Question: PLEASE HELP ASAP. ILL UPVOTE YOUR ANSWER Considering the following information and Assuming below 11 allocations are the only portfolios you can invest in .....

PLEASE HELP ASAP. ILL UPVOTE YOUR ANSWER

PLEASE HELP ASAP. ILL UPVOTE YOUR ANSWER

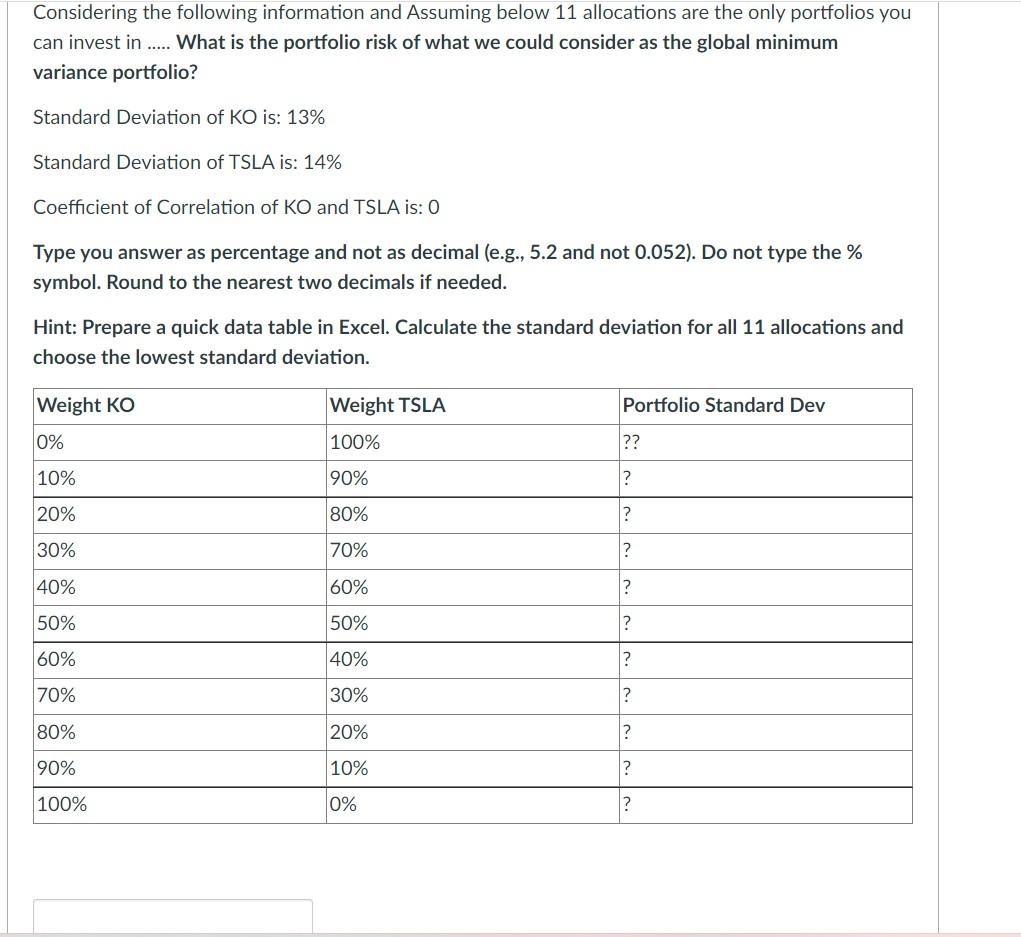

Considering the following information and Assuming below 11 allocations are the only portfolios you can invest in ..... What is the portfolio risk of what we could consider as the global minimum variance portfolio? Standard Deviation of KO is: 13% Standard Deviation of TSLA is: 14% Coefficient of Correlation of KO and TSLA is: 0 Type you answer as percentage and not as decimal (e.g., 5.2 and not 0.052). Do not type the % symbol. Round to the nearest two decimals if needed. Hint: Prepare a quick data table in Excel. Calculate the standard deviation for all 11 allocations and choose the lowest standard deviation. Weight Ko Weight TSLA Portfolio Standard Dev 0% 100% ?? 10% 90% ? 20% 80% ? 30% 70% ? 40% 60% ? 50% 50% ? 60% 40% ? 70% 30% ? 80% 20% ? 90% 10% ? 100% 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts