Question: Please help below. Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industry-Johnson and Johnson and Pfizer,

Please help below.

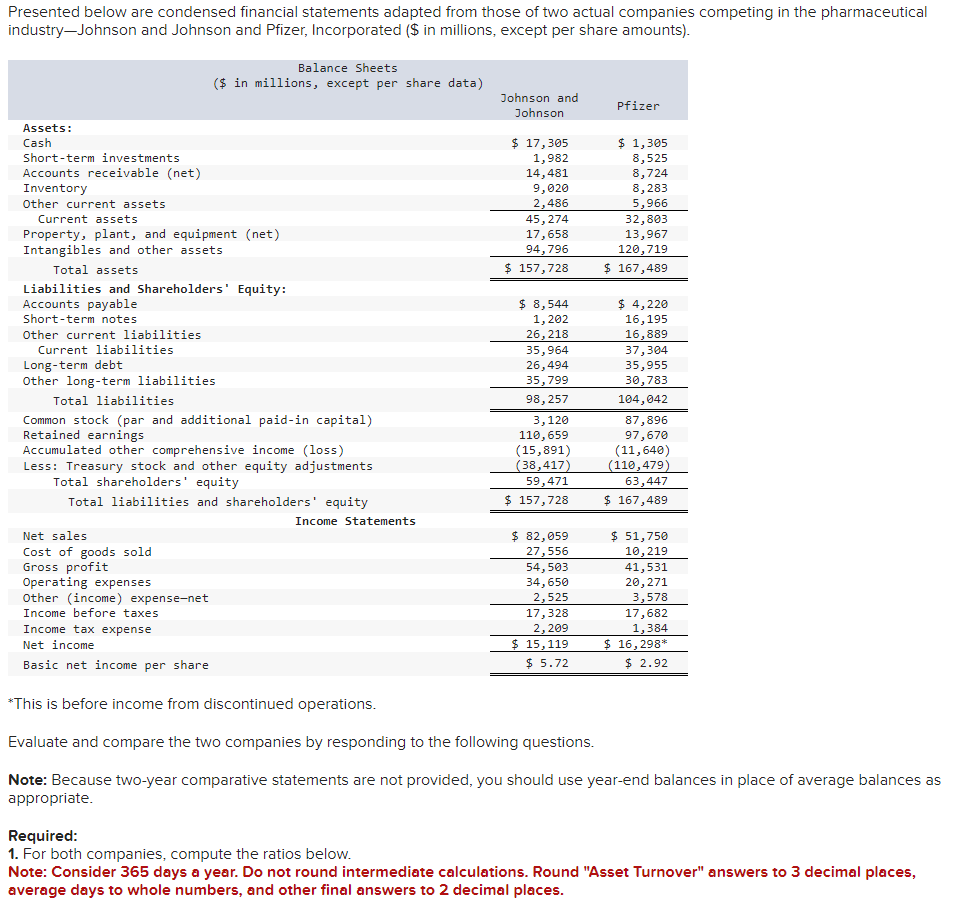

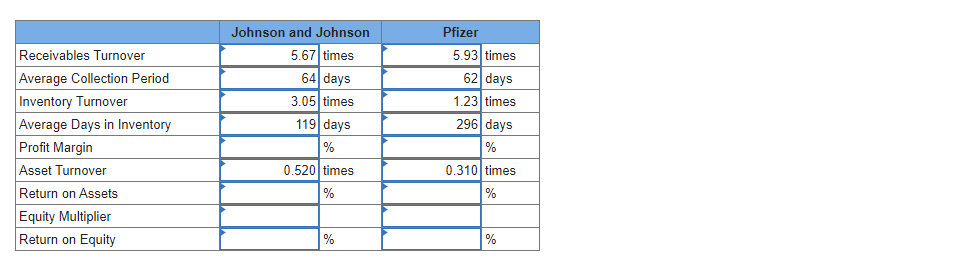

Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industry-Johnson and Johnson and Pfizer, Incorporated (\$ in millions, except per share amounts). *This is before income from discontinued operations. Evaluate and compare the two companies by responding to the following questions. Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate. Required: 1. For both companies, compute the ratios below. Note: Consider 365 days a year. Do not round intermediate calculations. Round "Asset Turnover" answers to 3 decimal places, average days to whole numbers, and other final answers to 2 decimal places. \begin{tabular}{|l|r|r|r|l|} \hline & Johnson and Johnson & \multicolumn{3}{|c|}{ Pfizer } \\ \hline Receivables Turnover & 5.67 & times & 5.93 & times \\ \hline Average Collection Period & 64 & days & 62 & days \\ \hline Inventory Turnover & 3.05 & times & 1.23 & times \\ \hline Average Days in Inventory & 119 & days & 296 & days \\ \hline Profit Margin & & % & & % \\ \hline Asset Turnover & 0.520 & times & 0.310 & times \\ \hline Return on Assets & & % & & % \\ \hline Equity Multiplier & & & & \\ \hline Return on Equity & & % & & % \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts