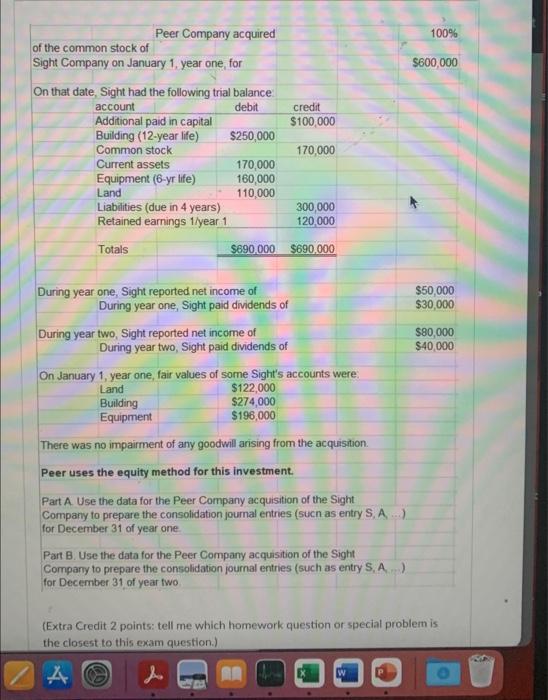

Question: please help begin{tabular}{|c|c|} hline During year one, Sight reported net income of & $50,000 hline During year one, Sight paid dividends of & $30,000

\begin{tabular}{|c|c|} \hline During year one, Sight reported net income of & $50,000 \\ \hline During year one, Sight paid dividends of & $30,000 \\ \hline During year two, Sight reported net income of & $80,000 \\ \hline During year two, Sight paid dividends of & $40,000 \\ \hline \end{tabular} On January 1, year one, fair values of some Sight's accounts were: \begin{tabular}{l|l} \hline Land & $122,000 \\ \hline Building & $274,000 \\ \hline Equipment & $196,000 \\ \hline \end{tabular} There was no impairment of any goodwill arising from the acquisition. Peer uses the equity method for this investment. Part A Use the data for the Peer Company acquisition of the Sight Company to prepare the consolidation joumal entries (sucn as entry S, A ...) for December 31 of year one Part B. Use the data for the Peer Company acquisition of the Sight Company to prepare the consolidation journal entries (such as entry S, A ..) for December 31 of year two (Extra Credit 2 points: tell me which homework question or special problem is the closest to this exam question.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts