Question: please help B. Use the following information to answer questions 05 through 07 ( 04 Points per question) by clearly indicating your answer - You

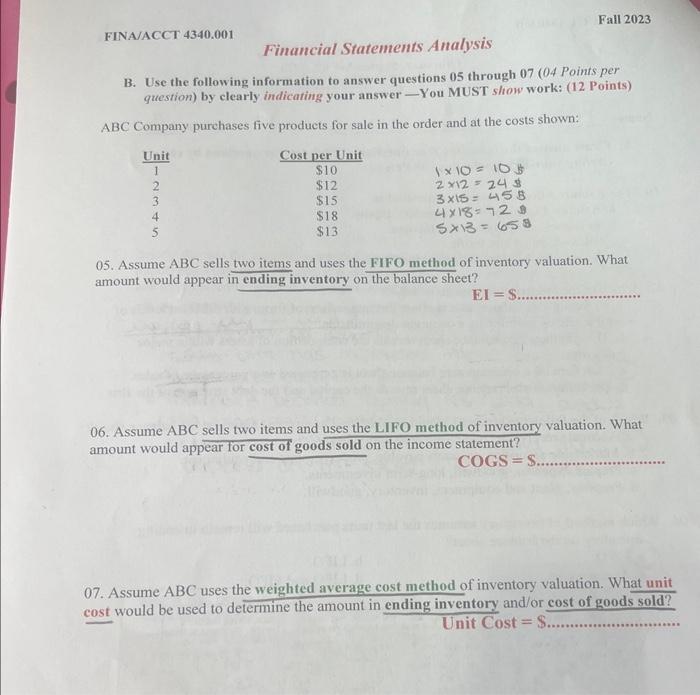

B. Use the following information to answer questions 05 through 07 ( 04 Points per question) by clearly indicating your answer - You MUST show work: (12 Points) ABC Company purchases five products for sale in the order and at the costs shown: 05. Assume ABC sells two items and uses the FIFO method of inventory valuation. What amount would appear in ending inventory on the balance sheet? EI=S. 06. Assume ABC sells two items and uses the LIFO method of inventory valuation. What amount would appear for cost of goods sold on the income statement? COGS=S. 07. Assume ABC uses the weighted average cost method of inventory valuation. What unit cost would be used to determine the amount in ending inventory and/or cost of goods sold? Unit Cost =$. B. Use the following information to answer questions 05 through 07 ( 04 Points per question) by clearly indicating your answer - You MUST show work: (12 Points) ABC Company purchases five products for sale in the order and at the costs shown: 05. Assume ABC sells two items and uses the FIFO method of inventory valuation. What amount would appear in ending inventory on the balance sheet? EI=S. 06. Assume ABC sells two items and uses the LIFO method of inventory valuation. What amount would appear for cost of goods sold on the income statement? COGS=S. 07. Assume ABC uses the weighted average cost method of inventory valuation. What unit cost would be used to determine the amount in ending inventory and/or cost of goods sold? Unit Cost =$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts