Question: PLEASE HELP ASAP In 2022. Amy Corporation changed its method of inventory pricing from LIFO to FIFO. Net income computed on a LIFO as compared

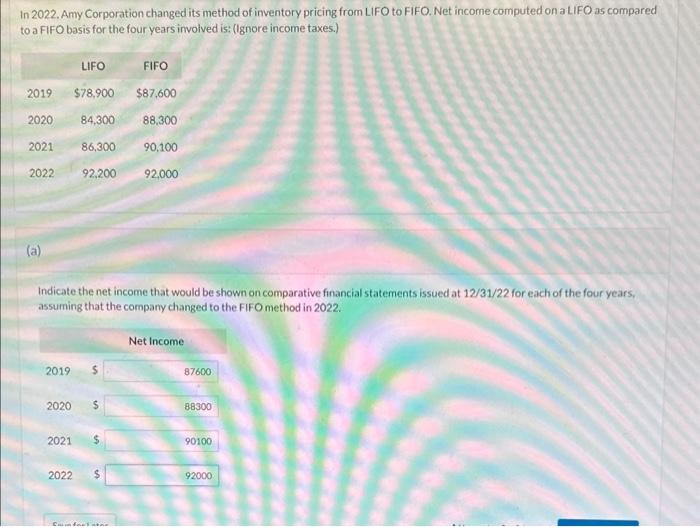

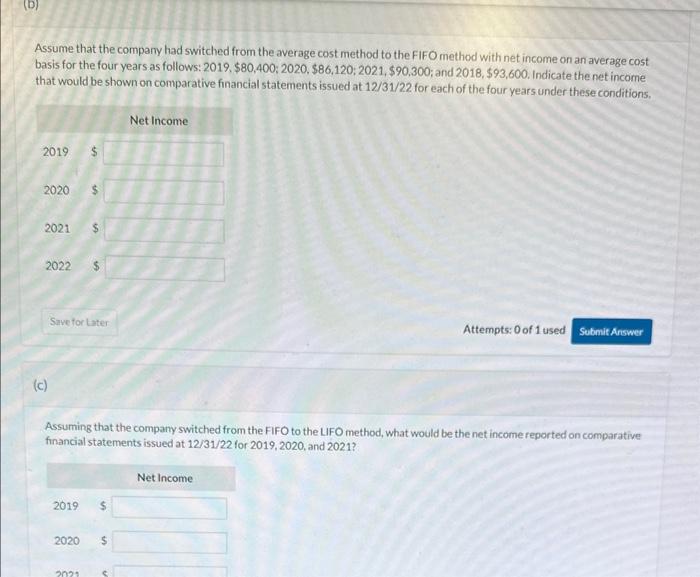

In 2022. Amy Corporation changed its method of inventory pricing from LIFO to FIFO. Net income computed on a LIFO as compared to a FIFO basis for the four years involved is: (Ignore income taxes.) (a) Indicate the net income that would be shown on comparative financial statements issued at 12/31/22 for each of the four years, assuming that the company changed to the FIFO method in 2022. Assume that the company had switched from the average cost method to the FIFO method with net income on an average cost basis for the four years as follows: 2019,$80,400;2020,$86,120;2021,$90,300; and 2018,$93,600. Indicate the net income that would be shown on comparative financial statements issued at 12/31/22 for each of the four years under these conditions, Attempts: 0 of 1 used (c) Assuming that the compary switched from the FIFO to the LFO method, what would be the net income reported on comparative financial statements issued at 12/31/22 for 2019,2020 , and 2021 ? In 2022. Amy Corporation changed its method of inventory pricing from LIFO to FIFO. Net income computed on a LIFO as compared to a FIFO basis for the four years involved is: (Ignore income taxes.) (a) Indicate the net income that would be shown on comparative financial statements issued at 12/31/22 for each of the four years, assuming that the company changed to the FIFO method in 2022. Assume that the company had switched from the average cost method to the FIFO method with net income on an average cost basis for the four years as follows: 2019,$80,400;2020,$86,120;2021,$90,300; and 2018,$93,600. Indicate the net income that would be shown on comparative financial statements issued at 12/31/22 for each of the four years under these conditions, Attempts: 0 of 1 used (c) Assuming that the compary switched from the FIFO to the LFO method, what would be the net income reported on comparative financial statements issued at 12/31/22 for 2019,2020 , and 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts