Question: please help asap uestion ur client has contacted you for advice on his proposed investment in property, he has two tions detailed as follows: Option

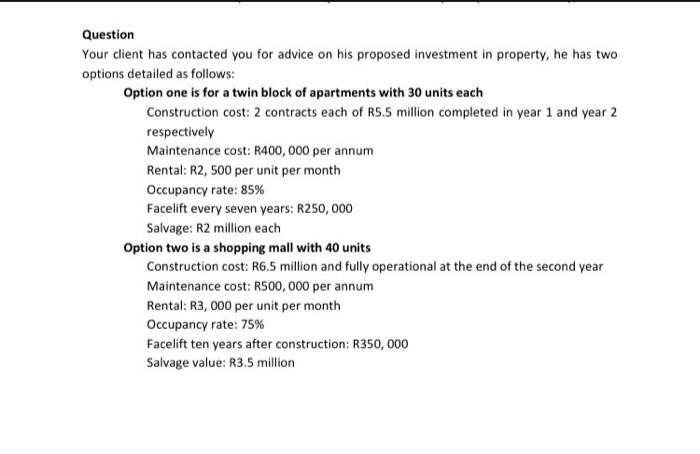

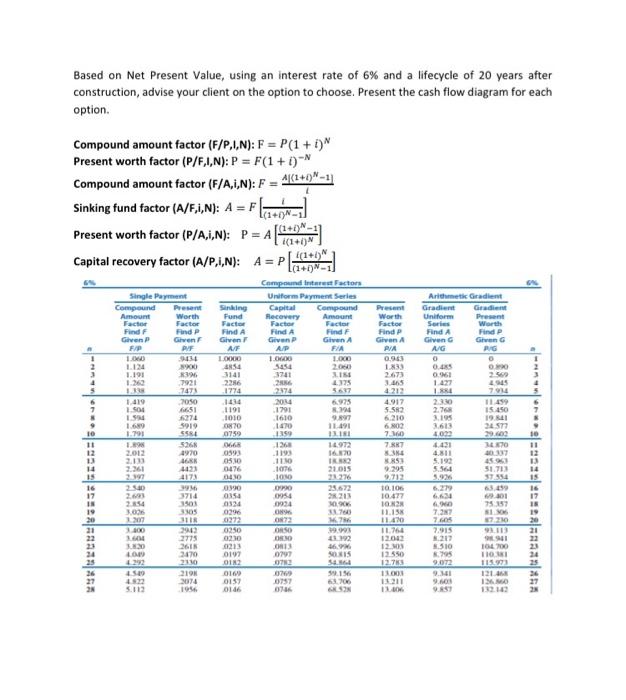

uestion ur client has contacted you for advice on his proposed investment in property, he has two tions detailed as follows: Option one is for a twin block of apartments with 30 units each Construction cost: 2 contracts each of R5.5 million completed in year 1 and year 2 respectively Maintenance cost: R400,000 per annum Rental: R2, 500 per unit per month Occupancy rate: 85% Facelift every seven years: R250,000 Salvage: R2 million each Option two is a shopping mall with 40 units Construction cost: R6.5 million and fully operational at the end of the second year Maintenance cost: R500,000 per annum Rental: R3, 000 per unit per month Occupancy rate: 75% Facelift ten years after construction: R350,000 Salvage value: R3.5 million Based on Net Present Value, using an interest rate of 6% and a lifecycle of 20 years after construction, advise your client on the option to choose. Present the cash flow diagram for each option. Compound amount factor (F/P,I,N):F=P(1+i)N Present worth factor (P/F,I,N):P=F(1+i)N Compound amount factor (F/A,i,N): F=lA(1+i)N1] Sinking fund factor (A/F,i,N):A=F[(1+i)N1i] Present worth factor (P/A,i,N):P=A[i(1+i)N(1+i)N1] Capital recovery factor (A/P,i,N):A=P[(1+i)N1i(1+i)N]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts