Question: please help As a lender, go through the information provided and determine if the clients qualify for their loan request. Jesiah and Cassandra Hamilton have

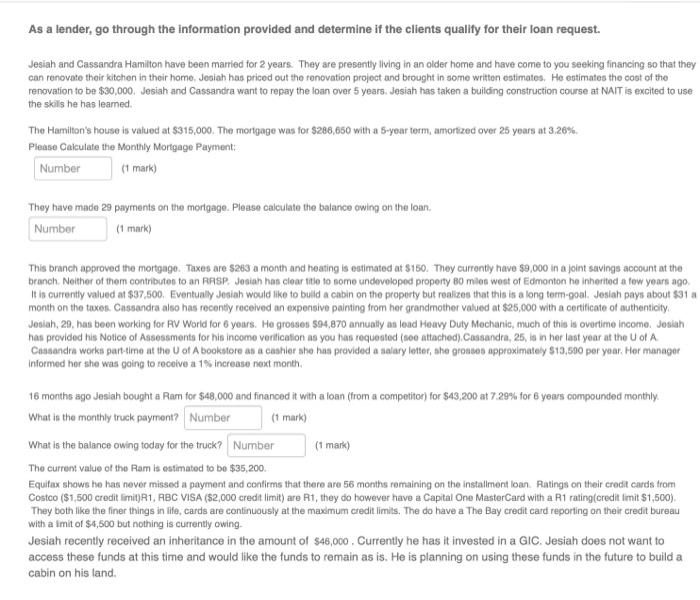

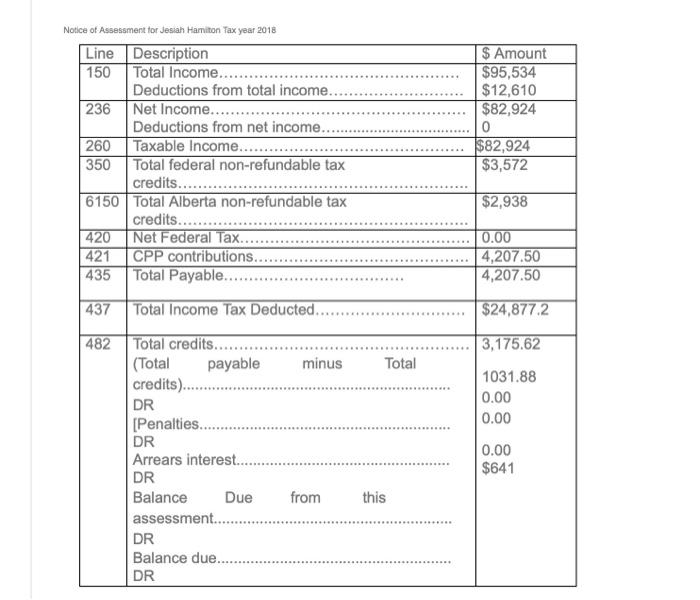

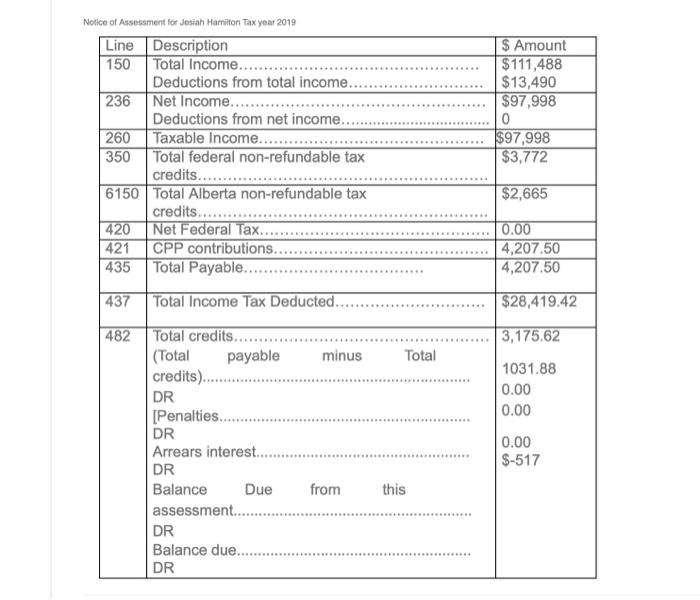

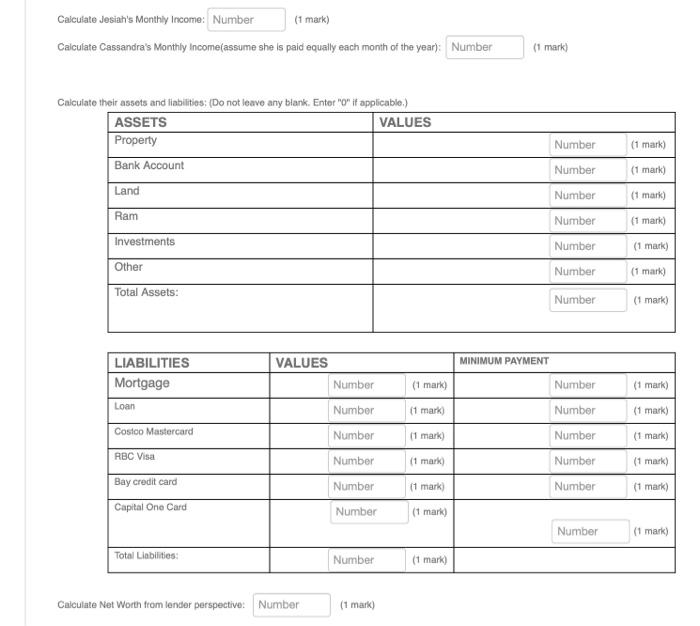

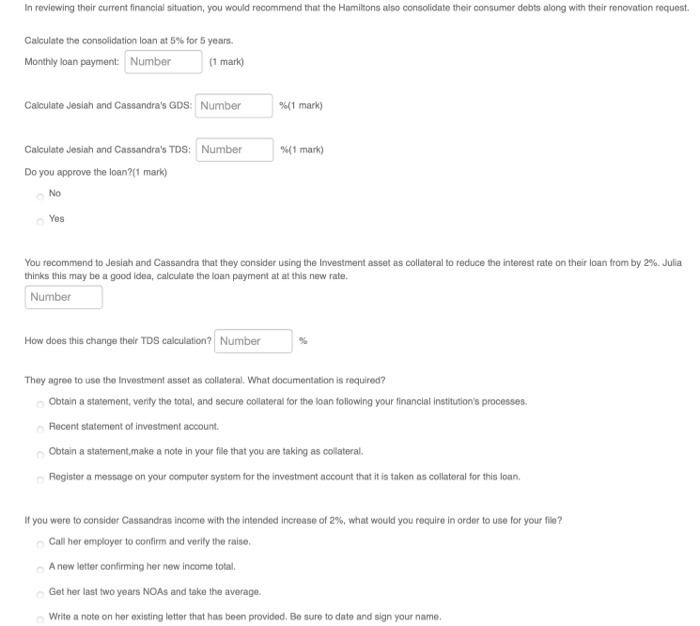

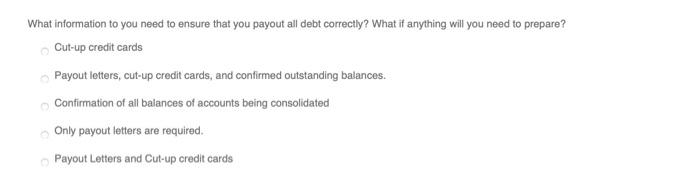

As a lender, go through the information provided and determine if the clients qualify for their loan request. Jesiah and Cassandra Hamilton have been married for 2 years. They are presently living in an older home and have come to you seeking financing so that they can renovate their kitchen in their home, Josiah has priced out the renovation project and brought in some writton estimates. He estimates the cost of the renovation to be $30,000. Jesiah and Cassandra want to repay the loan over 5 years. Jesiah has taken a building construction course at NAIT is excited to use the skills he has leamed The Hamilton's house is valued at $315,000. The mortgage was for $288,650 with a 5-year term amortized over 25 years at 3.26% Please Calculate the Monthly Mortgage Payment: Number (1 mark) They have made 29 payments on the mortgage. Please calculate the balance owing on the loan Number (1 mark) This branch approved the mortgage. Taxes are $283 a month and heating is estimated at $150. They currently have $9,000 in a joint savings account at the branch. Nother of them contribute to an RASP. Josian has clear title to some undeveloped property 80 milon wout of Edmonton ho inherited a few years ago It is currently valued at $37.500. Eventually Josiah would like to build a cabin on the property but realize that this is a long term.goal. Josiah pays about $31 a month on the taxes. Cassandra also has recently received an expensive painting from her grandmother valued at $25,000 with a certificate of authenticity. Josiah, 29, has been working for RV World for yours. He grosses 594,870 annually as lead Heavy Duty Mechanic, much of this is overtime incomo, Josiah has provided his Notice of Assessments for his income verification as you has requested (100 attached). Cassandra, 25, is in her last year at the U of A Cassandra works part-time at the U of A bookstore an a cashier she has provided a salary letter, the grosses approximately $13,500 per year. Her manager Informed her she was going to receive a 1% increase next month. 16 months ago Josiah bought a Ram for $48,000 and financed it with a loan (from a competitor) for $43,200 at 7.29% for 6 years compounded monthly What is the monthly truck payment? Number (1 mark) What is the balance owing today for the truck? Number (1 mark) The current value of the Ram is estimated to be $35,200. Equifax shows ho has never missed a payment and confirms that there are 56 months romaining on the installment loan Ratings on their credit cards from Costco ($1,500 credit limit) R1, RBC VISA ($2,000 credit limit) are R1, they do however have a Capital One MasterCard with a R1 rating(credit limit $1,500) They both like the finer things in life, cards are continuously at the maximum credit limits. The do have a The Bay credit card reporting on their credit bureau with a imit of $4,500 but nothing is currently owing. Jesiah recently received an inheritance in the amount of $45,000 . Currently he has it invested in a GIC. Jesiah does not want to access these funds at this time and would like the funds to remain as is. He is planning on using these funds in the future to build a cabin on his land Notice of Assessment for Jesiah Hamiton Tax year 2018 Line Description 150 Total Income..... Deductions from total income.. 236 Net Income...... Deductions from net income.. 260 Taxable income...... 350 Total federal non-refundable tax credits......... 6150 Total Alberta non-refundable tax credits...... 420 Net Federal Tax. 421 CPP contributions.. 435 Total Payable..... $ Amount $95,534 $12,610 $82,924 0 $82,924 $3,572 $2,938 0.00 4,207.50 4,207.50 437 Total Income Tax Deducted.. $24,877.2 482 3,175.62 minus Total 1031.88 0.00 0.00 Total credits...... (Total payable credits).............. DR [Penalties....... DR Arrears interest.. DR Balance Due assessment.......... DR Balance due...... DR 0.00 $641 from this Notice of Assessment for Josiah Hamilton Tax year 2019 Line Description 150 Total Income..... Deductions from total income.. 236 Net Income........ Deductions from net income.. 260 Taxable income........ 350 Total federal non-refundable tax credits......... 6150 Total Alberta non-refundable tax credits...... 420 Net Federal Tax... 421 CPP contributions... 435 Total Payable....... $ Amount $111,488 $13,490 $97,998 0 $97,998 $3,772 $2,665 0.00 4,207.50 4,207.50 437 Total Income Tax Deducted.. $28,419.42 3,175.62 minus Total HER 1031.88 0.00 0.00 482 Total credits......... (Total payable credits)......... DR [Penalties..... DR Arrears interest.. DR Balance Due assessment........... DR Balance due......... DR 0.00 $-517 from this Cassandra's Income Confirmation Letter: Jackson Peters Human Resources Manager University of Alberta 116 Stand 85 Ave Edmonton, Alberta TEG 23 November 30, 2021 To Whom This May Concern, This letter is to confirm that Cassandras Hamilton is an employee of the University of Alberta Bookstore. Cassandra has been wo in a part-time position since September 15th 2020. Her annual salary is 13,590 per annum If there are any questions or concerns, please feel free to call me at 780-452-3216, Thank you Jackson Peters Calculate Jeslah's Monthly Income: Number (1 mark) Calculate Cassandra's Monthly Income(assume she is paid equally each month of the year): Number (1 mark) Calculate Jesiah's Monthly Income: Number (1 mark) Calculate Cassandra's Monthly Income (assume she is paid equally each month of the year): Number (1 mark) Number (1 mark) Number (1 mark) Calculate their assets and liabilities: (Do not leave any blank. Enter "o" if applicable.) ASSETS VALUES Property Bank Account Land Ram Investments Other Total Assets: Number (1 mark) Number (1 mark) Number (1 mark) Number (1 mark) Number (1 mark) VALUES MINIMUM PAYMENT LIABILITIES Mortgage Number (1 mark) Number (1 mark) Loan Number (1 mark) Number (1 mark) Number (1 mark) Number (1 mark) Costo Mastercard RBC Visa Number (1 mark) Number (1 mark) Bay credit card Number (1 mark) Capital One Card Number Number (1 mark) (1 mark) Number (1 mark) Total Liabilities: Number (1 mark) Calculate Net Worth from lender perspective: Number (1 mark) In reviewing their current financial situation, you would recommend that the Hamiltons also consolidate their consumer debts along with their renovation request Calculate the consolidation loan at 5% for 5 years. Monthly loan payment: Number (1 mark) Calculate Josiah and Cassandra's GDS: Number %[1 mark) %(1 mark) Calculate Josiah and Cassandra's TDS: Number Do you approve the loan?[1 mark) No Yes You recommend to Jesiah and Cassandra that they consider using the investment asset as collateral to reduce the interest rate on their loan from by 2%. Julia thinks this may be a good idea, calculate the loan payment at at this new rate. Number How does this change their TDS calculation? Number They agree to use the Investment asset as collateral. What documentation is required? Obtain a statement verify the total, and secure collateral for the loan following your financial institution's processes. Recent statement of investment account. Obtain a statement make a note in your file that you are taking as colateral. Register a message on your computer system for the investment account that it is taken as collateral for this loan, if you were to consider Cassandras income with the intended increase of 2%, what would you require in order to use for your file? Call her employer to confirm and verify the raise A new letter confirming her new income total, Get her last two years NOAs and take the average. Write a note on her existing letter that has been provided. Be sure to date and sign your name, What information to you need to ensure that you payout all debt correctly? What if anything will you need to prepare? Cut-up credit cards Payout letters, cut-up credit cards, and confirmed outstanding balances. Confirmation of all balances of accounts being consolidated Only payout letters are required. Payout Letters and Cut-up credit cards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts