Question: PLEASE HELP ASAP Allowance Method versus Direct Write-Off Method On March 10, Mize, Inc., declared an $1,100 account receivable from the Anders Company as uncollectible

PLEASE HELP ASAP

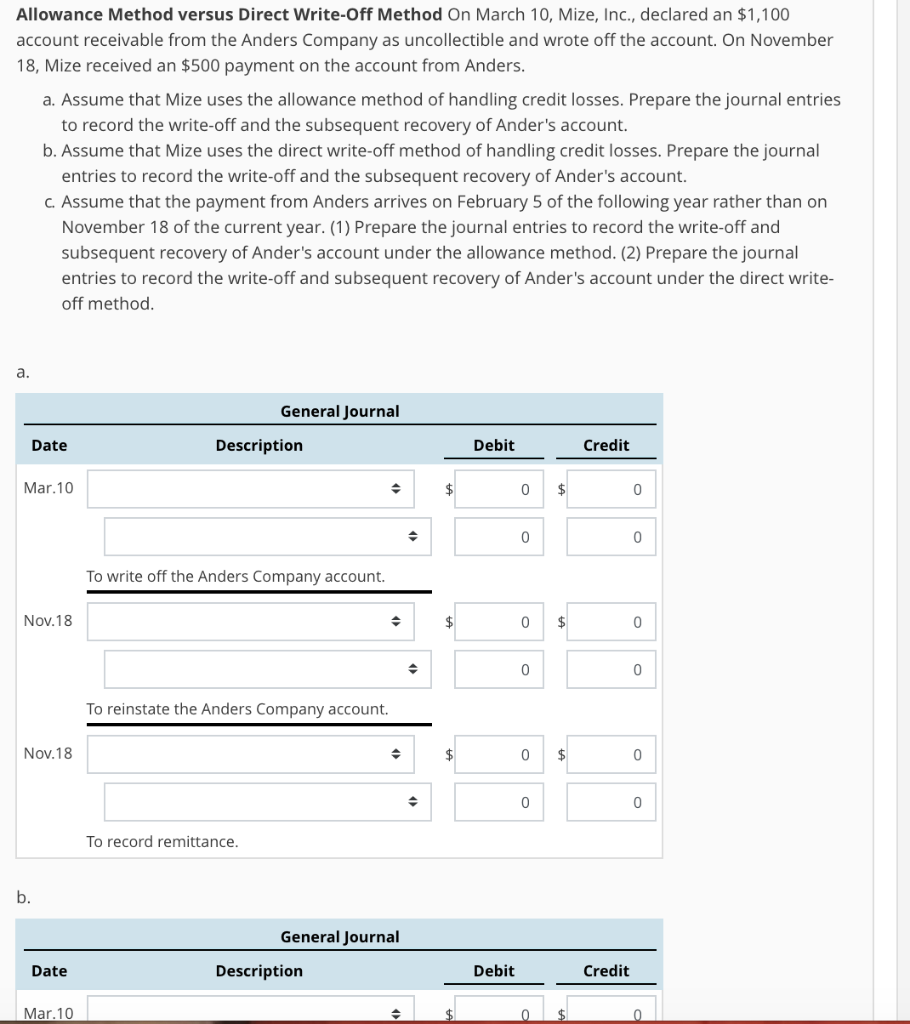

Allowance Method versus Direct Write-Off Method On March 10, Mize, Inc., declared an $1,100 account receivable from the Anders Company as uncollectible and wrote off the account. On November 18, Mize received an $500 payment on the account from Anders.

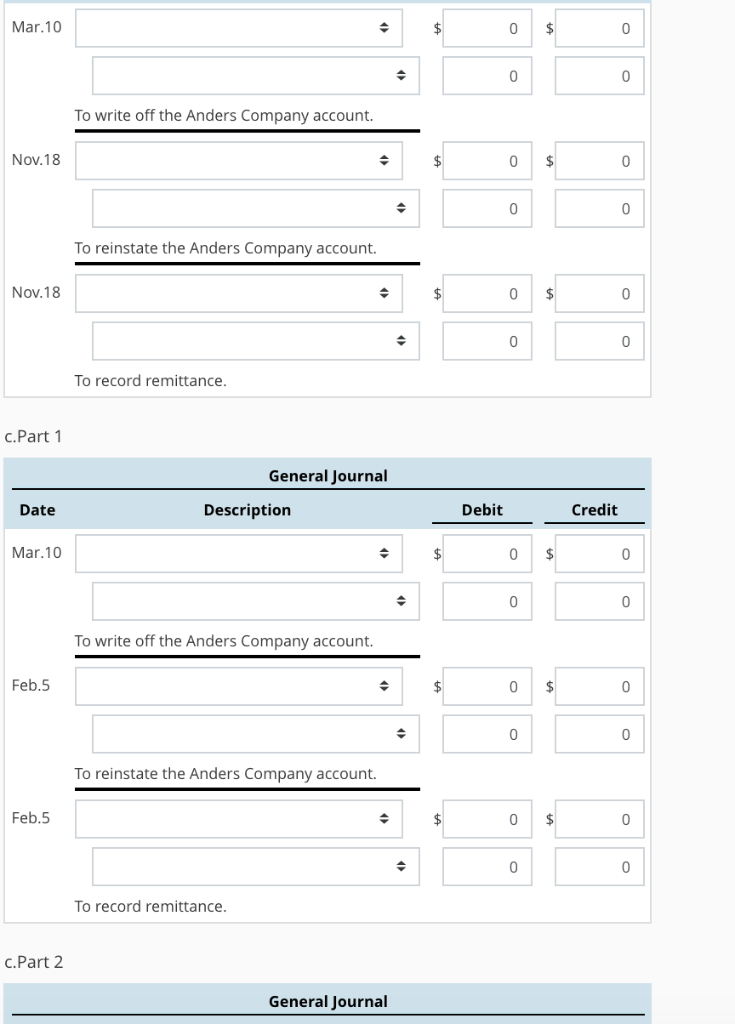

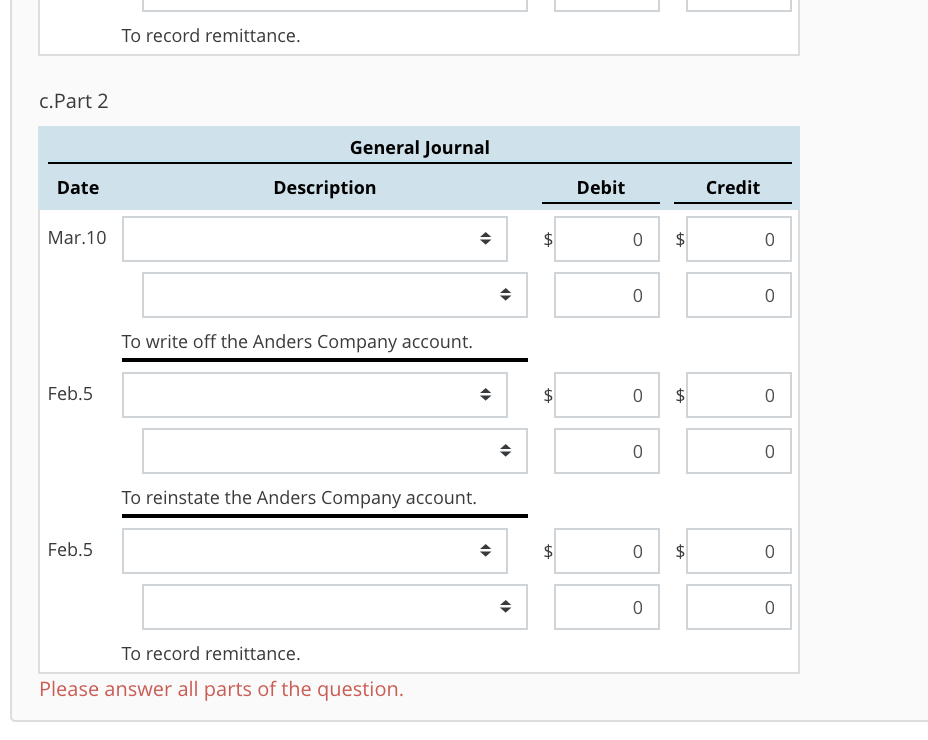

Allowance Method versus Direct Write-Off Method On March 10, Mize, Inc., declared an $1,100 account receivable from the Anders Company as uncollectible and wrote off the account. On November 18, Mize received an $500 payment on the account from Anders a. Assume that Mize uses the allowance method of handling credit losses. Prepare the journal entries b. Assume that Mize uses the direct write-off method of handling credit losses. Prepare the journal c. Assume that the payment from Anders arrives on February 5 of the following year rather than on to record the write-off and the subsequent recovery of Ander's account. entries to record the write-off and the subsequent recovery of Ander's account. November 18 of the current year. (1) Prepare the journal entries to record the write-off and subsequent recovery of Ander's account under the allowance method. (2) Prepare the journal entries to record the write-off and subsequent recovery of Ander's account under the direct write- off method General Journal Date Description Debit Credit Mar.10 0 To write off the Anders Company account. Nov.18 To reinstate the Anders Company account. Nov.18 To record remittance General Journal Date Description Debit Credit Mar.10 To record remittance. C.Part 2 General Journal Date Description Debit Credit Mar.10 0 0 0 To write off the Anders Company account. Feb.5 0 0 0 To reinstate the Anders Company account. Feb.5 0 0 0 To record remittance. Please answer all parts of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts