Question: please help asap. previous chegg tutors have calculated wrong 8 picture is unadjusted trial . 1st adjust the unadjusted entries and then find then find

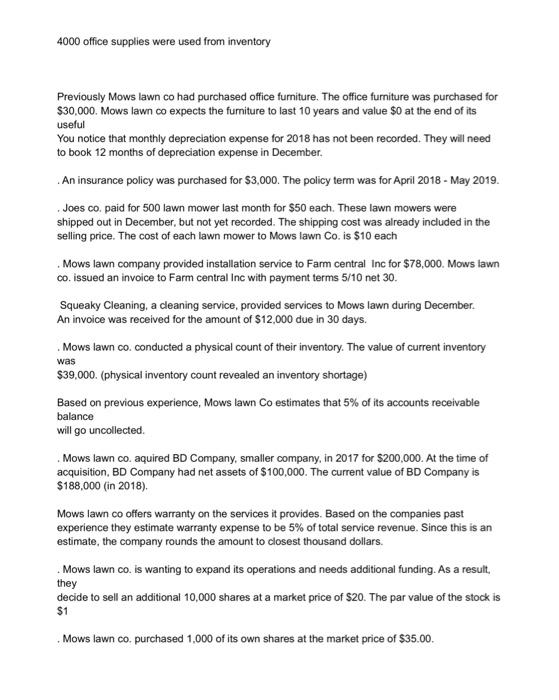

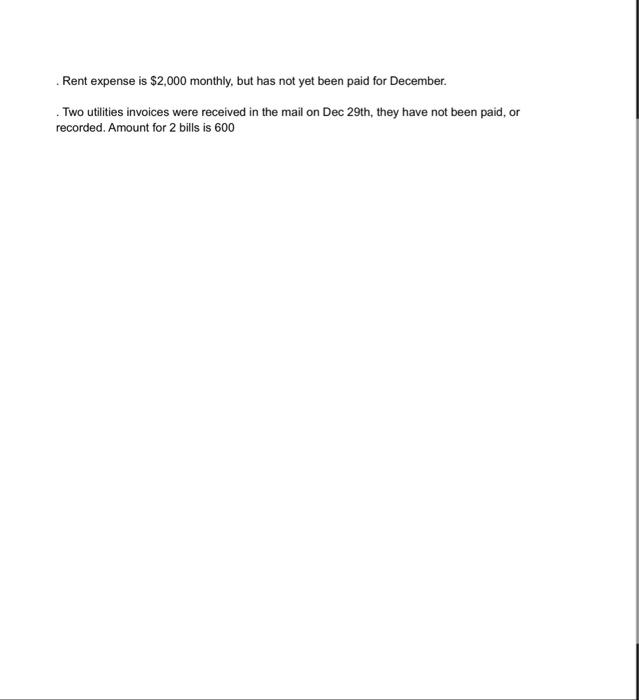

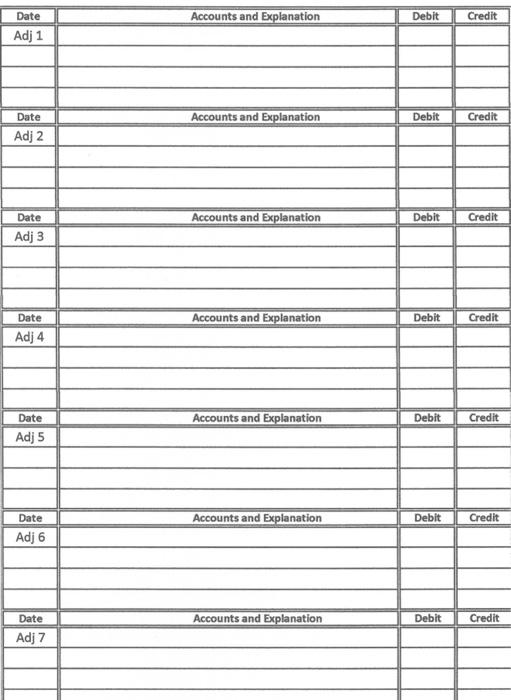

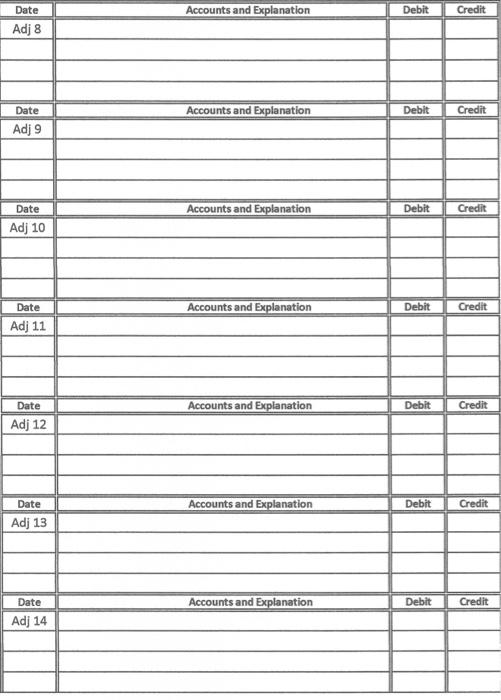

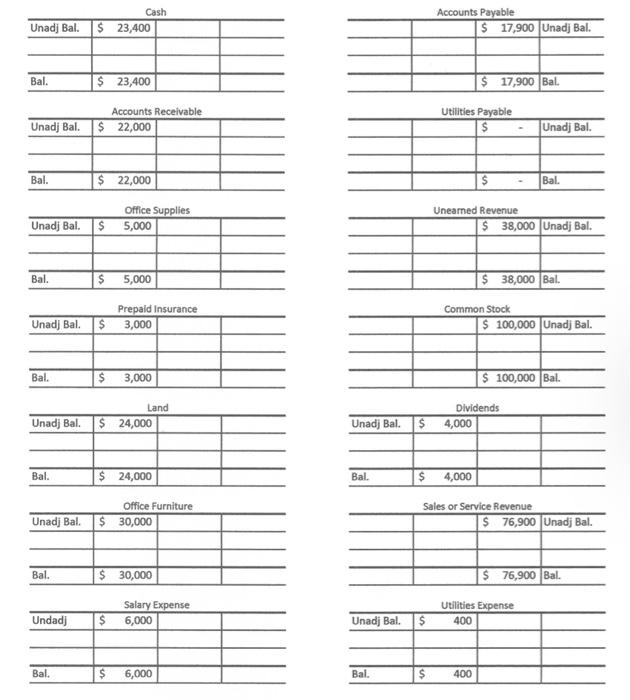

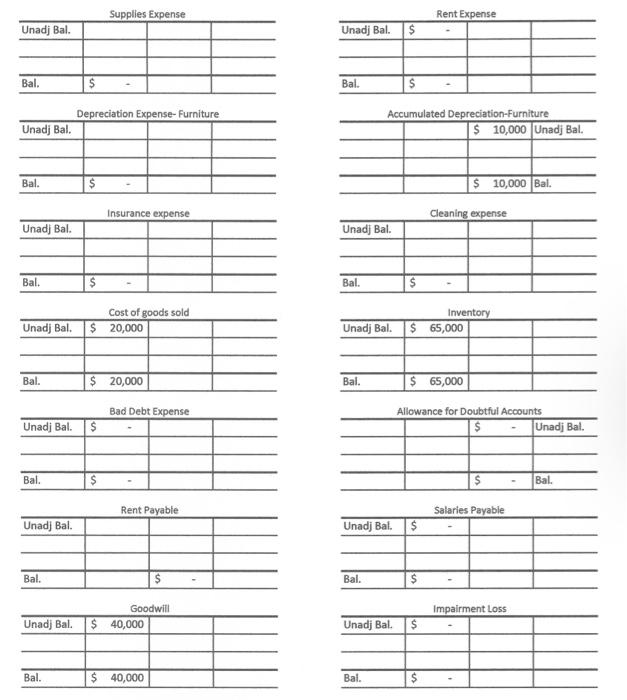

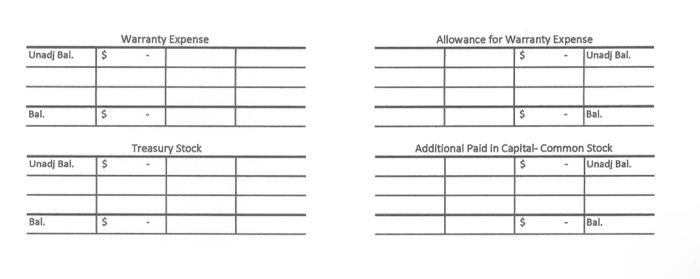

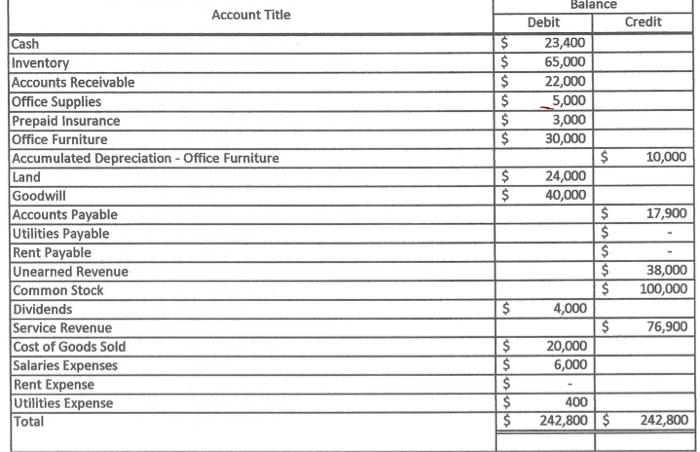

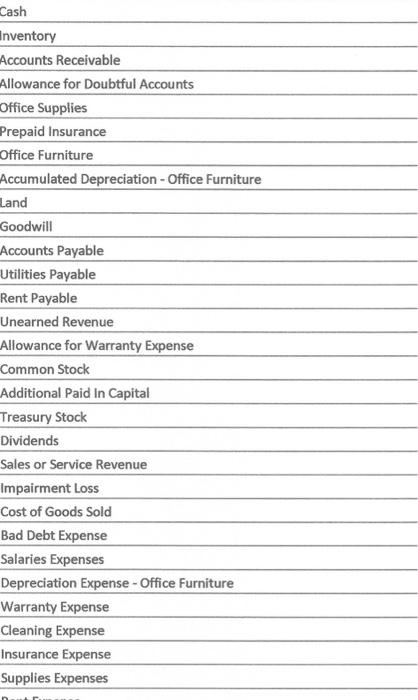

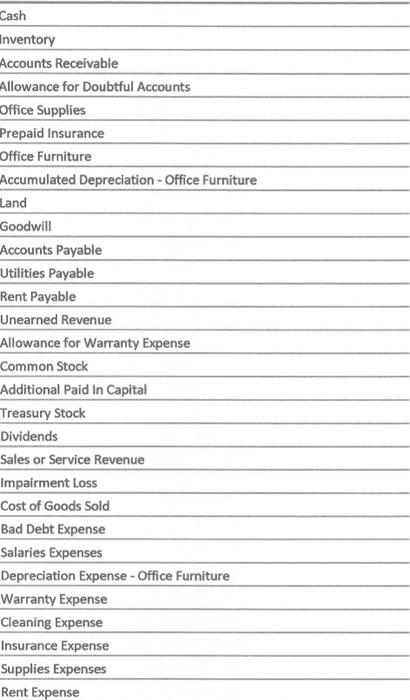

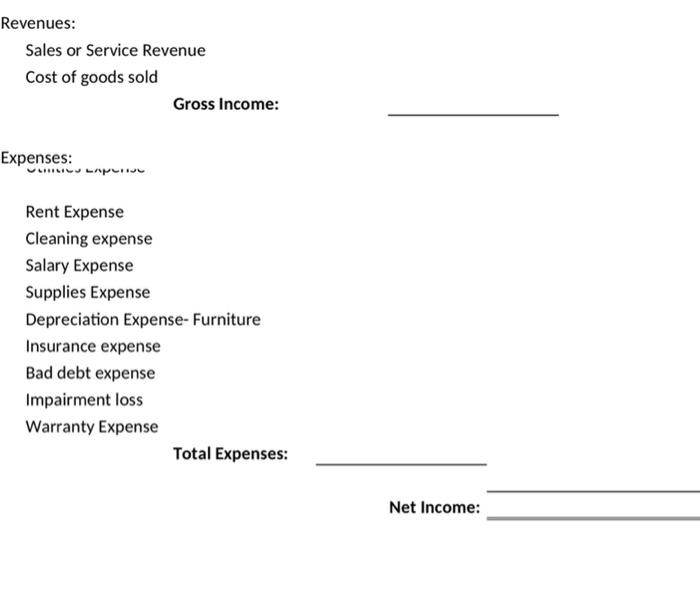

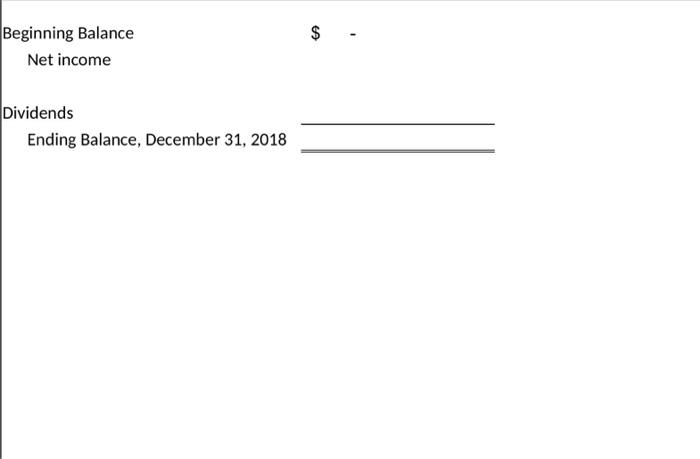

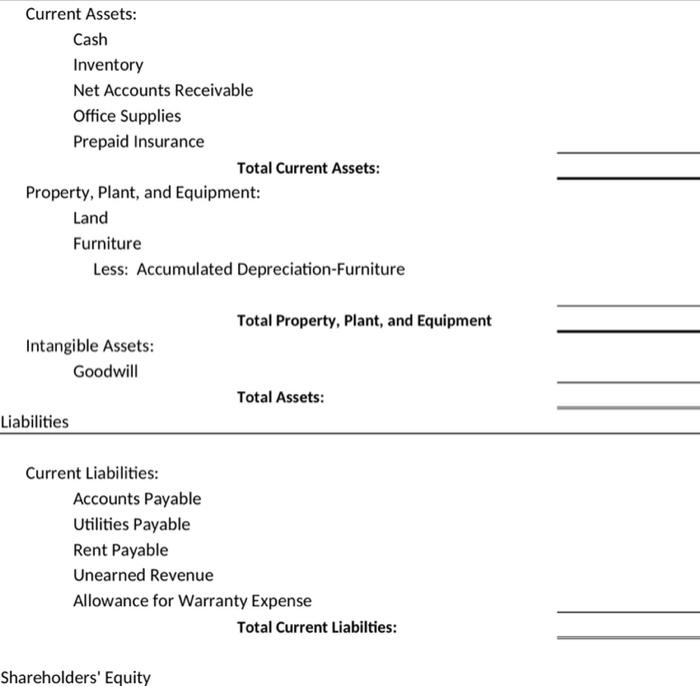

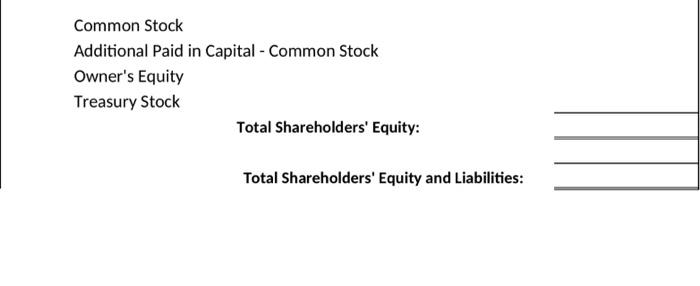

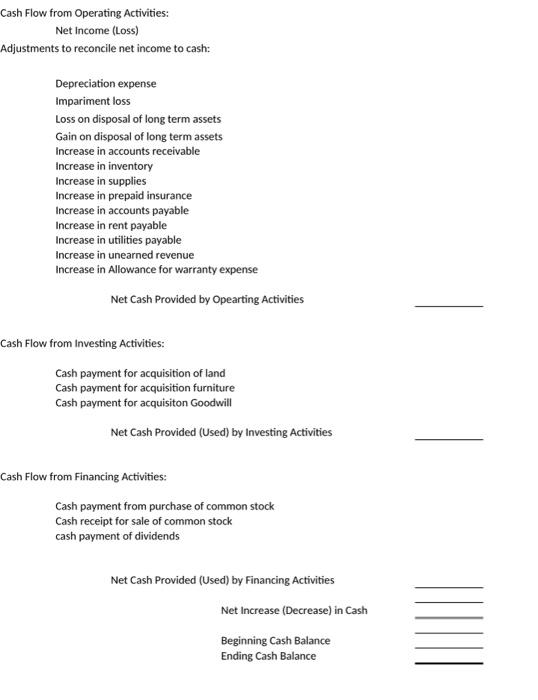

4000 office supplies were used from inventory was Previously Mows lawn co had purchased office furniture. The office furniture was purchased for $30,000. Mows lawn co expects the furniture to last 10 years and value $0 at the end of its useful You notice that monthly depreciation expense for 2018 has not been recorded. They will need to book 12 months of depreciation expense in December An insurance policy was purchased for $3,000. The policy term was for April 2018 - May 2019. Joes co. paid for 500 lawn mower last month for $50 each. These lawn mowers were shipped out in December, but not yet recorded. The shipping cost was already included in the selling price. The cost of each lawn mower to Mows lawn Co. is $10 each . Mows lawn company provided installation service to Farm central Inc for $78,000. Mows lawn Co. issued an invoice to Farm central Inc with payment terms 5/10 net 30. Squeaky cleaning, a cleaning service provided services to Mows lawn during December An invoice was received for the amount of $12,000 due in 30 days. Mows lawn co conducted a physical count of their inventory. The value of current inventory $39,000. (physical inventory count revealed an inventory shortage) Based on previous experience, Mows lawn Co estimates that 5% of its accounts receivable balance will go uncollected Mows lawn co aquired BD Company, smaller company. In 2017 for $200,000. At the time of acquisition, BD Company had net assets of $100,000. The current value of BD Company is $188,000 (in 2018). Mows lawn co offers warranty on the services it provides. Based on the companies past experience they estimate warranty expense to be 5% of total service revenue. Since this is an estimate the company rounds the amount to closest thousand dollars. Mows lawn co. is wanting to expand its operations and needs additional funding. As a result, decide to sell an additional 10,000 shares at a market price of $20. The par value of the stock is $1 Mows lawn co. purchased 1,000 of its own shares at the market price of $35.00 they Rent expense is $2,000 monthly, but has not yet been paid for December Two utilities invoices were received in the mail on Dec 29th, they have not been paid, or recorded. Amount for 2 bills is 600 Date Accounts and Explanation Debit Credit Adj 1 Accounts and Explanation Debit Credit Date Adj 2 Date Accounts and Explanation Debit Credit Adj 3 Date Accounts and Explanation Debit Credit Adj 4 Accounts and Explanation Debit Credit Date Adj 5 Date Accounts and explanation Debit Credit Adj 6 Accounts and Explanation Debit Credit Date Adj 7 Date Accounts and Explanation Debit Credit Adj 8 Date Accounts and Explanation Debit Credit Adj 9 Accounts and Explanation Debit Credit Date Adj 10 Accounts and Explanation Debit Credit Date Adj 11 Accounts and Explanation Debit Credit Date Adj 12 Accounts and Explanation Debit Credit Date Adj 13 Date Accounts and Explanation Debit Credit Adj 14 Unadj Bal. Cash $ 23,400 Accounts Payable $ 17,900 Unadj Bal. Bal. $ 23,400 $ 17,900 Bal Accounts Receivable $ 22,000 Utilities Payable $ Unadj Bal. Unadj Bal. Bal. $ 22,000 Bal. Office Supplies 5,000 Unadj Bal. $ Uneamed Revenue $ 38,000 Unadj Bal. Bal. $ 5,000 $ 38,000 Bal. Common Stock Prepaid Insurance 3,000 Unadj Bal. $ $ 100,000 Unadj Bal. Bal. $ 3,000 $ 100,000 Bal. Unadj Bal Land $ 24,000 Unadj Bal. $ Dividends 4,000 Bal. $ 24,000 Bal. 4,000 Office Furniture $ 30,000 Unadj Bal. Sales or Service Revenue $ 76,900 Unadj Bal. Bal. $ 30,000 $ 76,900 Bal. Salary Expense 6,000 Utilities Expense 400 Undad) $ Unadj Bal. $ Bal. $ 6,000 Bal. $ $ 400 Supplies Expense Rent Expense Unadj Bal. Unadj Bal. $ Bal. $ Bal. S Depreciation Expense- Furniture Unadj Bal. Accumulated Depreciation Furniture $ 10,000 Unadj Bal. Bal. $ $10,000 Bal. Insurance expense Cleaning expense Unadj Bal. Unadj Bal. Bal. $ Bal. Cost of goods sold $ 20,000 Unadj Bal. Unadj Bal. Inventory $ 65,000 Bal. $ 20,000 Bal. $ 65,000 Bad Debt Expense Unadi Bal. $ Allowance for Doubtful Accounts Unadi Bal. Bal. $ Bal. Rent Payable Salarles Payable Unadj Bal. Unadj Bal. $ Bal. $ Bal. $ Impairment Loss Unadj Bal. Goodwill $ 40,000 Unadj Bal. Bal. 40,000 Bal. Warranty Expense Unadi Bal. $ Allowance for Warranty Expense Unad Bal. $ Bal. $ $ Bal. Treasury Stock Unad Bal. $ Additional Pald in Capital-Common Stock $ Unadi Bal. Bal. $ Bal. Account Title Credit $ $ $ $ $ $ 10,000 Uus $ $ Balance Debit 23,400 65,000 22,000 5,000 3,000 30,000 $ 24,000 40,000 $ $ $ $ $ 4,000 $ 20,000 6,000 Cash Inventory Accounts Receivable Office Supplies Prepaid Insurance Office Furniture Accumulated Depreciation - Office Furniture Land Goodwill Accounts Payable Utilities Payable Rent Payable Unearned Revenue Common Stock Dividends Service Revenue Cost of Goods Sold Salaries Expenses Rent Expense Utilities Expense Total 17,900 susas 38,000 100,000 $ 76,900 $ $ $ $ $ 400 242,800$ 242,800 Cash Inventory Accounts Receivable Allowance for Doubtful Accounts Office Supplies Prepaid Insurance Office Furniture Accumulated Depreciation - Office Furniture Land Goodwill Accounts Payable Utilities Payable Rent Payable Unearned Revenue Allowance for Warranty Expense Common Stock Additional Paid In Capital Treasury Stock Dividends Sales or Service Revenue Impairment Loss Cost of Goods Sold Bad Debt Expense Salaries Expenses Depreciation Expense - Office Furniture Warranty Expense Cleaning Expense Insurance Expense Supplies Expenses Cash Inventory Accounts Receivable Allowance for Doubtful Accounts Office Supplies Prepaid Insurance Office Furniture Accumulated Depreciation - Office Furniture Land Goodwill Accounts Payable Utilities Payable Rent Payable Unearned Revenue Allowance for Warranty Expense Common Stock Additional Paid In Capital Treasury Stock Dividends Sales or Service Revenue Impairment Loss Cost of Goods Sold Bad Debt Expense Salaries Expenses Depreciation Expense - Office Furniture Warranty Expense Cleaning Expense Insurance Expense Supplies Expenses Rent Expense Revenues: Sales or Service Revenue Cost of goods sold Gross Income: Expenses: ULTRICULATI Rent Expense Cleaning expense Salary Expense Supplies Expense Depreciation Expense- Furniture Insurance expense Bad debt expense Impairment loss Warranty Expense Total Expenses: Net Income: $ - Beginning Balance Net income Dividends Ending Balance, December 31, 2018 Current Assets: Cash Inventory Net Accounts Receivable Office Supplies Prepaid Insurance Total Current Assets: Property, Plant, and Equipment: Land Furniture Less: Accumulated Depreciation-Furniture Total Property, Plant, and Equipment Intangible Assets: Goodwill Total Assets: Liabilities Current Liabilities: Accounts Payable Utilities Payable Rent Payable Unearned Revenue Allowance for Warranty Expense Total Current Liabilties: Shareholders' Equity Common Stock Additional Paid in Capital - Common Stock Owner's Equity Treasury Stock Total Shareholders' Equity: Total Shareholders' Equity and Liabilities: Cash Flow from Operating Activities: Net Income (Loss) Adjustments to reconcile net income to cash: Depreciation expense Impariment loss Loss on disposal of long term assets Gain on disposal of long term assets Increase in accounts receivable Increase in inventory Increase in supplies Increase in prepaid insurance Increase in accounts payable Increase in rent payable Increase in utilities payable Increase in unearned revenue Increase in Allowance for warranty expense Net Cash Provided by Opearting Activities Cash Flow from Investing Activities: Cash payment for acquisition of land Cash payment for acquisition furniture Cash payment for acquisiton Goodwill Net Cash Provided (Used) by Investing Activities Cash Flow from Financing Activities: Cash payment from purchase of common stock Cash receipt for sale of common stock cash payment of dividends Net Cash Provided (Used) by Financing Activities Net Increase (Decrease) in Cash Beginning Cash Balance Ending Cash Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts