Question: PLEASE HELP ASAP & ANSWER FULLY WILL UPVOTE PLS HELP 2 Debt analysis Springfeld Bank is evaluating Creek Enterprises, which has requested a $3.850,000 loan,

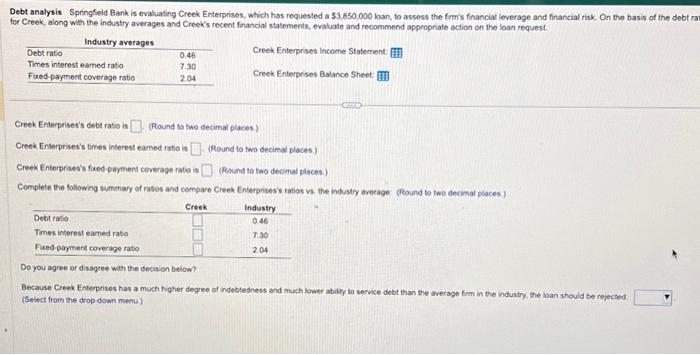

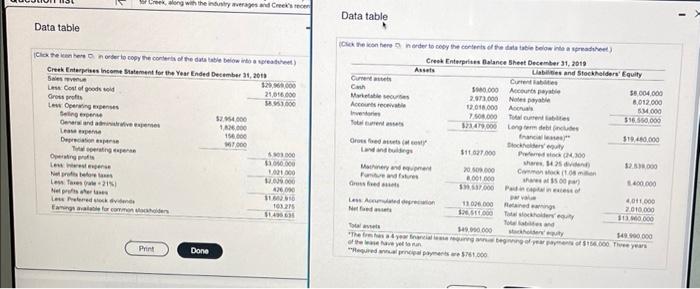

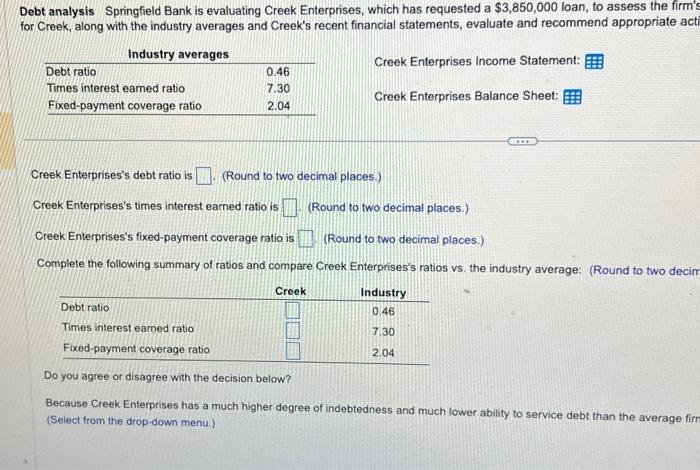

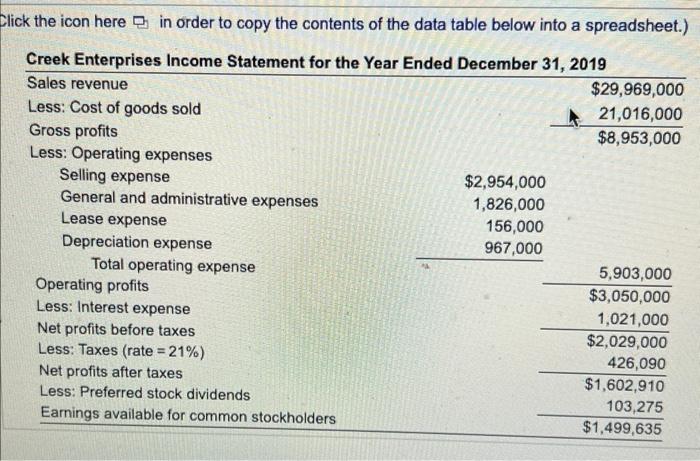

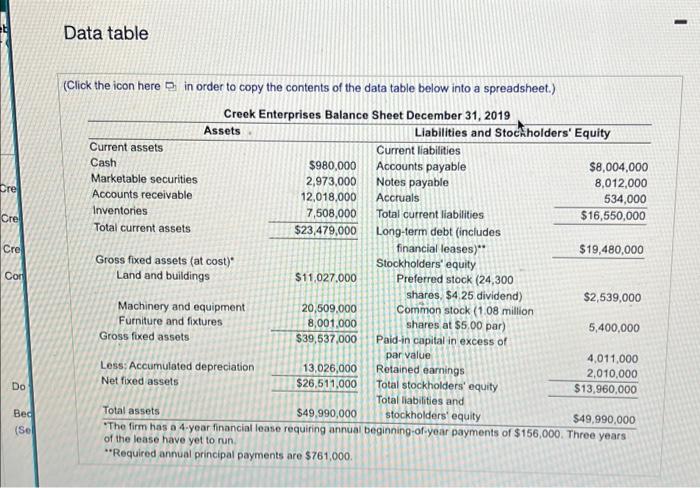

Debt analysis Springfeld Bank is evaluating Creek Enterprises, which has requested a $3.850,000 loan, to assess the frmis financial leverage and financial risk. On the basis of the debt rn for Creek, along with the industry averages and Creek's recent financial statements, evaluate and recommend appropriate action on the loan request. Creek Enterprises income Staterent: Creek Enterprses Balance Sheet Creek Enterpeises's debt ratio is (Round to tho decimal places) Creek Enterprises's times inderest earned rato is (Round to two decimal places) Creek Enterproes's fired payment ceverage rato is (Round to tao decimal pinces) Complete the following wmmary of ratos and compare Creek Enterprisess ratios vi the industy average (Round to two decimal ploces) Do you agree or disagree wth the decision below? Because Creek Enterprises has a much higher degree of indebtedness and much lower abilly to service debt than the average fimh in the industry, the loan should be rejected (Select from the drop-down menu) Data table Data table stry, the loan should be rejected. Agree Disagree Debt analysis Springfield Bank is evaluating Creek Enterprises, which has requested a $3,850,000 loan, to assess the firm for Creek, along with the industry averages and Creek's recent financial statements, evaluate and recommend appropriate aci Creek Enterprises Income Statement: Creek Enterprises Balance Sheet: Creek Enterprises's debt ratio is (Round to two decimal places.) Creek Enterprises's times interest earned ratio is (Round to two decimal places.) Creek Enterprises's fixed-payment coverage ratio is (Round to two decimal places.) Complete the following summary of ratios and compare Creek Enterprises's ratios vs. the industry average: (Round to two decir Do you agree or disagree with the decision below? Because Creek Enterprises has a much higher degree of indebtedness and much lower ability to service debt than the average fir (Select from the drop-down menu.) lick the icon here in order to copy the contents of the data table below into a spreadsheet.) Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) of the lease have yet to nun. Required annual principal payments are $761,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts