Question: PLEASE HELP ASAP, THANK YOU, UPVOTE WILL BE GIVEN An Australian-based company plans to divest either its Singapore or its New Zealand subsidiary. Assume that

PLEASE HELP ASAP, THANK YOU, UPVOTE WILL BE GIVEN

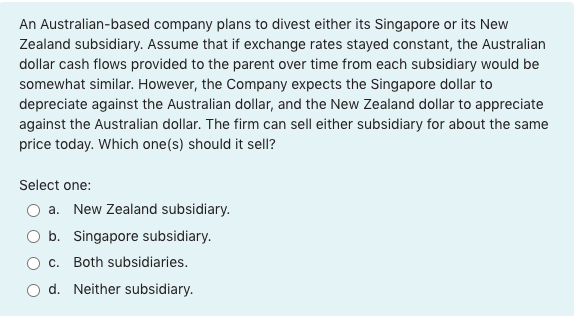

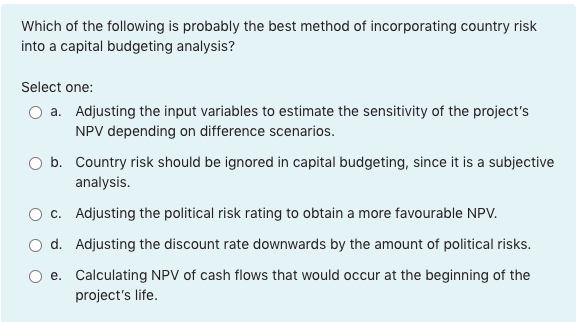

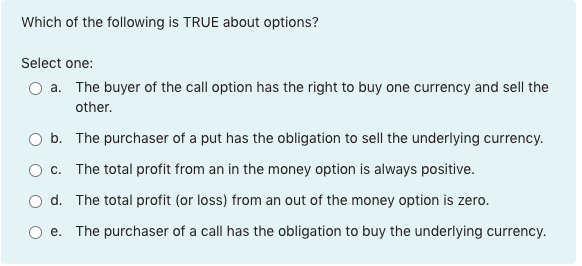

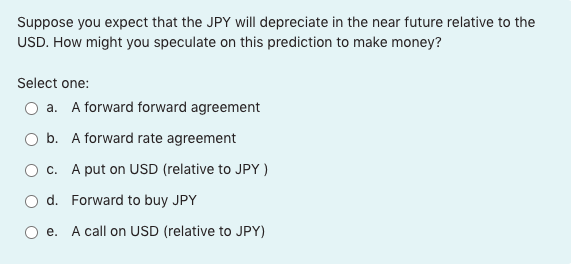

An Australian-based company plans to divest either its Singapore or its New Zealand subsidiary. Assume that if exchange rates stayed constant, the Australian dollar cash flows provided to the parent over time from each subsidiary would be somewhat similar. However, the Company expects the Singapore dollar to depreciate against the Australian dollar, and the New Zealand dollar to appreciate against the Australian dollar. The firm can sell either subsidiary for about the same price today. Which one(s) should it sell? Select one: a. New Zealand subsidiary. O b. Singapore subsidiary. c. Both subsidiaries. d. Neither subsidiary. Which of the following is probably the best method of incorporating country risk into a capital budgeting analysis? Select one: a. Adjusting the input variables to estimate the sensitivity of the project's NPV depending on difference scenarios. b. Country risk should be ignored in capital budgeting, since it is a subjective analysis. O c. Adjusting the political risk rating to obtain a more favourable NPV. d. Adjusting the discount rate downwards by the amount of political risks. e. Calculating NPV of cash flows that would occur at the beginning of the project's life. Which of the following is TRUE about options? Select one: a. The buyer of the call option has the right to buy one currency and sell the other. b. The purchaser of a put has the obligation to sell the underlying currency. C. The total profit from an in the money option is always positive. d. The total profit (or loss) from an out of the money option is zero. e. The purchaser of a call has the obligation to buy underlying currency. Suppose you expect that the JPY will depreciate in the near future relative to the USD. How might you speculate on this prediction to make money? Select one: a. A forward forward agreement O b. A forward rate agreement OC. A put on USD (relative to JPY) O d. Forward to buy JPY e. A call on USD (relative to JPY)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts