Question: please help asap!! You are the manager at a U.S based firm that imports parts from Canada. Your boss asked you to generate a forecast

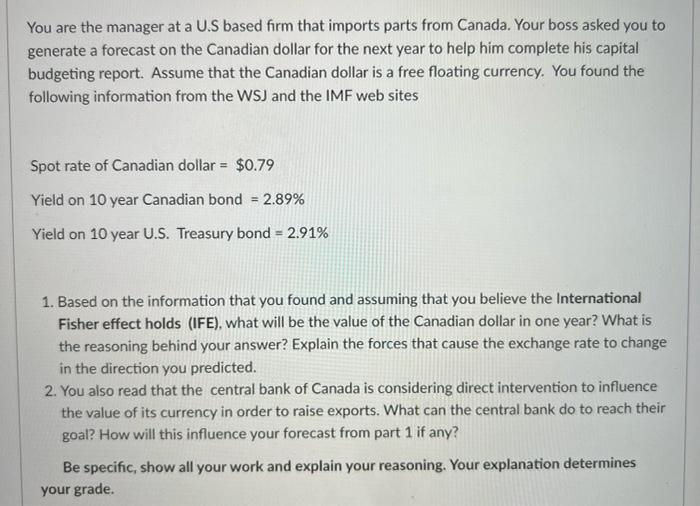

You are the manager at a U.S based firm that imports parts from Canada. Your boss asked you to generate a forecast on the Canadian dollar for the next year to help him complete his capital budgeting report. Assume that the Canadian dollar is a free floating currency. You found the following information from the WSJ and the IMF web sites Spot rate of Canadian dollar = $0.79 Yield on 10 year Canadian bond = 2.89% Yield on 10 year U.S. Treasury bond = 2.91% 1. Based on the information that you found and assuming that you believe the International Fisher effect holds (IFE), what will be the value of the Canadian dollar in one year? What is the reasoning behind your answer? Explain the forces that cause the exchange rate to change in the direction you predicted. 2. You also read that the central bank of Canada is considering direct intervention to influence the value of its currency in order to raise exports. What can the central bank do to reach their goal? How will this influence your forecast from part 1 if any? Be specific, show all your work and explain your reasoning. Your explanation determines your grade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts