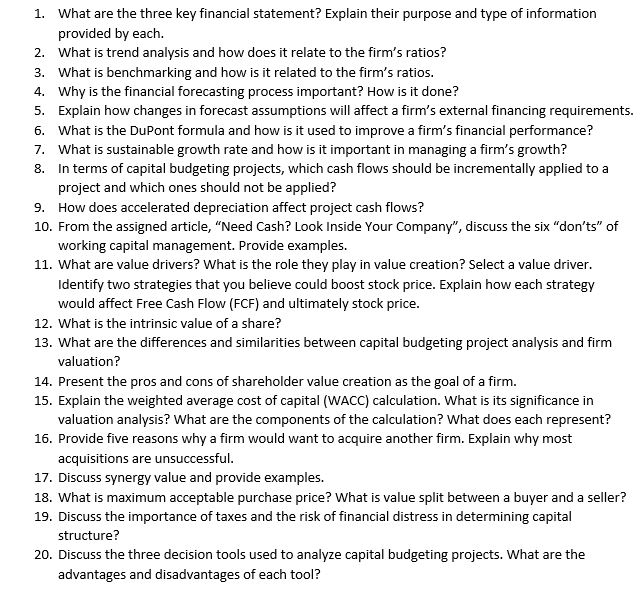

Question: Please help assist in explaining as many as possible, all would be terrific. In need of this to help be prepared for an upcoming prep

Please help assist in explaining as many as possible, all would be terrific. In need of this to help be prepared for an upcoming prep course. Thanks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts