Question: Please, help ASAP!!!!! Use Apple's financial statements in Appendix A to answer the following. Required: 1. What amount of inventories did Apple report as a

Please, help ASAP!!!!!

Please, help ASAP!!!!!

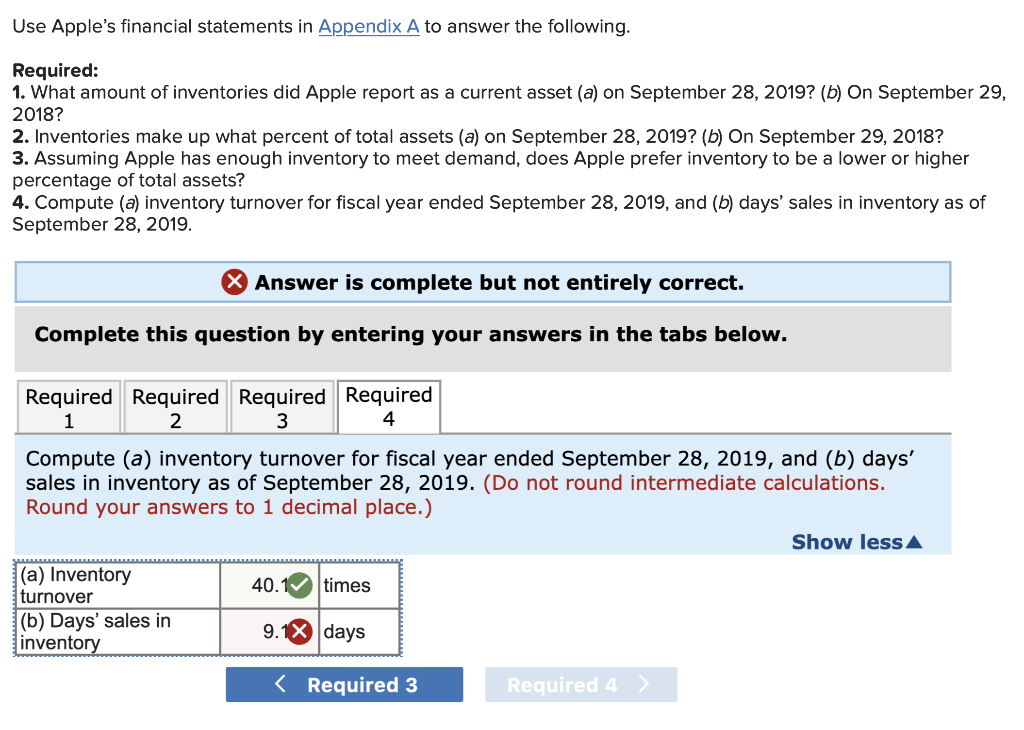

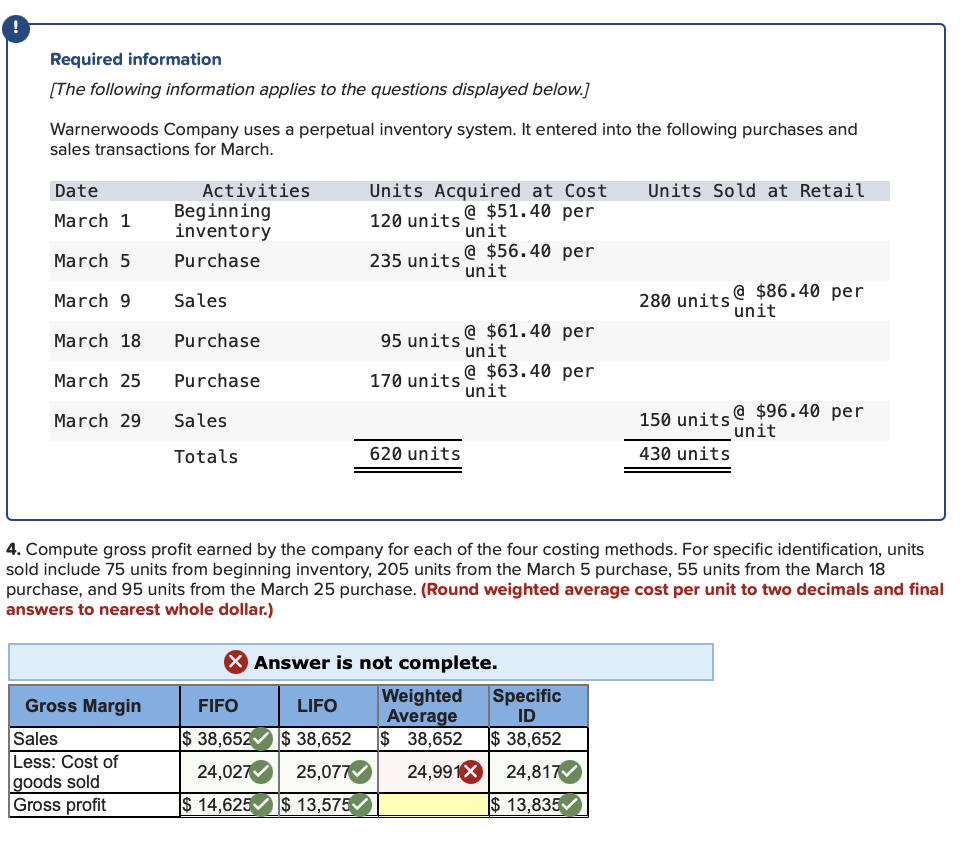

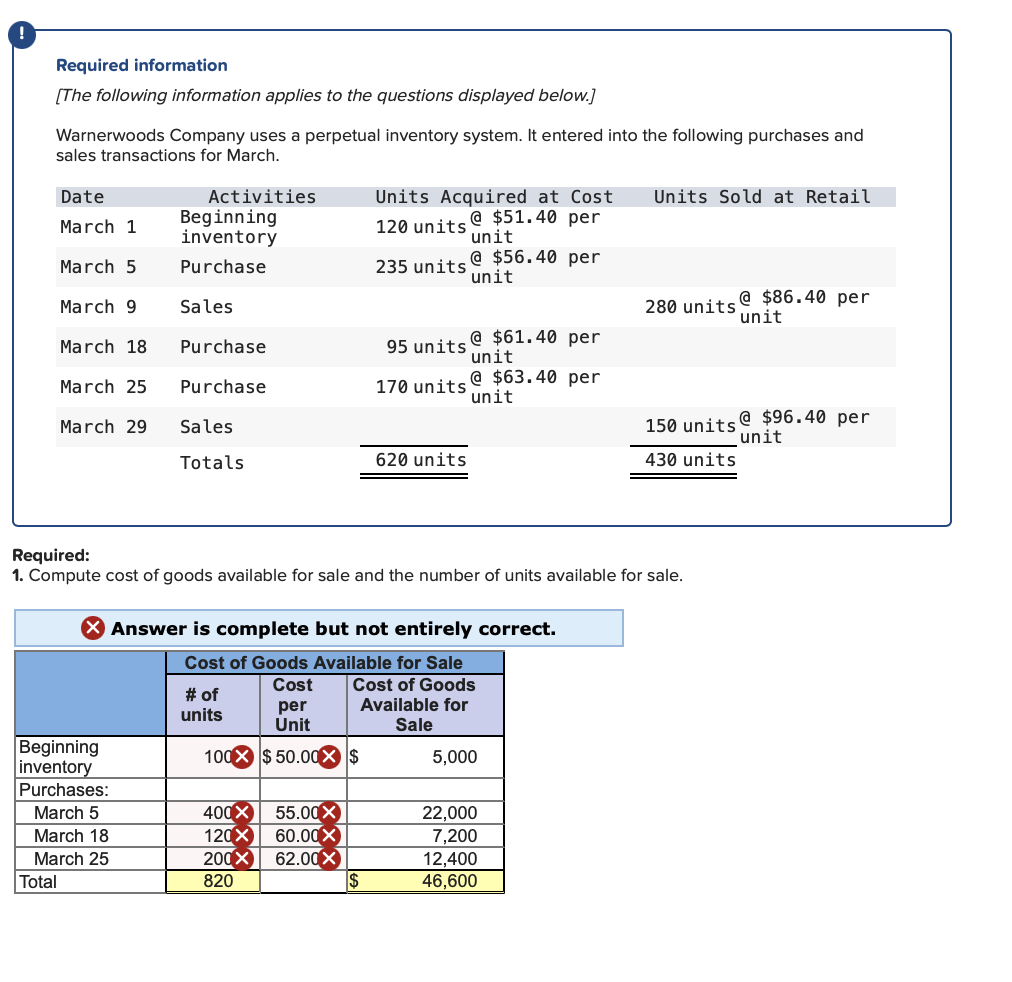

Use Apple's financial statements in Appendix A to answer the following. Required: 1. What amount of inventories did Apple report as a current asset (a) on September 28, 2019? (b) On September 29, 2018? 2. Inventories make up what percent of total assets (a) on September 28, 2019? (b) On September 29, 2018? 3. Assuming Apple has enough inventory to meet demand, does Apple prefer inventory to be a lower or higher percentage of total assets? 4. Compute (a) inventory turnover for fiscal year ended September 28, 2019, and (b) days' sales in inventory as of September 28, 2019. X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required Required Required Required 1 2 3 4 Compute (a) inventory turnover for fiscal year ended September 28, 2019, and (b) days' sales in inventory as of September 28, 2019. (Do not round intermediate calculations. Round your answers to 1 decimal place.) (a) Inventory turnover (b) Days' sales in inventory 40. 9. times days Show less A Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18 March 25 March 29 Activities Gross Margin Sales Less: Cost of goods sold Gross profit Beginning inventory Purchase Sales Purchase Purchase Sales Totals Units Acquired at Cost @ $51.40 per unit 120 units @ $56.40 per unit 235 units FIFO LIFO $ 38,652 $ 38,652 24,027 25,077 $ 14,625 $ 13,575 95 units 170 units 620 units @ $61.40 per unit @ $63.40 per unit X Answer is not complete. Weighted Average $ 38,652 24,991 Specific ID $ 38,652 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 75 units from beginning inventory, 205 units from the March 5 purchase, 55 units from the March 18 purchase, and 95 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest whole dollar.) 24,817 Units Sold at Retail $ 13,835 280 units 150 units 430 units @ $86.40 per unit @ $96.40 per unit Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 Total March 18 March 25 March 29 Activities Beginning inventory Purchases: March 5 March 18 March 25 Beginning inventory Purchase Sales Purchase Purchase Sales Totals # of units per Unit 100X $50.00 $ Units Acquired at Cost @ $51.40 per unit 120 units @ $56.40 per unit 400X 55.00 X 120X 60.00x 200X 62.00X 820 235 units $ 95 units X Answer is complete but not entirely correct. Cost of Goods Available for Sale Cost Cost of Goods Available for Sale 170 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. 620 units @ $61.40 per unit @ $63.40 per unit 5,000 Units Sold at Retail 22,000 7,200 12,400 46,600 280 units @ $86.40 per unit 150 units@ $96.40 per unit 430 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts