Question: please help ASP For the current year, Robert, a single taxpayer, earned wages of $235,000 from Big Shot Corporation. He also received interest income of

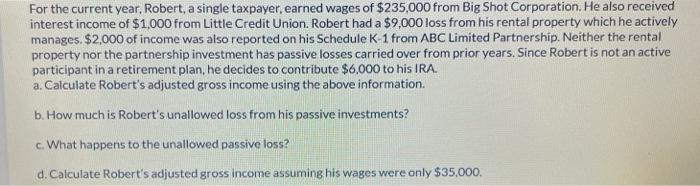

For the current year, Robert, a single taxpayer, earned wages of $235,000 from Big Shot Corporation. He also received interest income of $1,000 from Little Credit Union. Robert had a $9,000 loss from his rental property which he actively manages. $2,000 of income was also reported on his Schedule K-1 from ABC Limited Partnership. Neither the rental property nor the partnership investment has passive losses carried over from prior years. Since Robert is not an active participant in a retirement plan, he decides to contribute $6,000 to his IRA. a. Calculate Robert's adjusted gross income using the above information. b. How much is Robert's unallowed loss from his passive investments? c. What happens to the unallowed passive loss? d. Calculate Robert's adjusted gross income assuming his wages were only $35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts