Question: PLEASE HELP ASAP! The drop down selections are included Please help asap Good Deal, Inc: uses a standard cost system and provides the following information.

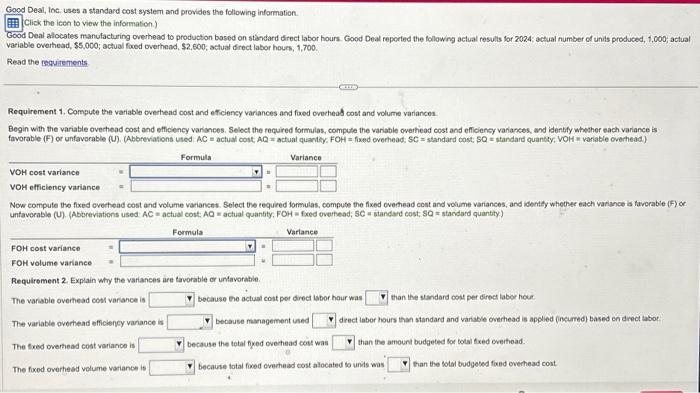

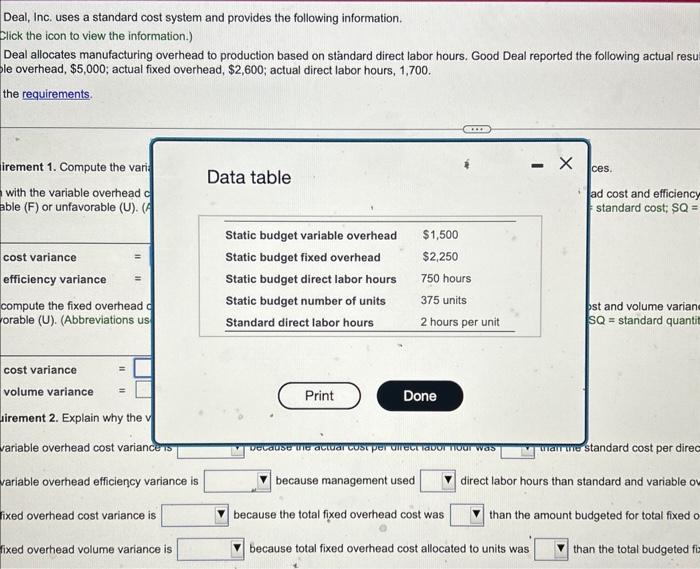

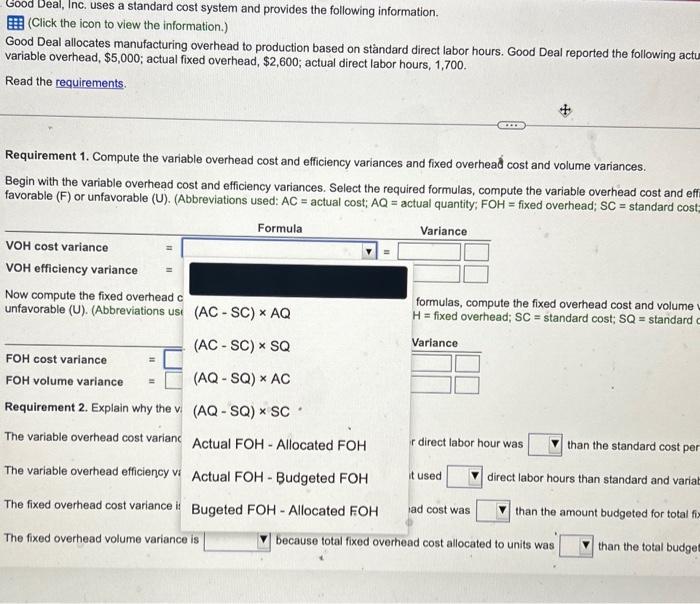

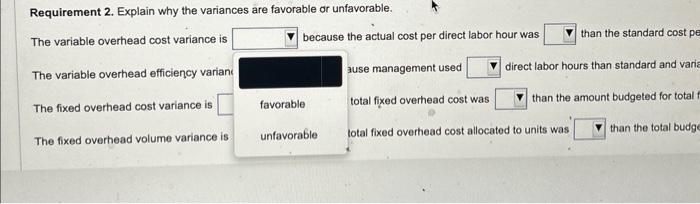

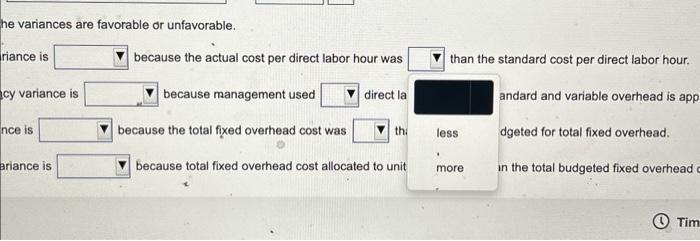

Good Deal, Inc: uses a standard cost system and provides the following information. Click the icen to view the information.) Good Deal allocates manufacturing overhead to production based on stindard direct labor hours. Good Deal reported the following actual results for 2024. actual number of units produced, 1.000; actual variable overhead, $5,000; actual food cverheod, \$2,600; actual direct labor hours, 1,700. Read the tequitements Requirement 1, Compute the variable cverhead cost and effiency variances and fixed ovechead cost and volume variances. Begin with the variable ovechead cost and efficency variances. Select the tequred formilas, compute the varable overhead cost and efficiency variances, and idenbly whether each variance is Now compute the fixed evertead cost and volume variances. Seloct the required formulas, compuse the fixed overtead cost and volime variances, and identif whether each variance is faverable (F) or untavorable (U). (Abbreviations used: AC= actual cost: AO= actual quantity, FOH= foed overhead, SC= standard cost; SQ= standard quantity) Requirement 2. Explain wty the variances are tavorable or untavorable. The variable overhead cos varance is because the actual cost per direct labor hour was than the standard cot per direct labor houe The variable overtead efficiency vanance is because magagement ised drect labor hours than standard and varable overhead is applied (neurred) based co drect taboc. The fred overhead cost variance is because the total fixed ovechead coit was than the amound budgeted for total fxed creithad. The fixed overhead volume varianoe is because tatal fixed ovehaad cost alocated to units was Bhan the sotal budgeted fxed everthead cost Deal, Inc. uses a standard cost system and provides the following information. Click the icon to view the information.) Deal allocates manufacturing overhead to production based on stndard direct labor hours. Good Deal reported the following actual resu le overhead, $5,000; actual fixed overhead, $2,600; actual direct labor hours, 1,700 . the requirements. Data table ces. with the variable overhead ad cost and efficiency able (F) or unfavorable (U). ( standard cost; SQ= cost variance = volume variance = direment 2. Explain why the v variable overhead cost variance ts ECadse the actuar costper airecta00 huor was Trartwe standard cost per direc variable overhead efficiency variance is because management used direct labor hours than standard and variable or fixed overhead cost variance is because the total fixed overhead cost was than the amount budgeted for total fixed o fixed overhead volume variance is because total fixed overhead cost allocated to units was than the total budgeted fi: Good Deal, Inc. uses a standard cost system and provides the following information. (Click the icon to view the information.) Good Deal allocates manufacturing overhead to production based on stndard direct labor hours. Good Deal reported the following actu variable overhead, $5,000; actual fixed overhead, $2,600; actual direct labor hours, 1,700. Read the requirements. Requirement 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and eff favorable (F) or unfavorable (U). (Abbreviations used: AC= actual cost; AQ= actual quantity; FOH= fixed overhead; SC= standard cost VOH cost variance VOH efficiency variance Now compute the fixed ovi unfavorable (U). (Abbrevia las, compute the fixed overhead cost and volume ed overhead; SC= standard cost; SQ= standard Requirement 2. Explain why the variances are favorable or unfavorable. The variable overhead cost variance is because the actual cost per direct labor hour was than the standard cost pt The variable overhead efficiency varian direct labor hours than standard and vari The fixed overhead cost variance is total fixed overhead cost was than the total budg The fixed overhead volume variance is otal fixed overhead cost allocated to units was he variances are favorable or unfavorable. rance is because the actual cost per direct labor hour was than the standard cost per direct labor hour. cy variance is because management used direct la andard and variable overhead is app is because the total fixed overhead cost was thi dgeted for total fixed overhead. because total fixed overhead cost allocated to unit n the total budgeted fixed overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts