Question: please help asap Question 4 (1 point) A public corporation wants to value a privately held company. The pure play approach has been used to

please help asap

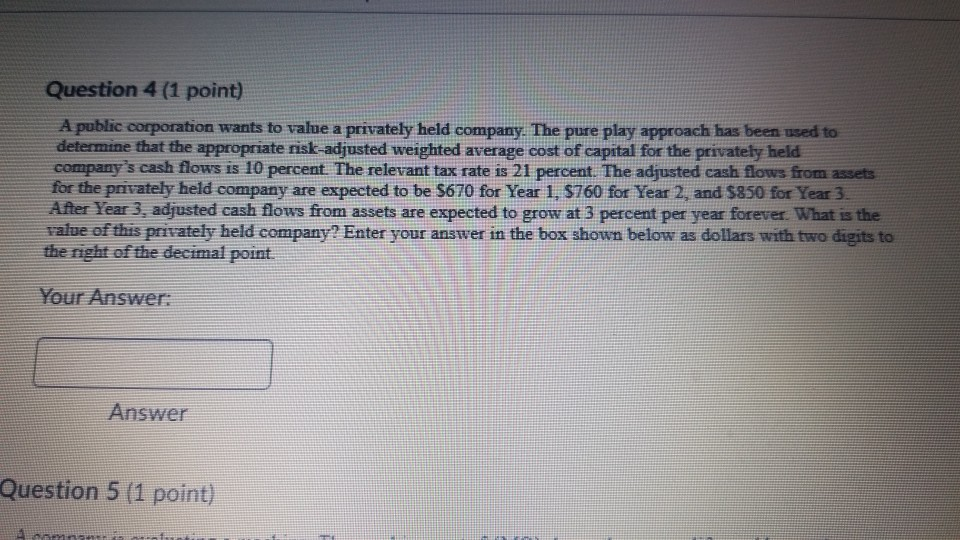

Question 4 (1 point) A public corporation wants to value a privately held company. The pure play approach has been used to determine that the appropriate risk-adjusted weighted average cost of capital for the privately held company's cash flows is 10 percent. The relevant tax rate is 21 percent. The adjusted cash flows from assets for the privately held company are expected to be $670 for Year 1, $760 for Year 2, and $850 for Year 3. After Year 3. adjusted cash flows from assets are expected to grow at 3 percent per year forever. What is the value of this privately held company? Enter your answer in the box shown below as dollars with two digits to the night of the decimal point. Your Answer: Answer Question 5 (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts