Question: please help asap with complete answer for the joint question (Interest Rate risk) Bond S has 4 years to maturity. Bond T has 30 years

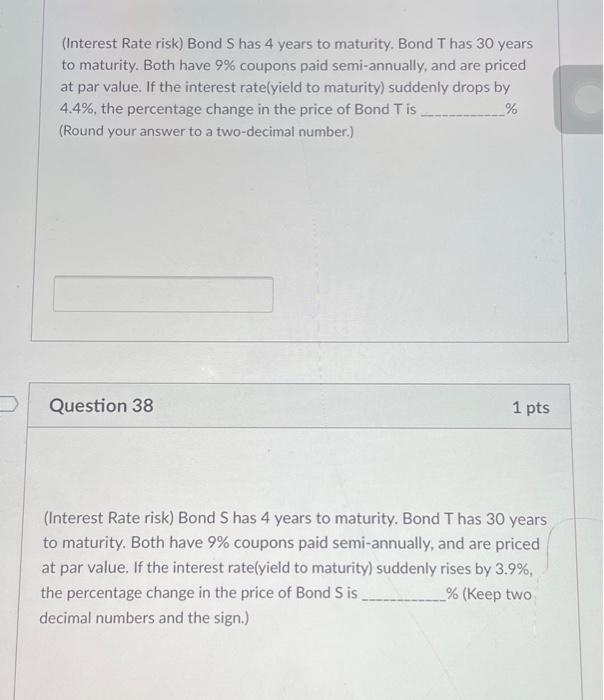

(Interest Rate risk) Bond S has 4 years to maturity. Bond T has 30 years to maturity. Both have 9% coupons paid semi-annually, and are priced at par value. If the interest rate(yield to maturity) suddenly drops by 4.4%, the percentage change in the price of Bond T is % (Round your answer to a two-decimal number.) Question 38 1pts (Interest Rate risk) Bond S has 4 years to maturity. Bond T has 30 years to maturity. Both have 9% coupons paid semi-annually, and are priced at par value. If the interest rate(yield to maturity) suddenly rises by 3.9%, the percentage change in the price of Bond S is \% (Keep two decimal numbers and the sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts