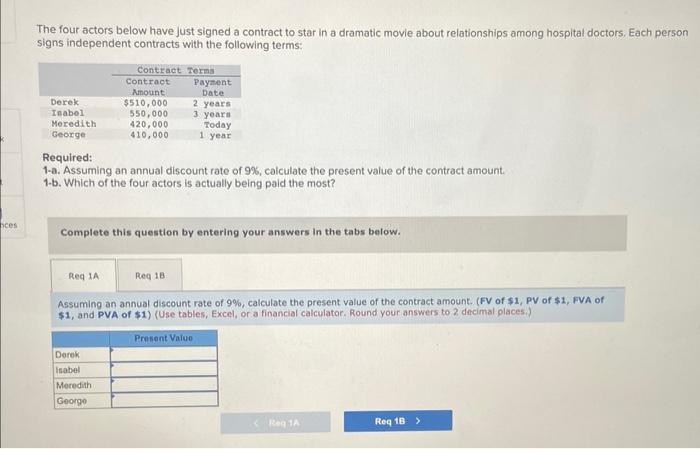

Question: Please help as soon as possible!! The four actors below have Just signed a contract to star in a dramatic movie about relationships among hospltal

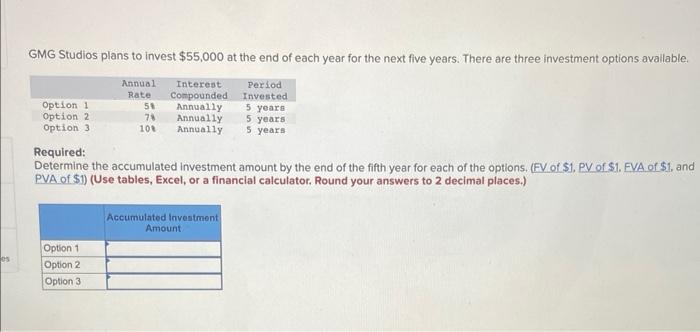

The four actors below have Just signed a contract to star in a dramatic movie about relationships among hospltal doctors, Each person signs independent contracts with the following terms: Required: 1-a. Assuming an annual discount rate of 9%, calculate the present value of the contract amount. 1-b. Which of the four actors is actually being paid the most? Complete this question by entering your answers in the tabs below. Assuming an annual discount rate of 9%, calculate the present value of the contract amount. (FV of $1,PV of $1, FVA of $1, and PVA of $1 ) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) GMG Studios plans to invest $55,000 at the end of each year for the next five years. There are three investment options available. Required: Determine the accumulated investment amount by the end of the fifth year for each of the options. (FV of \$1, PV of \$1. FVA of \$1, and PVA of \$1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) The four actors below have Just signed a contract to star in a dramatic movie about relationships among hospltal doctors, Each person signs independent contracts with the following terms: Required: 1-a. Assuming an annual discount rate of 9%, calculate the present value of the contract amount. 1-b. Which of the four actors is actually being paid the most? Complete this question by entering your answers in the tabs below. Assuming an annual discount rate of 9%, calculate the present value of the contract amount. (FV of $1,PV of $1, FVA of $1, and PVA of $1 ) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) GMG Studios plans to invest $55,000 at the end of each year for the next five years. There are three investment options available. Required: Determine the accumulated investment amount by the end of the fifth year for each of the options. (FV of \$1, PV of \$1. FVA of \$1, and PVA of \$1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts