Question: please help asap Exercise 11-2 (Algorithmic) (LO. 2) Mio was transferred from New York to Germany. He lived and worked in Germany for 359 days

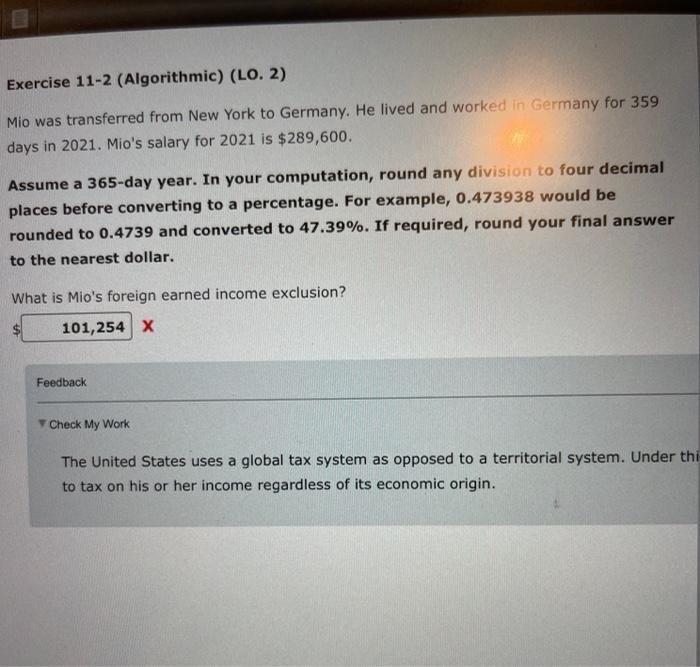

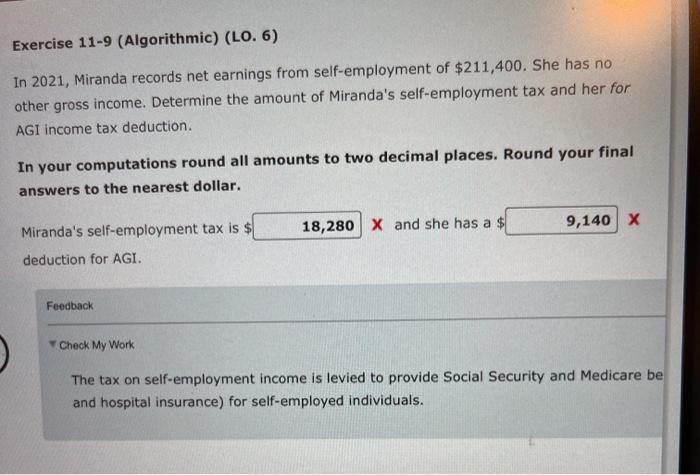

Exercise 11-2 (Algorithmic) (LO. 2) Mio was transferred from New York to Germany. He lived and worked in Germany for 359 days in 2021. Mio's salary for 2021 is $289,600. Assume a 365-day year. In your computation, round any division to four decimal places before converting to a percentage. For example, 0.473938 would be rounded to 0.4739 and converted to 47.39%. If required, round your final answer to the nearest dollar. What is Mio's foreign earned income exclusion? 101,254 X Feedback Check My Work The United States uses a global tax system as opposed to a territorial system. Under thi to tax on his or her income regardless of its economic origin. Exercise 11-9 (Algorithmic) (LO. 6) In 2021, Miranda records net earnings from self-employment of $211,400. She has no other gross income. Determine the amount of Miranda's self-employment tax and her for AGI income tax deduction. In your computations round all amounts to two decimal places. Round your final answers to the nearest dollar. 18,280 X and she has a $ 9,140 x Miranda's self-employment tax is $ deduction for AGI. Feedback Check My Work The tax on self-employment income is levied to provide Social Security and Medicare be and hospital insurance) for self-employed individuals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts