Question: please help as fast as possible 3.Calculations and analysis (40 points total) (1) The Great Corporation had $ 200,000 in 2021 taxable income. Using the

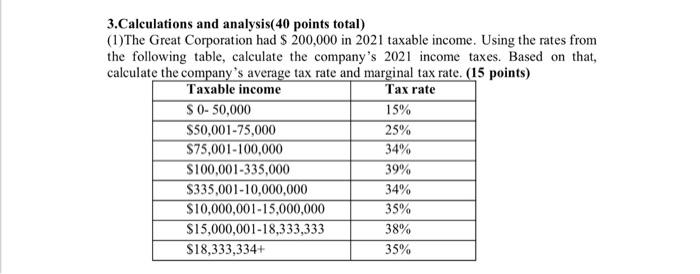

3.Calculations and analysis (40 points total) (1) The Great Corporation had $ 200,000 in 2021 taxable income. Using the rates from the following table, calculate the company's 2021 income taxes. Based on that, calculate the company's average tax rate and marginal tax rate. (15 points) Taxable income Tax rate 15% 25% 34% 39% 34% 35% 38% 35% $ 0-50,000 $50,001-75,000 $75,001-100,000 $100,001-335,000 $335,001-10,000,000 $10,000,001-15,000,000 $15,000,001-18,333,333 $18,333,334+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts