Question: please help asap Interpreting Acquisition Footnote with In-Process Research and DevelopmentOn October 3, 2017, Gilead Sciences, Inc. (Gilead) acquired 100% of the outstanding common stock

please help asap

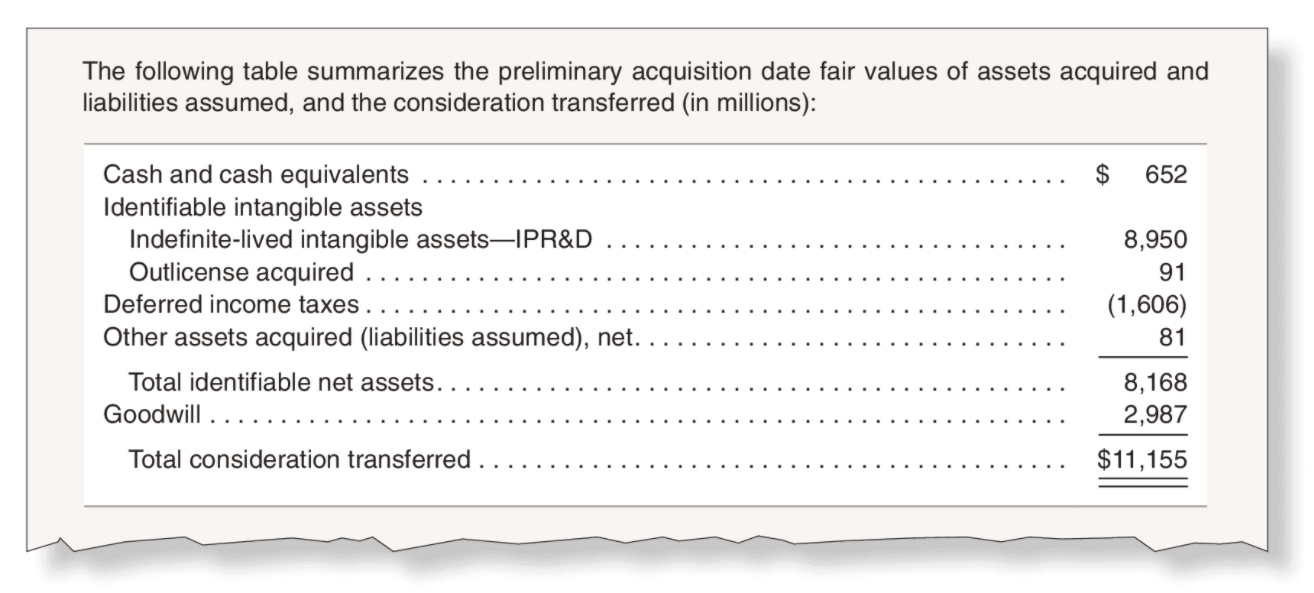

Interpreting Acquisition Footnote with In-Process Research and DevelopmentOn October 3, 2017, Gilead Sciences, Inc. (Gilead) acquired 100% of the outstanding common stock of Kite Pharma, Inc. (Kite). According to Gilead's December 31, 2017 Securities and Exchange Com-mission Form 10-K, "[t]he acquisition of Kite was accounted for as a business combination using the acquisition method of accounting." The following excerpt is from Note 5 (i.e., Acquisitions) of Gilead's 2017 10-K:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts