Question: please help asap i do not understand Required information [The following information applies to the questions displayed below] Assume that TDW Corporation (calendar year-end) has

![applies to the questions displayed below] Assume that TDW Corporation (calendar year-end)](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbc9b2afe8f_20266fbc9b24cd5b.jpg)

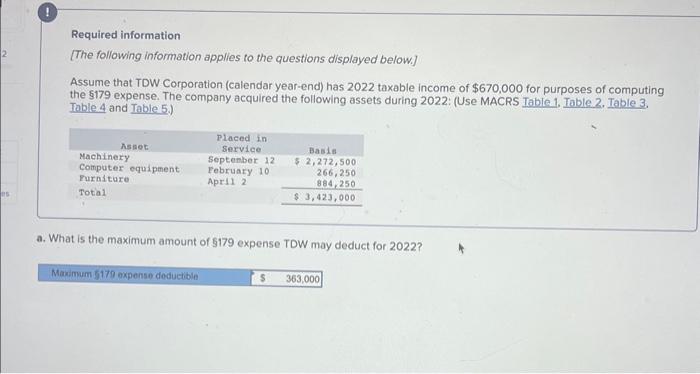

Required information [The following information applies to the questions displayed below] Assume that TDW Corporation (calendar year-end) has 2022 taxable income of $670,000 for purposes of computing the 5179 expense. The company acquired the following assets during 2022: (Use MACRS Table 1, Table 2, Table 3. Table 4 and Table 5.) a. What is the maximum amount of $179 expense TDW may deduct for 2022? Required information [The following information applies to the questions displayed below] Assume that TDW Corporation (calendar year-end) has 2022 taxable income of $670,000 for purposes of computing the \$179 expense. The company acquired the following assets during 2022: (Use MACRS Table 1, Table 2, Table 3. Table 4 and Table 5 .) b. What is the maximum total depreciation, including 5179 expense, that TDW may deduct in 2022 on the assets it placed in service in 2022, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Required information [The following information applies to the questions displayed below] Assume that TDW Corporation (calendar year-end) has 2022 taxable income of $670,000 for purposes of computing the 5179 expense. The company acquired the following assets during 2022: (Use MACRS Table 1, Table 2, Table 3. Table 4 and Table 5.) a. What is the maximum amount of $179 expense TDW may deduct for 2022? Required information [The following information applies to the questions displayed below] Assume that TDW Corporation (calendar year-end) has 2022 taxable income of $670,000 for purposes of computing the \$179 expense. The company acquired the following assets during 2022: (Use MACRS Table 1, Table 2, Table 3. Table 4 and Table 5 .) b. What is the maximum total depreciation, including 5179 expense, that TDW may deduct in 2022 on the assets it placed in service in 2022, assuming no bonus depreciation? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts