Question: PLEASE HELP ASAP!!! will upvote!! Managers and analysts from all over the firm have evaluated a potential new $10 million investment for their firm that

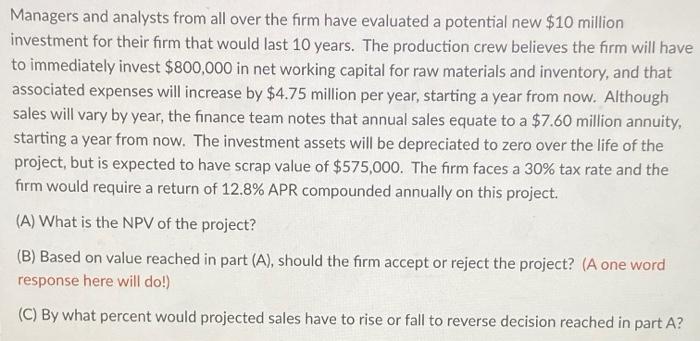

Managers and analysts from all over the firm have evaluated a potential new $10 million investment for their firm that would last 10 years. The production crew believes the firm will have to immediately invest $800,000 in net working capital for raw materials and inventory, and that associated expenses will increase by $4.75 million per year, starting a year from now. Although sales will vary by year, the finance team notes that annual sales equate to a $7.60 million annuity, starting a year from now. The investment assets will be depreciated to zero over the life of the project, but is expected to have scrap value of $575,000. The firm faces a 30% tax rate and the firm would require a return of 12.8% APR compounded annually on this project. (A) What is the NPV of the project? (B) Based on value reached in part (A), should the firm accept or reject the project? (A one word response here will do! (C) By what percent would projected sales have to rise or fall to reverse decision reached in part A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts