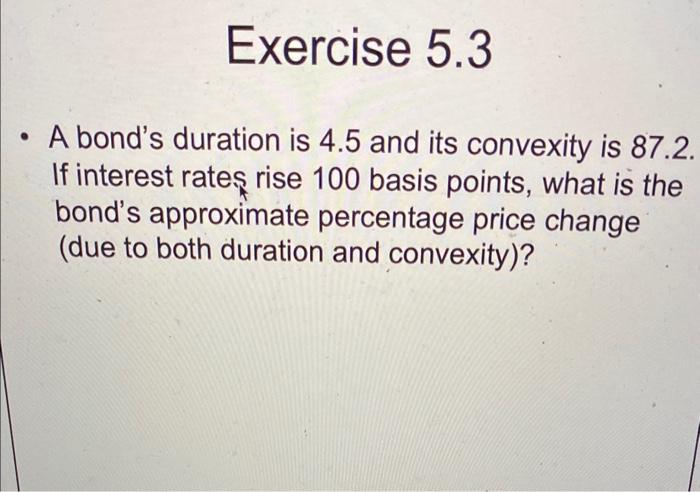

Question: Please Help Asap - A bond's duration is 4.5 and its convexity is 87.2. If interest rates rise 100 basis points, what is the bond's

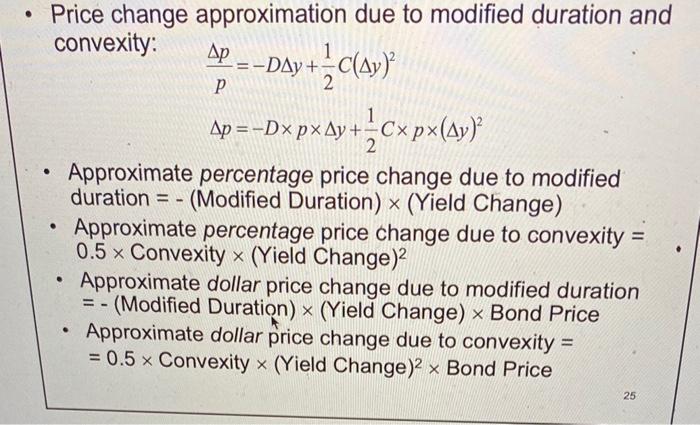

- A bond's duration is 4.5 and its convexity is 87.2. If interest rates rise 100 basis points, what is the bond's approximate percentage price change (due to both duration and convexity)? Price change approximation due to modified duration and convexity: pp=Dy+21C(y)2p=Dpy+21Cp(y)2 - Approximate percentage price change due to modified duration = (Modified Duration )( Yield Change ) - Approximate percentage price change due to convexity = 0.5 Convexity (YieldChange)2 - Approximate dollar price change due to modified duration =( Modified Duration )( Yield Change ) Bond Price - Approximate dollar price change due to convexity = =0.5 Convexity (YieldChange)2 Bond Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts