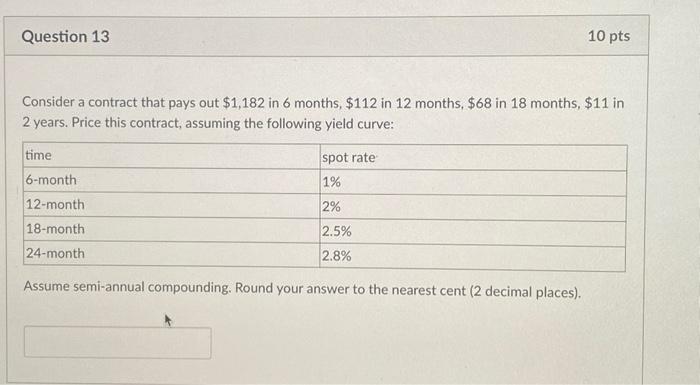

Question: please help. B. Consider a contract that pays out $1,182 in 6 months, $112 in 12 months, $68 in 18 months, $11 in 2 years.

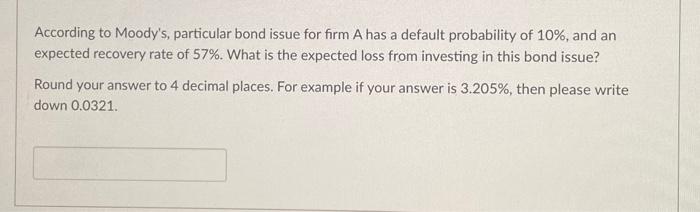

Consider a contract that pays out $1,182 in 6 months, $112 in 12 months, $68 in 18 months, $11 in 2 years. Price this contract, assuming the following yield curve: Assume semi-annual compounding. Round your answer to the nearest cent (2 decimal places). According to Moody's, particular bond issue for firm A has a default probability of 10%, and an expected recovery rate of 57%. What is the expected loss from investing in this bond issue? Round your answer to 4 decimal places. For example if your answer is 3.205%, then please write down 0.0321

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts