Question: please help as soon as possible// use same format as excel spreadsheet. For the spreadsheet just fill in the values for the yellow highlighted portions.

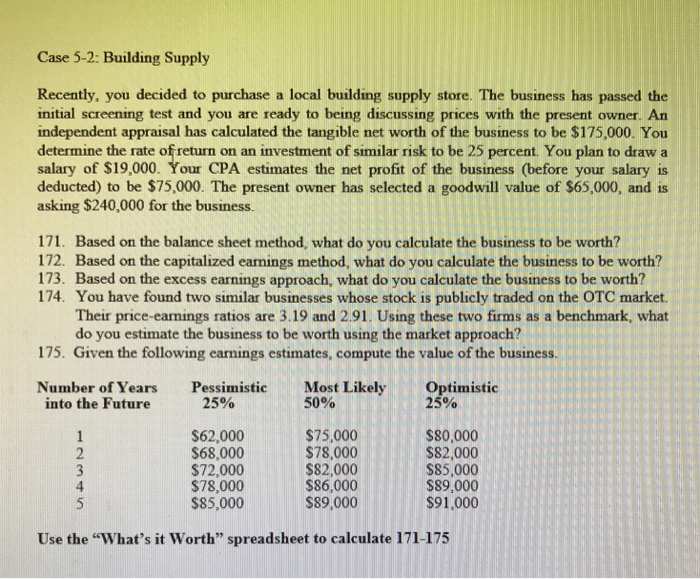

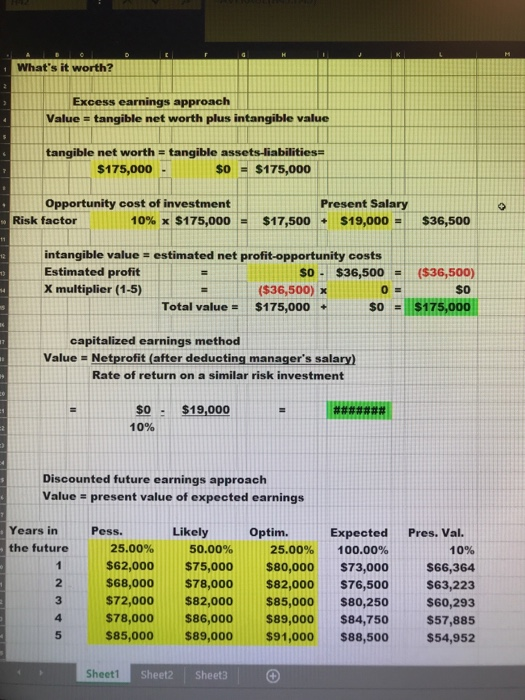

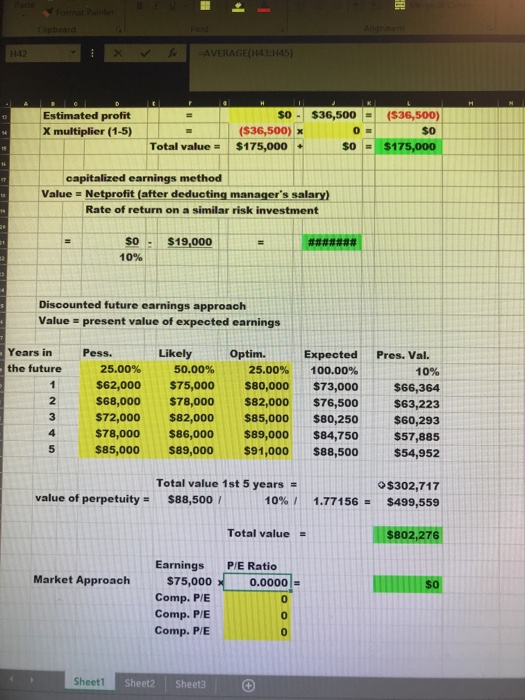

Case 5-2: Building Supply Recently, you decided to purchase a local building supply store. The business has passed the initial screening test and you are ready to being discussing prices with the present owner. An independent appraisal has calculated the tangible net worth of the business to be $175,000. You determine the rate of return on an investment of similar risk to be 25 percent. You plan to draw a salary of $19,000. Your CPA estimates the net profit of the business (before your salary is deducted) to be $75,000. The present owner has selected a goodwill value of $65,000, and is asking $240,000 for the business. 171. Based on the balance sheet method, what do you calculate the business to be worth? 172. Based on the capitalized earnings method, what do you calculate the business to be worth? 173. Based on the excess earnings approach, what do you calculate the business to be worth? 174. You have found two similar businesses whose stock is publicly traded on the OTC market. Their price-earnings ratios are 3.19 and 2.91. Using these two firms as a benchmark, what do you estimate the business to be worth using the market approach? 175. Given the following earnings estimates, compute the value of the business. Most Likely 50% Optimistic 25% Number of Years into the Future Pessimistic 25% $75,000 $78,000 $82,000 $86,000 $89,000 $80,000 $82,000 $85,000 89,000 $91,000 $62,000 $68,000 $72,000 $78,000 $85,000 Use the "What's it Worth" spreadsheet to calculate 171-175 What's it worth? Excess earnings approach Value-tangible net worth plus intangible value tangible net worth $175,000 tangible assets-liabilities- SO $175,000 Opportunity cost of investment Present Salary Risk factor 10% x $175,000 = $17,500 + S|9,000 = S36,500 intangible value Estimated profit X multiplier (15) estimated net profit-opportunity costs So $36,500 ($36,500) SO $36,500) x Total value$17,000SO $175,000 capitalized earnings method Value = Netprofit(after deductingm anager's salary) Rate of return on a similar risk investment S0 $19,000 10% Discounted future earnings approach value = present value of expected earnings Years in Pess. LikelyOptim. ExpectedPres.Val. the future 25.00% 50.00% 25.00% 100.00% $62,000 $75,000 $80,000 $73,000 $68,000 $78,000 $82,000 $76,500 $72,000$82,000 $85,000$80,250 $78,000$86,000 $89,000$84,750 10% S66,364 $63,223 $60,293 $57,885 5 $85,000 $89,000$91,000 $88,500 $54,952 2 3 4 Sheet1 Sheet2 Sheet3 so- $36,500 ($36,500) Estimated profit x multiplier (1-5) ($36,500) $175,000 $O $0BI$175,001 Total value= + capitalized earnings method Value = Netprofit (after deducting manager's salary) Rate of return on a similar risk investment so $19,000 10% Discounted future earnings approach Value- present value of expected earnings Years inPess the future LikelyOptim.Expected Pres. Val. 25.00% 50.00% 25.00% 100.00% $62,000 $75,000 $80,000 $73,000 $68,000 $78,000 $82,000$76,500 $72,000 $82,000 $85,000$80,250 $78,000$86,000 $89,000 $84,750 $57,885 $85,000 $89,000 $91,000 S88,500 10% $66,364 $63,223 $60,293 2 5 $54,952 Total value 1st 5 years $88,500 $302,717 10%, 1.77156= $499,559 value of perpetuity $802,.276 Total value Earnings P/E Ratio Market Approach $75,0000.0000 0 0 0 Comp. P/E Comp. P/E Comp. P/E Sheet2 | Sheet3 Case 5-2: Building Supply Recently, you decided to purchase a local building supply store. The business has passed the initial screening test and you are ready to being discussing prices with the present owner. An independent appraisal has calculated the tangible net worth of the business to be $175,000. You determine the rate of return on an investment of similar risk to be 25 percent. You plan to draw a salary of $19,000. Your CPA estimates the net profit of the business (before your salary is deducted) to be $75,000. The present owner has selected a goodwill value of $65,000, and is asking $240,000 for the business. 171. Based on the balance sheet method, what do you calculate the business to be worth? 172. Based on the capitalized earnings method, what do you calculate the business to be worth? 173. Based on the excess earnings approach, what do you calculate the business to be worth? 174. You have found two similar businesses whose stock is publicly traded on the OTC market. Their price-earnings ratios are 3.19 and 2.91. Using these two firms as a benchmark, what do you estimate the business to be worth using the market approach? 175. Given the following earnings estimates, compute the value of the business. Most Likely 50% Optimistic 25% Number of Years into the Future Pessimistic 25% $75,000 $78,000 $82,000 $86,000 $89,000 $80,000 $82,000 $85,000 89,000 $91,000 $62,000 $68,000 $72,000 $78,000 $85,000 Use the "What's it Worth" spreadsheet to calculate 171-175 What's it worth? Excess earnings approach Value-tangible net worth plus intangible value tangible net worth $175,000 tangible assets-liabilities- SO $175,000 Opportunity cost of investment Present Salary Risk factor 10% x $175,000 = $17,500 + S|9,000 = S36,500 intangible value Estimated profit X multiplier (15) estimated net profit-opportunity costs So $36,500 ($36,500) SO $36,500) x Total value$17,000SO $175,000 capitalized earnings method Value = Netprofit(after deductingm anager's salary) Rate of return on a similar risk investment S0 $19,000 10% Discounted future earnings approach value = present value of expected earnings Years in Pess. LikelyOptim. ExpectedPres.Val. the future 25.00% 50.00% 25.00% 100.00% $62,000 $75,000 $80,000 $73,000 $68,000 $78,000 $82,000 $76,500 $72,000$82,000 $85,000$80,250 $78,000$86,000 $89,000$84,750 10% S66,364 $63,223 $60,293 $57,885 5 $85,000 $89,000$91,000 $88,500 $54,952 2 3 4 Sheet1 Sheet2 Sheet3 so- $36,500 ($36,500) Estimated profit x multiplier (1-5) ($36,500) $175,000 $O $0BI$175,001 Total value= + capitalized earnings method Value = Netprofit (after deducting manager's salary) Rate of return on a similar risk investment so $19,000 10% Discounted future earnings approach Value- present value of expected earnings Years inPess the future LikelyOptim.Expected Pres. Val. 25.00% 50.00% 25.00% 100.00% $62,000 $75,000 $80,000 $73,000 $68,000 $78,000 $82,000$76,500 $72,000 $82,000 $85,000$80,250 $78,000$86,000 $89,000 $84,750 $57,885 $85,000 $89,000 $91,000 S88,500 10% $66,364 $63,223 $60,293 2 5 $54,952 Total value 1st 5 years $88,500 $302,717 10%, 1.77156= $499,559 value of perpetuity $802,.276 Total value Earnings P/E Ratio Market Approach $75,0000.0000 0 0 0 Comp. P/E Comp. P/E Comp. P/E Sheet2 | Sheet3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts