Question: Please help as I am really struggling with this concept Jan Shumard, president and general manager of Danbury Company, was concerned about the future of

Please help as I am really struggling with this concept

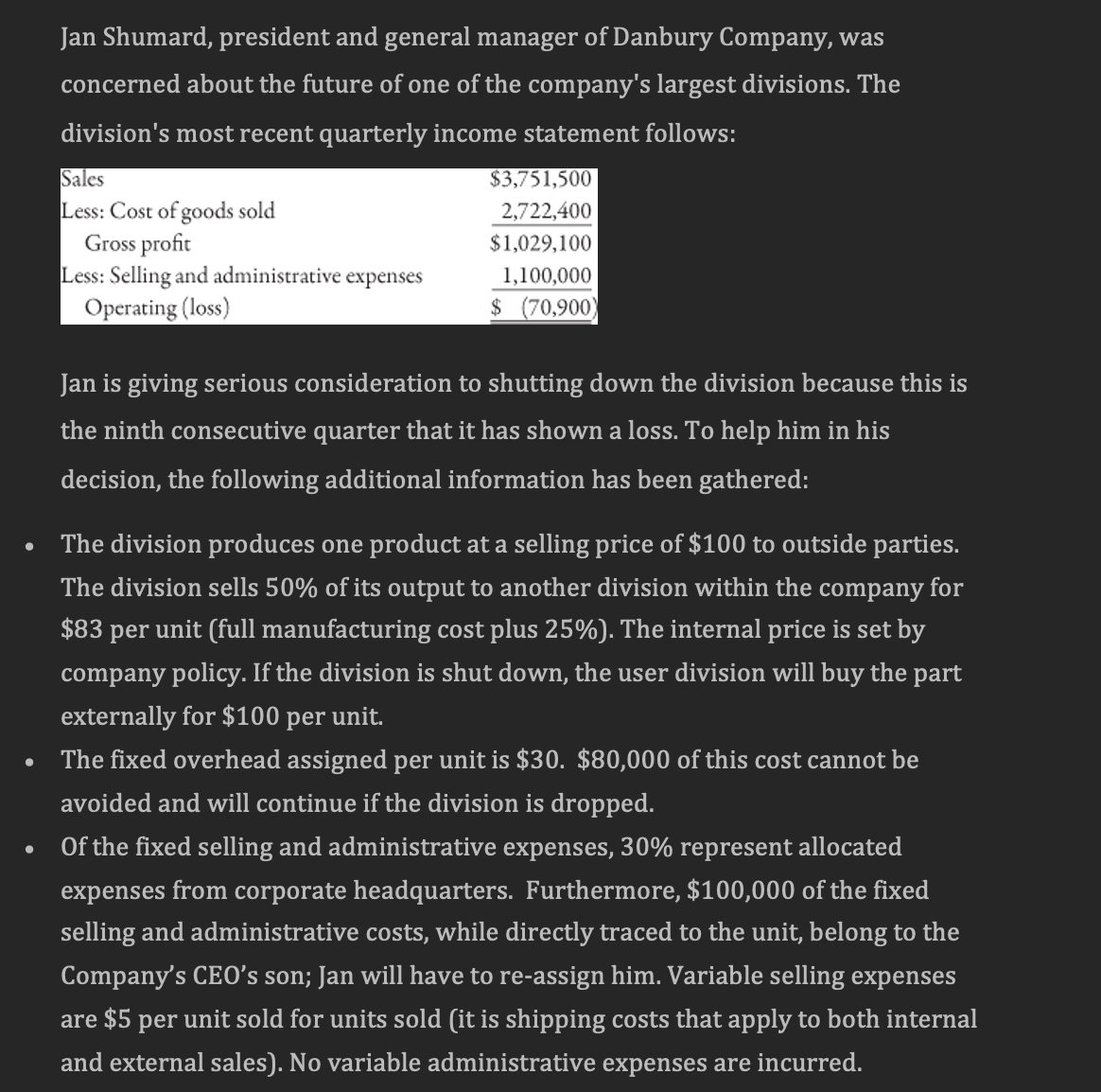

Jan Shumard, president and general manager of Danbury Company, was

concerned about the future of one of the company's largest divisions. The

division's most recent quarterly income statement follows:

Jan is giving serious consideration to shutting down the division because this is

the ninth consecutive quarter that it has shown a loss. To help him in his

decision, the following additional information has been gathered:

The division produces one product at a selling price of $ to outside parties.

The division sells of its output to another division within the company for

$ per unit full manufacturing cost plus The internal price is set by

company policy. If the division is shut down, the user division will buy the part

externally for $ per unit.

The fixed overhead assigned per unit is $ $ of this cost cannot be

avoided and will continue if the division is dropped.

Of the fixed selling and administrative expenses, represent allocated

expenses from corporate headquarters. Furthermore, $ of the fixed

selling and administrative costs, while directly traced to the unit, belong to the

Company's CEO's son; Jan will have to reassign him. Variable selling expenses

are $ per unit sold for units sold it is shipping costs that apply to both internal

and external sales No variable administrative expenses are incurred.

A Prepare a segment margin or division margin income

statement that more accurately reflects the division's profit

performance given the numbers reported originally. Hint: do

not change any of the given numbers, but reformat, splitting

fixed costs into direct and common

B Using the segment margin income statement in A now adjust

for relevant information given in the facts and create a new

segment margin income statement based on relevant

numbers. Hint: be clear to show your work for the

adjustments from A to B

C Given what you did in B what is the net effect of dropping the

division?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock