Question: please help asap will give thumbs up Problem 15-5 Calculating Flotation Costs [LO 3] es The Elkmont Corporation needs to raise $52.5 million to finance

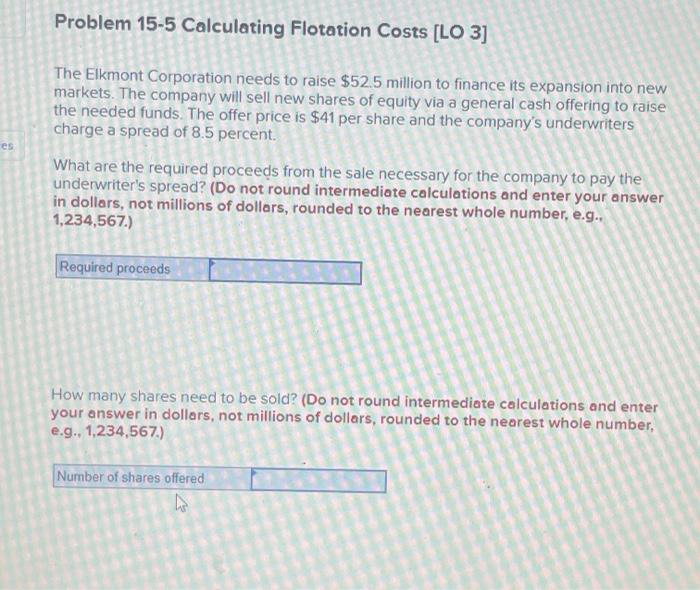

Problem 15-5 Calculating Flotation Costs [LO 3] es The Elkmont Corporation needs to raise $52.5 million to finance its expansion into new markets. The company will sell new shares of equity via a general cash offering to raise the needed funds. The offer price is $41 per share and the company's underwriters charge a spread of 8.5 percent. What are the required proceeds from the sale necessary for the company to pay the underwriter's spread? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g.. 1,234,567.) Required proceeds How many shares need to be sold? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g. 1,234,567.) Number of shares offered ho

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts