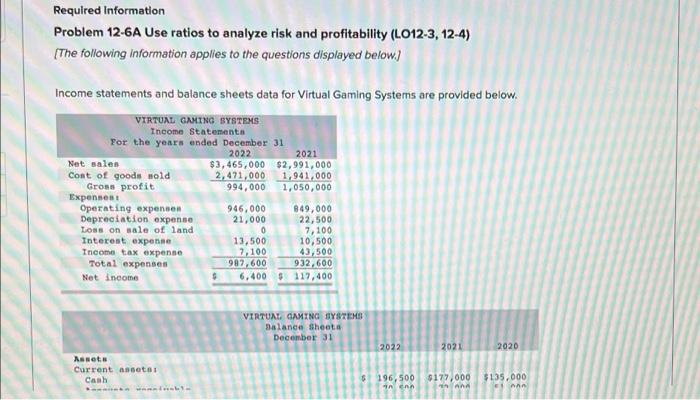

Question: please help asap! Required Information Problem 12-6A Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.]

![below.] Income statements and balance sheets data for Virtual Gaming Systems are](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7884316ac5_30666f78842b0099.jpg)

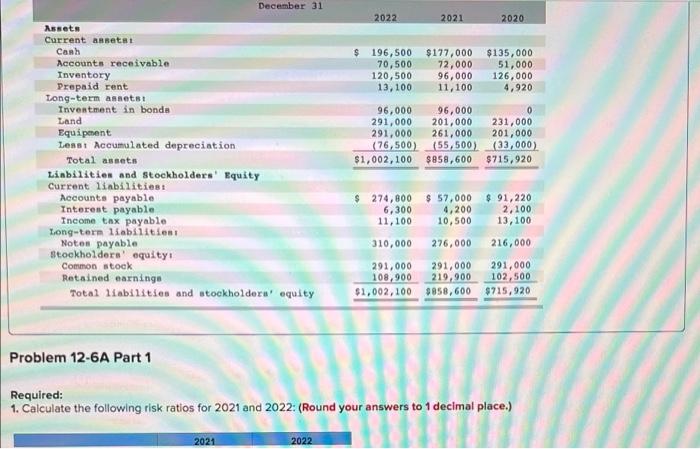

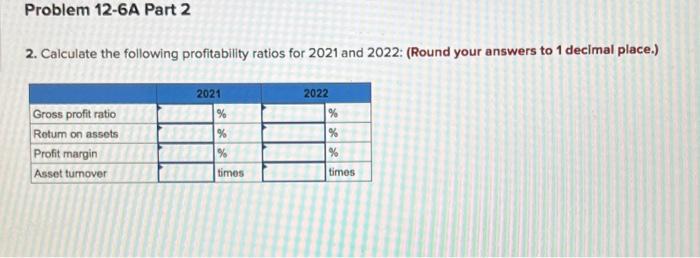

Required Information Problem 12-6A Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.] Income statements and balance sheets data for Virtual Gaming Systems are provided below. VIRTUAL GAMING SYSTEMS Income Statementa For the years ended December 31 2022 2021 Net sales $3,465,000 $2,991,000 Cost of goods sold 2,471,000 1,941,000 Gross profit 994,000 1,050,000 Expenses: Operating expenses 946,000 849,000 Depreciation expense 21,000 22,500 0 7,100 Loss on sale of land. Interest expense 13,500 10,500 Income tax expense 7,100 43,500 987,600 932,600 Total expenses Net income 6,400 $ 117,400 VIRTUAL GAMING SYSTEMS Balance Sheeta December 31 2021 2020 Assets Current assets: Cash $177,000 $135,000 4 And e nan www.bla G 2022 $196,500 an enn December 31 2022 2021 2020 Assets Current assets: Canh Accounts receivable $135,000 $196,500 $177,000 70,500 72,000 51,000 Inventory 120,500 96,000 126,000 Prepaid rent 13,100 11,100 4,920 Long-term assets: Investment in bonda Land 96,000 0 96,000 291,000 201,000 231,000 Equipment Less: Accumulated depreciation 291,000 261,000 201,000 (76,500) (55,500) (33,000) Total assets $1,002,100 $858,600 $715,920 Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable $ 274,800 $ 57,000 $91,220 6,300 4,200 2,100 Income tax payable 11,100 10,500 13,100 Long-term liabilities: 310,000 276,000 216,000 Notes payable Stockholders' equity: Common stock 291,000 291,000 291,000 Retained earnings 108,900 219,900 102,500 Total liabilities and stockholders' equity $1,002,100 $858,600 $715,920 Problem 12-6A Part 1 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 Problem 12-6A Part 1 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 Receivables turnover ratio times times Inventory turnover ratio times times Current ratio to 1 to 1 Debt to equity ratio % % Problem 12-6A Part 2 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 Gross profit ratio Retum on assets% Profit margin Asset turnover at at de % % times % % % times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts