Question: please help asap and ans both please please If the spot exchange rate is USD1.0229/CHF, the 3-month forward rate is USD1.0270/CHF, the 6-month forward rate

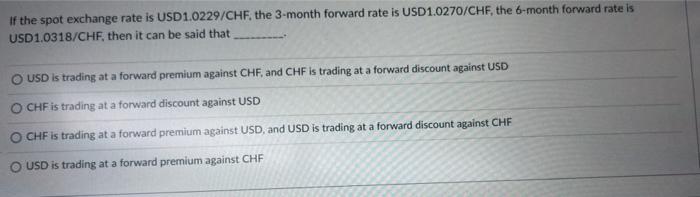

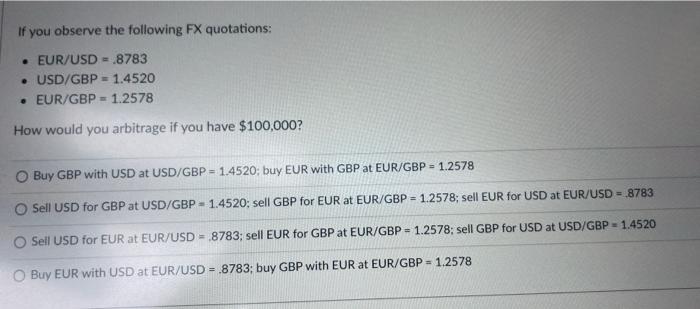

If the spot exchange rate is USD1.0229/CHF, the 3-month forward rate is USD1.0270/CHF, the 6-month forward rate is USD1.0318/CHF, then it can be said that USD is trading at a forward premium against CHF, and CHF is trading at a forward discount against USD CHF is trading at a forward discount against USD CHF is trading at a forward premium against USD, and USD is trading at a forward discount against CHE O USD is trading at a forward premium against CHF If you observe the following FX quotations: EUR/USD = .8783 USD/GBP = 1.4520 EUR/GBP = 1.2578 How would you arbitrage if you have $100,000? Buy GBP with USD at USD/GBP = 1.4520: buy EUR with GBP at EUR/GBP = 1.2578 Sell USD for GBP at USD/GBP - 1.4520: sell GBP for EUR at EUR/GBP = 1.2578; sell EUR for USD at EUR/USD = 8783 Sell USD for EUR at EUR/USD = 8783; sell EUR for GBP at EUR/GBP = 1.2578; sell GBP for USD at USD/GBP - 1.4520 O Buy EUR with USD at EUR/USD = .8783; buy GBP with EUR at EUR/GBP = 1.2578

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts