Question: Please Help! both problems. Thanks! An integrated, combined cycle power plant produces 280 MW of electricity by gasifying coal. The capital investment for the plant

Please Help! both problems. Thanks!

Please Help! both problems. Thanks!

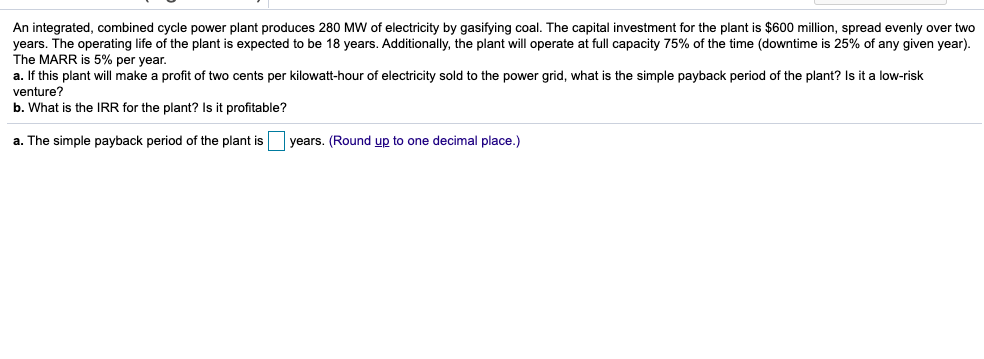

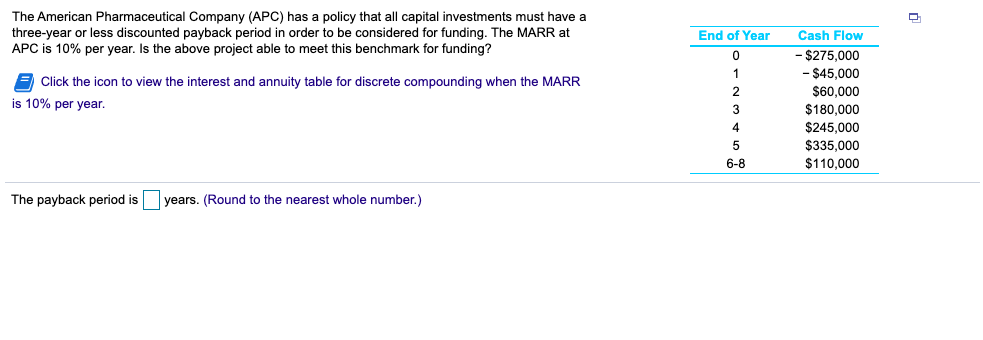

An integrated, combined cycle power plant produces 280 MW of electricity by gasifying coal. The capital investment for the plant is $600 million, spread evenly over two years. The operating life of the plant is expected to be 18 years. Additionally, the plant will operate at full capacity 75% of the time (downtime is 25% of any given year). The MARR is 5% per year. a. If this plant will make a profit of two cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is years. (Round up to one decimal place.) The American Pharmaceutical Company (APC) has a policy that all capital investments must have a three-year or less discounted payback period in order to be considered for funding. The MARR at APC is 10% per year. the above project able to meet this benchmark for funding? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. End of Year 0 1 2 3 Cash Flow - $275,000 - $45,000 $60,000 $180,000 $245.000 $335.000 $110,000 4 5 6-8 The payback period is years. (Round to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts