Question: Please Help ASAP Exercise 14-8A (Algo) Determining cash flow from investing activities LO 14-3 On January 1, Year 1, Fanning Company had a balance of

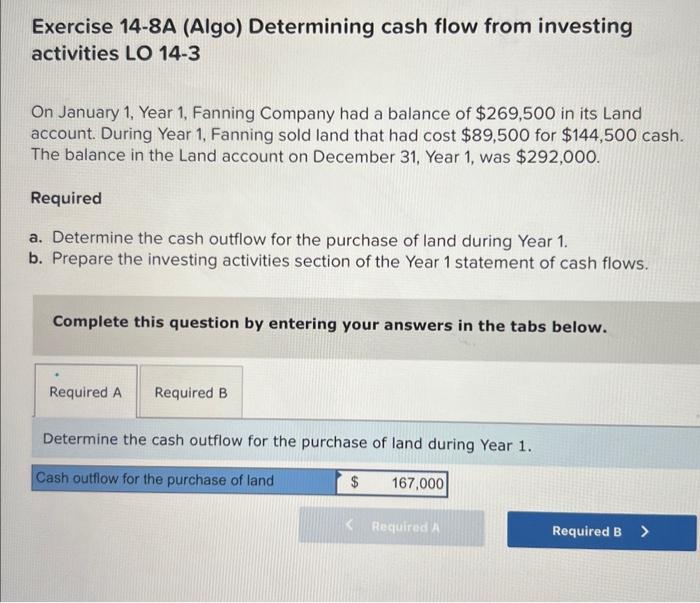

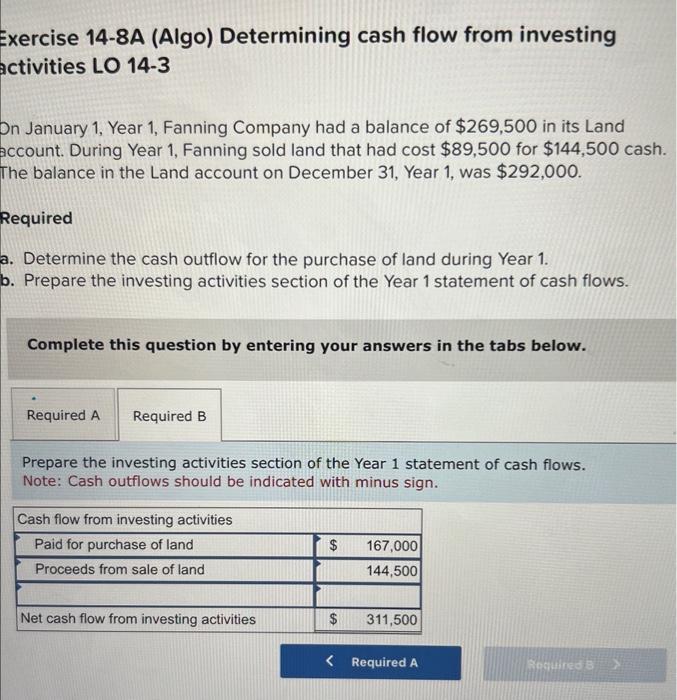

Exercise 14-8A (Algo) Determining cash flow from investing activities LO 14-3 On January 1, Year 1, Fanning Company had a balance of $269,500 in its Land account. During Year 1, Fanning sold land that had cost $89,500 for $144,500 cash. The balance in the Land account on December 31, Year 1, was $292,000. Required a. Determine the cash outflow for the purchase of land during Year 1. b. Prepare the investing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Determine the cash outflow for the purchase of land during Year 1. Exercise 14-8A (Algo) Determining cash flow from investing activities LO 14-3 On January 1, Year 1, Fanning Company had a balance of $269,500 in its Land account. During Year 1, Fanning sold land that had cost $89,500 for $144,500 cash. The balance in the Land account on December 31 , Year 1, was $292,000. Required a. Determine the cash outflow for the purchase of land during Year 1. b. Prepare the investing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Prepare the investing activities section of the Year 1 statement of cash flows. Note: Cash outflows should be indicated with minus sign. Exercise 14-8A (Algo) Determining cash flow from investing activities LO 14-3 On January 1, Year 1, Fanning Company had a balance of $269,500 in its Land account. During Year 1, Fanning sold land that had cost $89,500 for $144,500 cash. The balance in the Land account on December 31, Year 1, was $292,000. Required a. Determine the cash outflow for the purchase of land during Year 1. b. Prepare the investing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Determine the cash outflow for the purchase of land during Year 1. Exercise 14-8A (Algo) Determining cash flow from investing activities LO 14-3 On January 1, Year 1, Fanning Company had a balance of $269,500 in its Land account. During Year 1, Fanning sold land that had cost $89,500 for $144,500 cash. The balance in the Land account on December 31 , Year 1, was $292,000. Required a. Determine the cash outflow for the purchase of land during Year 1. b. Prepare the investing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Prepare the investing activities section of the Year 1 statement of cash flows. Note: Cash outflows should be indicated with minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts