Question: Please help ASAP. I'm not sure if my NPV table is correct and I need help with the questions followed. Thank you in advance! Firm

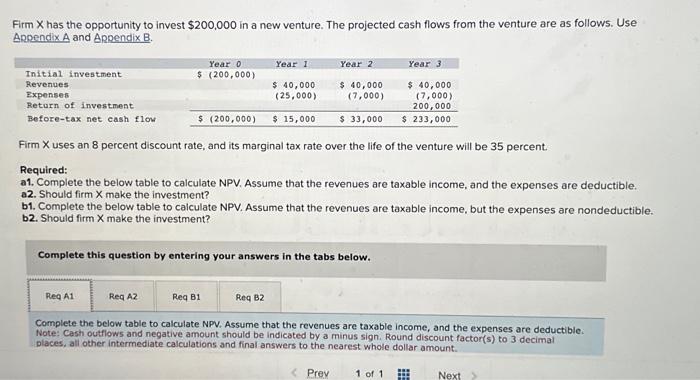

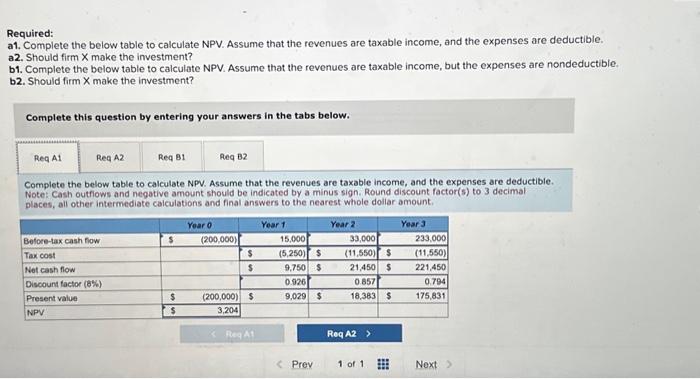

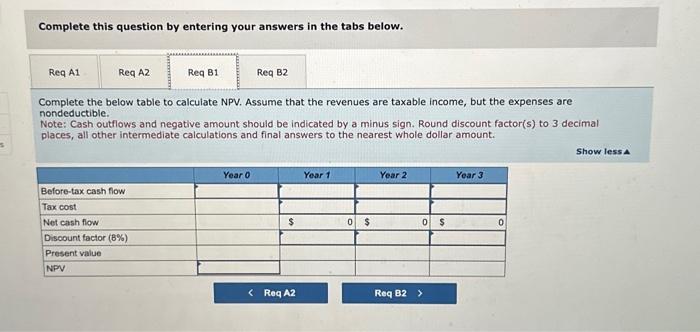

Firm X has the opportunity to invest $200,000 in a new venture. The projected cash flows from the venture are as follows. Use Appendix A and Appendix B. Firm X uses an 8 percent discount rate, and its marginal tax rate over the life of the venture will be 35 percent. Required: a1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, and the expenses are deductible. a. Should firm X make the investment? b1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, but the expenses are nondeductible b2. Should firm X make the investment? Complete this question by entering your answers in the tabs below. Complete the below table to calculate NPV. Assume that the revenues are taxable income, and the expenses are deductible: Note: Cash outflows and negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal Diaces, all other intermediate calculations and final answers to the nearest whole dollar amount. Required: 1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, and the expenses are deductible. a2. Should firm X make the investment? b1. Complete the below table to calculate NPV. Assume that the revenues are taxable income, but the expenses are nondeductible. b2. Should firm X make the investment? Complete this question by entering your answers in the tabs below. Complete the below table to calculate NPV. Assume that the revenues are taxable income, and the expenses are deductible. Complete the below tabie to calculate NPV. Assume that the revenues are taxable income, and the expenses are deductib Note: Cash outfiows and negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decima! places, all other intermediate calculations and final answers to the nearest whole dollar amount. Should firm X make the investment? Complete this question by entering your answers in the tabs below. Complete the below table to calculate NPV. Assume that the revenues are taxable income, but the expenses are nondeductible. Note: Cash outflows and negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, all other intermediate calculations and final answers to the nearest whole dollar amount. Should firm X make the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts