Question: please help!!! B Problem 15-7 Calculating Flotation Costs [LO 3] The Wiley Oakley Co. has just gone public. Under a firm commitment agreement, the company

![please help!!! B Problem 15-7 Calculating Flotation Costs [LO 3] The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd8bd4af6e5_43666fd8bd433a71.jpg)

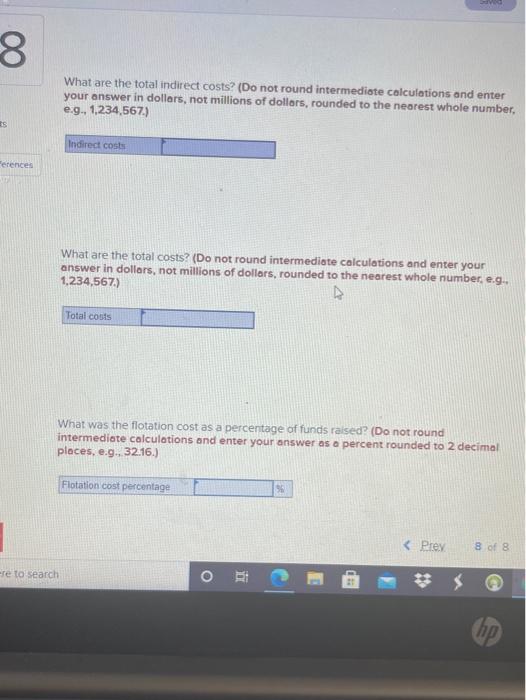

B Problem 15-7 Calculating Flotation Costs [LO 3] The Wiley Oakley Co. has just gone public. Under a firm commitment agreement, the company received $21.25 for each of the 6.61 million shares sold. The initial offering price was $23.10 per share, and the stock rose to $29.61 per share in the first few minutes of trading. The company paid $911,000 in legal and other direct costs and $186,000 in indirect costs. ences What is the net amount raised? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Net amount raised What are the total direct costs? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567) Direct costs 8. What are the total indirect costs? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) Es Indirect costs Ferences What are the total costs? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g. 1,234,567.) Total costs What was the flotation cost as a percentage of funds raised? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Flotation cost percentage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts