Question: please help asap! type out all calculations please so i can type into excel. thank you! 6 Marian Anderson Company is selling 10,000 bonds to

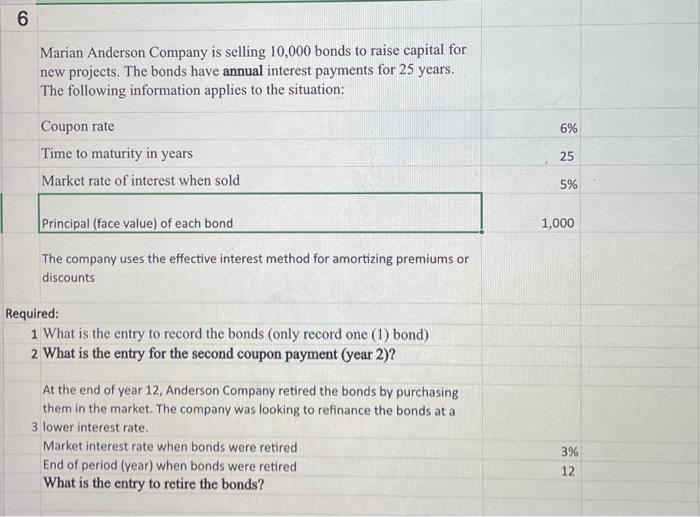

6 Marian Anderson Company is selling 10,000 bonds to raise capital for new projects. The bonds have annual interest payments for 25 years. The following information applies to the situation: Coupon rate 6% Time to maturity in years 25 Market rate of interest when sold 5% Principal (face value) of each bond 1,000 The company uses the effective interest method for amortizing premiums or discounts Required: 1 What is the entry to record the bonds (only record one (1) bond) 2 What is the entry for the second coupon payment (year 2)? At the end of year 12, Anderson Company retired the bonds by purchasing them in the market. The company was looking to refinance the bonds at a 3 lower interest rate. Market interest rate when bonds were retired End of period (year) when bonds were retired What is the entry to retire the bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts