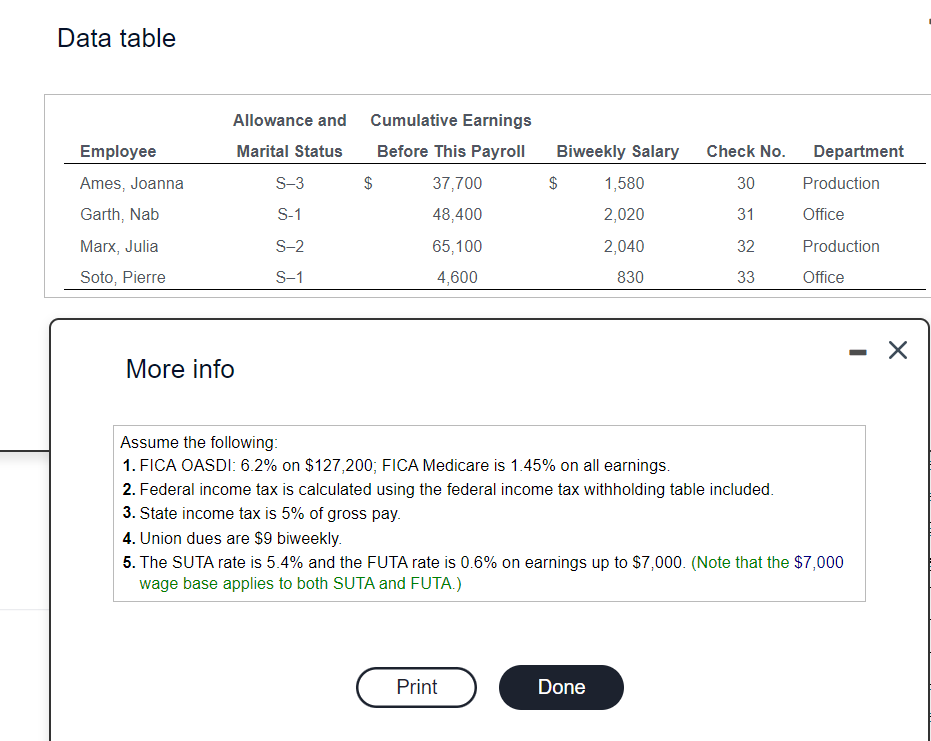

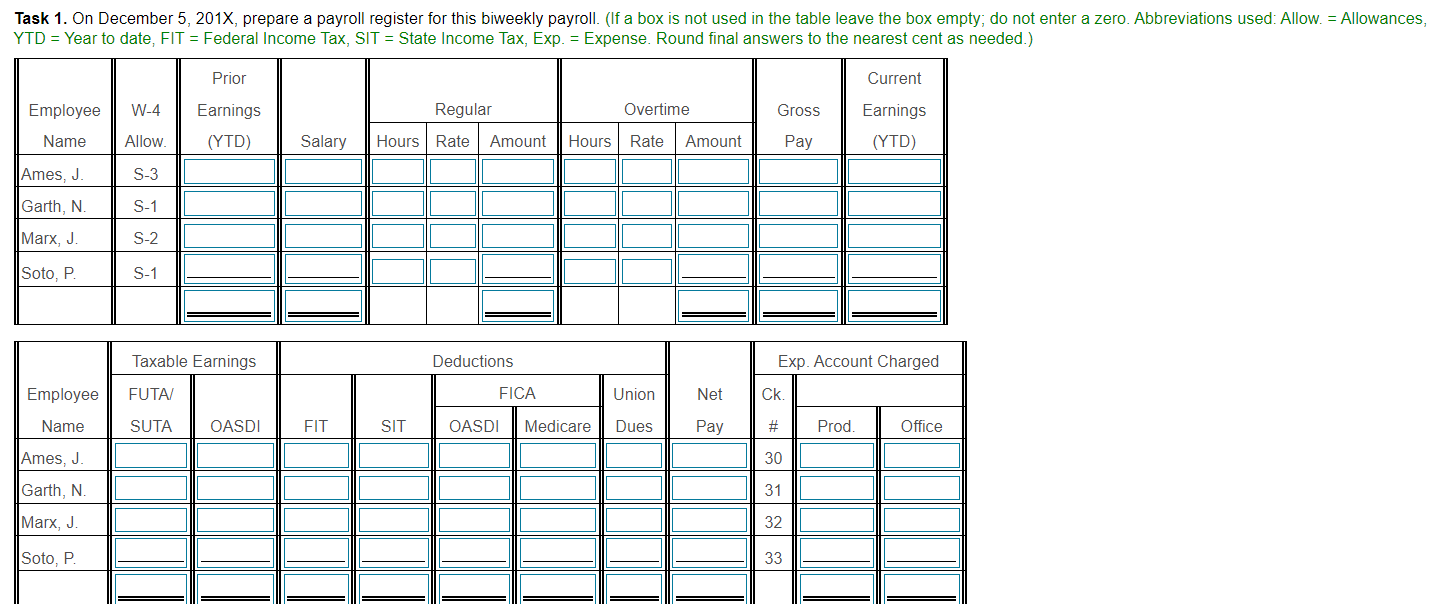

Question: Please help asap, will give a good review! :) Data table More info Assume the following: 1. FICA OASDI: 6.2% on $127,200; FICA Medicare is

Please help asap, will give a good review! :)

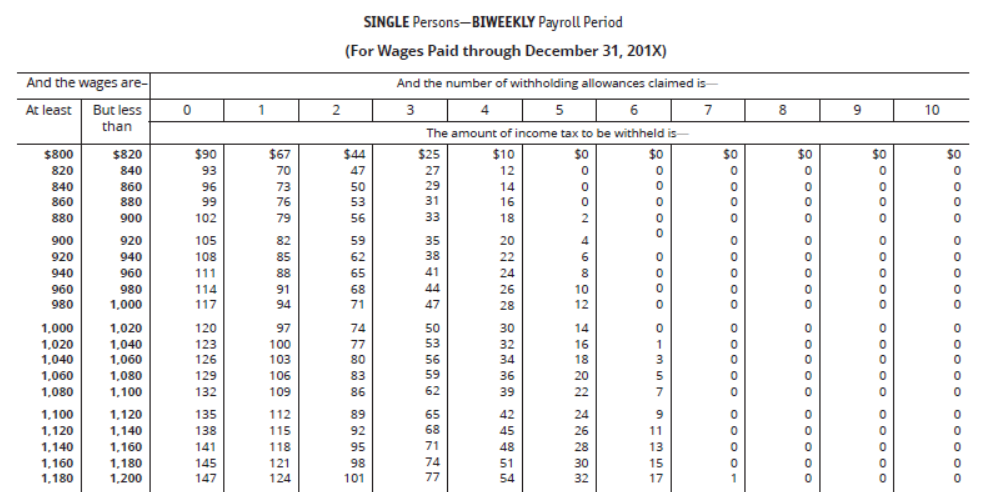

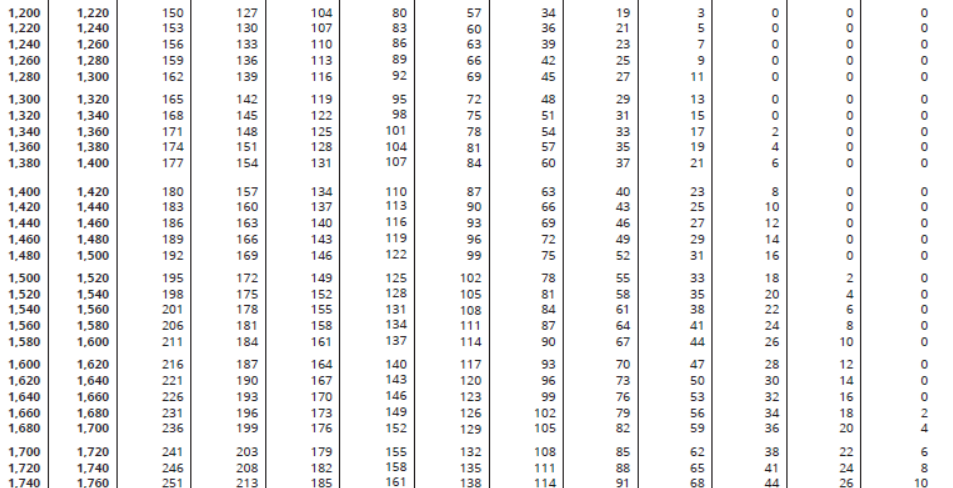

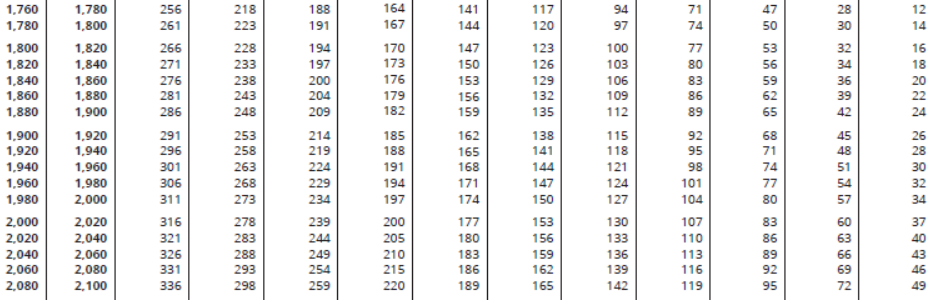

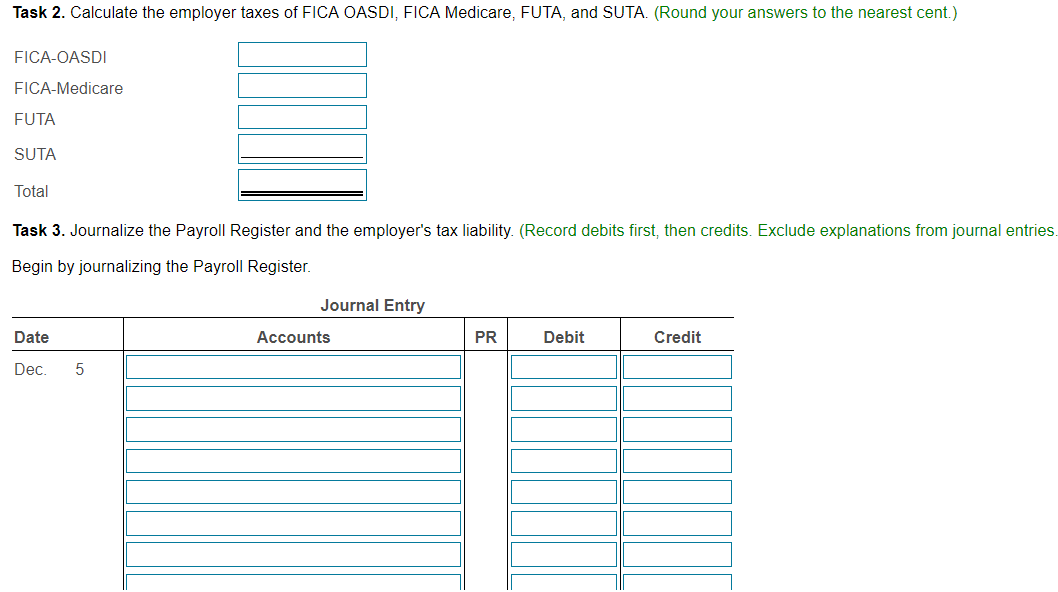

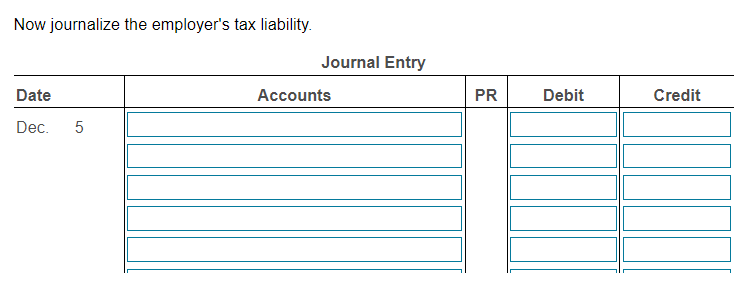

Data table More info Assume the following: 1. FICA OASDI: 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated using the federal income tax withholding table included. 3. State income tax is 5% of gross pay. 4. Union dues are $9 biweekly. 5. The SUTA rate is 5.4% and the FUTA rate is 0.6% on earnings up to $7,000. (Note that the $7,000 wage base applies to both SUTA and FUTA.) SINGLE Persons-BIWEEKLY Payroll Period (For Wages Paid through December 31, 201X) \begin{tabular}{l|l|} 1,760 & 1,780 \\ 1,780 & 1,800 \\ 1,800 & 1,820 \\ 1,820 & 1,840 \\ 1,840 & 1,860 \\ 1,860 & 1,880 \\ 1,880 & 1,900 \\ 1,900 & 1,920 \\ 1,920 & 1,940 \\ 1,940 & 1,960 \\ 1,960 & 1,980 \\ 1,980 & 2,000 \\ 2,000 & 2,020 \\ 2,020 & 2,040 \\ 2,040 & 2,060 \\ 2,060 & 2,080 \\ 2,080 & 2,100 \end{tabular} \begin{tabular}{l|l} 256 \\ 261 & 218 \\ 266 & 223 \\ 271 & 228 \\ 276 & 233 \\ 281 & 238 \\ 286 & 243 \\ 291 & 248 \\ 296 & 253 \\ 301 & 258 \\ 306 & 263 \\ 311 & 268 \\ 316 & 273 \\ 321 & 278 \\ 326 & 283 \\ 331 & 288 \\ 336 & 293 \\ 298 \end{tabular} \begin{tabular}{l|l} 188 \\ 191 & 164 \\ 194 & 167 \\ 197 & 170 \\ 200 & 173 \\ 204 & 176 \\ 209 & 179 \\ 214 & 182 \\ 219 & 185 \\ 224 & 188 \\ 229 & 191 \\ 234 & 194 \\ 239 & 197 \\ 244 & 200 \\ 249 & 205 \\ 254 & 210 \\ 259 & 215 \\ 220 \end{tabular} \begin{tabular}{l|l} 141 & 117 \\ 144 & 120 \\ 147 & 123 \\ 150 & 126 \\ 153 & 129 \\ 156 & 132 \\ 159 & 135 \\ 162 & 138 \\ 165 & 141 \\ 168 & 144 \\ 171 & 147 \\ 174 & 150 \\ 177 & 153 \\ 180 & 156 \\ 183 & 159 \\ 186 & 162 \\ 189 & 165 \end{tabular} 94 97 100 103 106 109 112 115 118 121 124 127 130 133 136 139 142 \begin{tabular}{r|r} 71 & 47 \\ 74 & 50 \\ 77 & 53 \\ 80 & 56 \\ 83 & 59 \\ 86 & 62 \\ 89 & 65 \\ 92 & 68 \\ 95 & 71 \\ 98 & 74 \\ 101 & 77 \\ 104 & 80 \\ 107 & 83 \\ 110 & 86 \\ 113 & 89 \\ 116 & 92 \\ 119 & 95 \end{tabular} Allow. = Allowances, Task 3. Journalize the Payroll Register and the employer's tax liability. (Record debits first, then credits. Exclude explanations from journal entries Begin by journalizing the Payroll Register. Now journalize the employer's tax liability. Data table More info Assume the following: 1. FICA OASDI: 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Federal income tax is calculated using the federal income tax withholding table included. 3. State income tax is 5% of gross pay. 4. Union dues are $9 biweekly. 5. The SUTA rate is 5.4% and the FUTA rate is 0.6% on earnings up to $7,000. (Note that the $7,000 wage base applies to both SUTA and FUTA.) SINGLE Persons-BIWEEKLY Payroll Period (For Wages Paid through December 31, 201X) \begin{tabular}{l|l|} 1,760 & 1,780 \\ 1,780 & 1,800 \\ 1,800 & 1,820 \\ 1,820 & 1,840 \\ 1,840 & 1,860 \\ 1,860 & 1,880 \\ 1,880 & 1,900 \\ 1,900 & 1,920 \\ 1,920 & 1,940 \\ 1,940 & 1,960 \\ 1,960 & 1,980 \\ 1,980 & 2,000 \\ 2,000 & 2,020 \\ 2,020 & 2,040 \\ 2,040 & 2,060 \\ 2,060 & 2,080 \\ 2,080 & 2,100 \end{tabular} \begin{tabular}{l|l} 256 \\ 261 & 218 \\ 266 & 223 \\ 271 & 228 \\ 276 & 233 \\ 281 & 238 \\ 286 & 243 \\ 291 & 248 \\ 296 & 253 \\ 301 & 258 \\ 306 & 263 \\ 311 & 268 \\ 316 & 273 \\ 321 & 278 \\ 326 & 283 \\ 331 & 288 \\ 336 & 293 \\ 298 \end{tabular} \begin{tabular}{l|l} 188 \\ 191 & 164 \\ 194 & 167 \\ 197 & 170 \\ 200 & 173 \\ 204 & 176 \\ 209 & 179 \\ 214 & 182 \\ 219 & 185 \\ 224 & 188 \\ 229 & 191 \\ 234 & 194 \\ 239 & 197 \\ 244 & 200 \\ 249 & 205 \\ 254 & 210 \\ 259 & 215 \\ 220 \end{tabular} \begin{tabular}{l|l} 141 & 117 \\ 144 & 120 \\ 147 & 123 \\ 150 & 126 \\ 153 & 129 \\ 156 & 132 \\ 159 & 135 \\ 162 & 138 \\ 165 & 141 \\ 168 & 144 \\ 171 & 147 \\ 174 & 150 \\ 177 & 153 \\ 180 & 156 \\ 183 & 159 \\ 186 & 162 \\ 189 & 165 \end{tabular} 94 97 100 103 106 109 112 115 118 121 124 127 130 133 136 139 142 \begin{tabular}{r|r} 71 & 47 \\ 74 & 50 \\ 77 & 53 \\ 80 & 56 \\ 83 & 59 \\ 86 & 62 \\ 89 & 65 \\ 92 & 68 \\ 95 & 71 \\ 98 & 74 \\ 101 & 77 \\ 104 & 80 \\ 107 & 83 \\ 110 & 86 \\ 113 & 89 \\ 116 & 92 \\ 119 & 95 \end{tabular} Allow. = Allowances, Task 3. Journalize the Payroll Register and the employer's tax liability. (Record debits first, then credits. Exclude explanations from journal entries Begin by journalizing the Payroll Register. Now journalize the employer's tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts