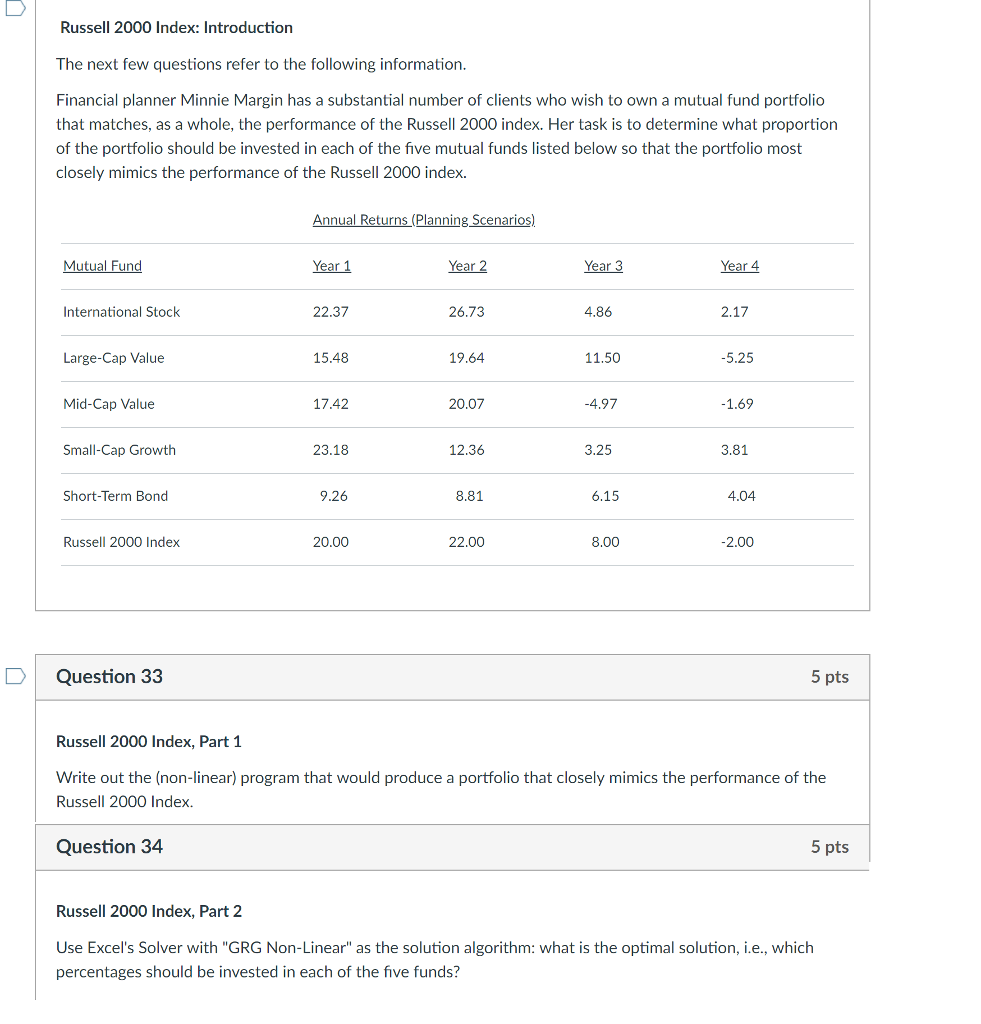

Russell 2000 Index: Introduction The next few questions refer to the following information Financial planner Minnie Margin has a substantial number of clients who wish to own a mutual fund portfolio that matches, as a whole, the performance of the Russell 2000 index. Her task is to determine what proportion of the portfolio should be invested in each of the five mutual funds listed below so that the portfolio most closely mimics the performance of the Russell 2000 index. Annual Returns (Planning Scenarios) Year 1 Year 2 26.73 19.64 ua Year 3 Year 4 International Stock 22.37 4.86 2.17 Large-Cap Value 15.48 11.50 5.25 Mid-Cap Value 17.42 20.07 -4.97 1.69 Small-Cap Growth 23.18 12.36 3.25 3.81 Short-Term Bond 9.26 8.81 6.15 4.04 Russell 2000 Index 20.00 22.00 8.00 2.00 D Question 33 5 pts Russell 2000 Index, Part 1 Write out the (non-linear) program that would produce a portfolio that closely mimics the performance of the Russell 2000 Index Question 34 5 pts Russell 2000 Index, Part 2 Use Excel's Solver with "GRG Non-Linear" as the solution algorithm: what is the optimal solution, i.e., which percentages should be invested in each of the five funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts