Question: please help Back to Assignment Attempts Average/14 4. Interest rate spread Suppose that North bank currently charges a 3.5% fixed interest rate on a six-year

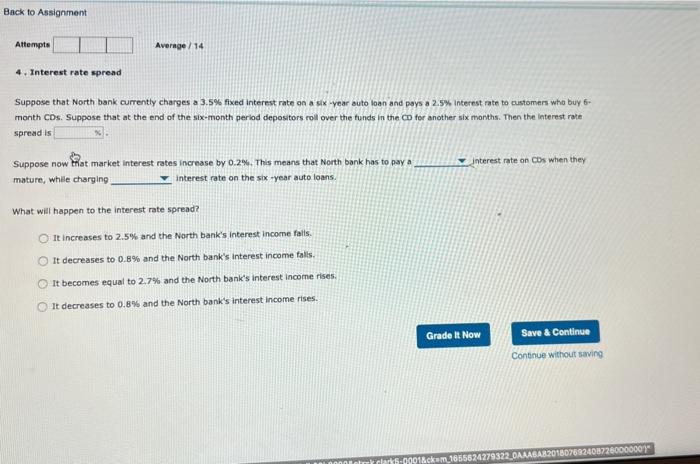

Back to Assignment Attempts Average/14 4. Interest rate spread Suppose that North bank currently charges a 3.5% fixed interest rate on a six-year auto loan and pays a 2.5% interest rate to customers who buy 6- month CDs. Suppose that at the end of the six-month period depositors roll over the funds in the CD for another six months. Then the interest rate spread is interest rate on CDs when they Suppose now that market interest rates increase by 0.2%. This means that North bank has to pay a mature, while charging interest rate on the six-year auto loans. What will happen to the interest rate spread? It increases to 2.5% and the North bank's interest income falls. It decreases to 0.8% and the North bank's Interest income falls. It becomes equal to 2.7% and the North bank's interest income rises. It decreases to 0.8% and the North bank's interest income rises. Save & Continue Continue without saving Grade It Now tmk clarks-0001&ck-m_1655624279322_0AAA6A82018 1087260000001

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts