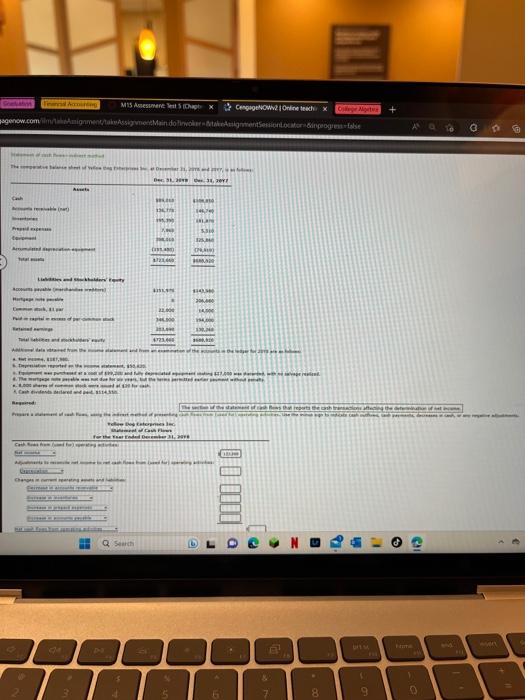

Question: please help asap!! ill offer a pb&j:) here is 2 different photos of the same thing, hopefully this helps Yellow Dog Enterprises Inc. Statement of

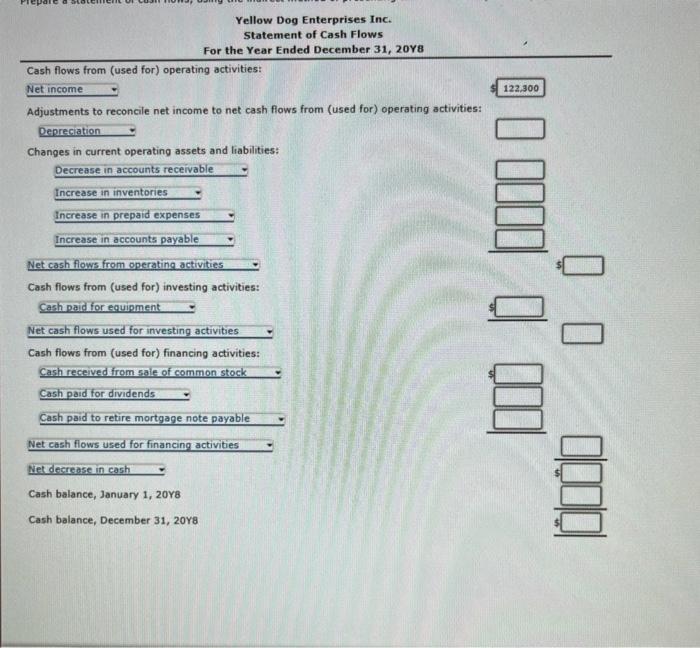

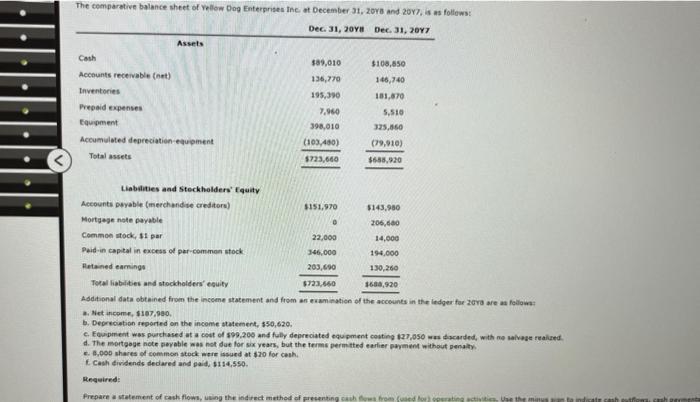

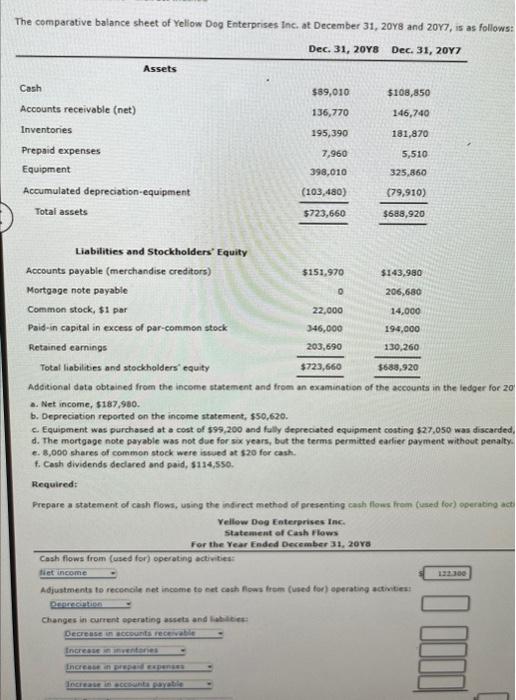

Yellow Dog Enterprises Inc. Statement of Cash Flows For the Year Ended December 31, 20 Ys Cash flows from (used for) operating activities: Net income $122.300 Adjustments to reconcile net income to net cash flows from (used for) operating activities: Depreciation Changes in current operating assets and liabilities: Decrease in accounts receivable Increase in inventories Increase in prepaid expenses Increase in accounts payable Net cash flows from operating activities Cash flows from (used for) investing activities: Cash paid for equipment Net cash flows used for investing activities Cash flows from (used for) financing activities: Cash received from sale of common stock Cash paid for dividends Cash paid to retire mortgage note payable Net cash flows used for financing activities Net decrease in cash Cash balance, January 1, 20Y8 Cash balance, December 31,20Y The cemparative balance sheet of Yellow Dog Enterghisen Ine ot December J1, 20ra and 20V, is as follows: Addional data obtained from the inceene statement and from an eramination of the accounts in the indger far zova are as fodlowa: a. Met income, 1197,980 , b. Deprecietion reported on the income statement, $50,620. c. Equipment wis purchased at a cout of s09,200 and fully depreciated equ pment couting 127,050 mas dacarded, with me salvase realiatd. d. The mortgege note porable was not due for six years, but the terms permitted earlier pmment mithout penalty c. B,000 shares of commen stock were issued at $70 for cenh. f. Cash iridends dedared and gaid, 1134,550. The comparative balance sheet of Yeliow Dog Enterprises inc, at December 31, 20Y8 and 20Y7, is as follows: Additional date obtained from the income statement and from an examination of the accounts in the ledger for 20 A. Net income, 5187,960 . b. Depreciotion reported on the income statement, 550,620 . c. Equipment was purchased at a cost of 599,200 and fully depreciated equipment costing $27,050 was discarded, d. The mortgoge note payable was not due for six years, but the terms permitted earfier payment without penalty. e. 8,000 chares of common stock were iswued at 520 for cash. f. Cash dividends declared and paid, 5114,550 . Required: Frepare a stetement of cash flows, using the ind irect methed of presenting cash flows frem (used for) ooerabing act

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts