Question: please help asap! need help performing on an excel sheet as well The stock of Jones Trucking is expected to return 16 percent annually with

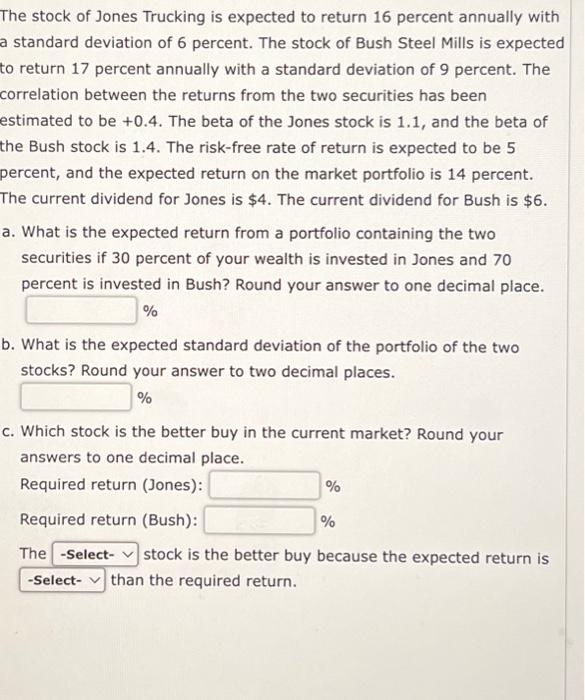

The stock of Jones Trucking is expected to return 16 percent annually with a standard deviation of 6 percent. The stock of Bush Steel Mills is expected to return 17 percent annually with a standard deviation of 9 percent. The correlation between the returns from the two securities has been estimated to be +0.4 . The beta of the Jones stock is 1.1 , and the beta of the Bush stock is 1.4 . The risk-free rate of return is expected to be 5 percent, and the expected return on the market portfolio is 14 percent. The current dividend for Jones is $4. The current dividend for Bush is $6. a. What is the expected return from a portfolio containing the two securities if 30 percent of your wealth is invested in Jones and 70 percent is invested in Bush? Round your answer to one decimal place. % b. What is the expected standard deviation of the portfolio of the two stocks? Round your answer to two decimal places. % c. Which stock is the better buy in the current market? Round your answers to one decimal place. Requiredreturn(Jones):Requiredreturn(Bush):%% The stock is the better buy because the expected return is than the required return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts