Question: PLEASE HELP ASAP, THANK YOU, UPVOTE WILL BE GIVEN Suppose the AUD depreciates by 11.8% against the Euro. By how much has the Euro appreciated

PLEASE HELP ASAP, THANK YOU, UPVOTE WILL BE GIVEN

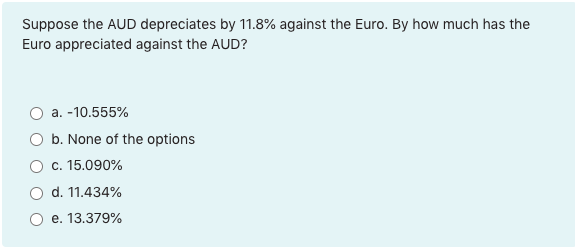

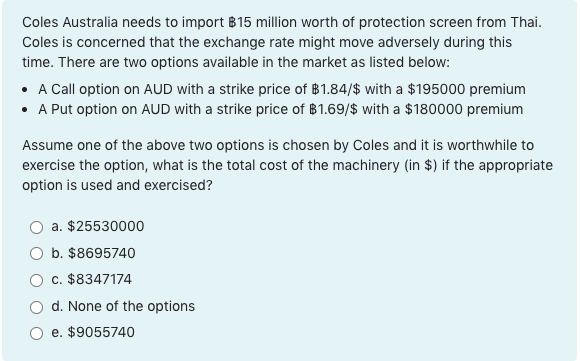

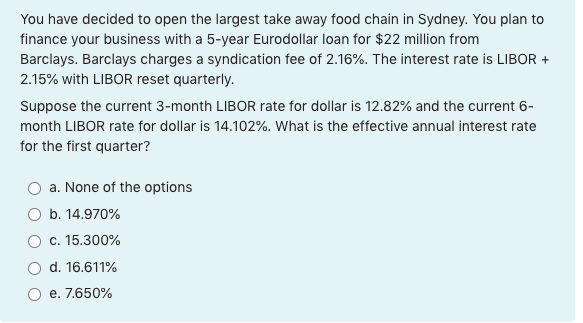

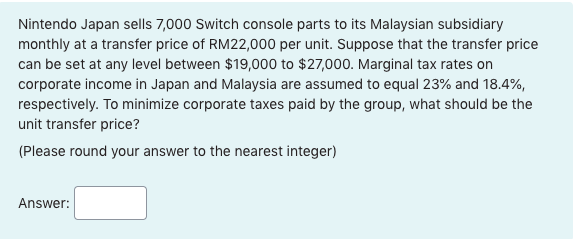

Suppose the AUD depreciates by 11.8% against the Euro. By how much has the Euro appreciated against the AUD? a. -10.555% b. None of the options c. 15.090% d. 11.434% e. 13.379% Coles Australia needs to import $15 million worth of protection screen from Thai. Coles is concerned that the exchange rate might move adversely during this time. There are two options available in the market as listed below: A Call option on AUD with a strike price of $1.84/$ with a $195000 premium A Put option on AUD with a strike price of B1.69/$ with a $180000 premium Assume one of the above two options is chosen by Coles and it is worthwhile to exercise the option, what is the total cost of the machinery (in $) if the appropriate option is used and exercised? a. $25530000 b. $8695740 c. $8347174 d. None of the options e. $9055740 You have decided to open the largest take away food chain in Sydney. You plan to finance your business with a 5-year Eurodollar loan for $22 million from Barclays. Barclays charges a syndication fee of 2.16%. The interest rate is LIBOR + 2.15% with LIBOR reset quarterly. Suppose the current 3-month LIBOR rate for dollar is 12.82% and the current 6- month LIBOR rate for dollar is 14.102%. What is the effective annual interest rate for the first quarter? a. None of the options b. 14.970% c. 15.300% d. 16.611% e. 7.650% Nintendo Japan sells 7,000 Switch console parts to its Malaysian subsidiary monthly at a transfer price of RM22,000 per unit. Suppose that the transfer price can be set at any level between $19,000 to $27,000. Marginal tax rates on corporate income in Japan and Malaysia are assumed to equal 23% and 18.4%, respectively. To minimize corporate taxes paid by the group, what should be the unit transfer price? (Please round your answer to the nearest integer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts